I thought it might be useful to star the week with a look at trends and possible inflections in a number of major markets. Here’s a quick look at stocks, biotechs, Treasury futures and crude oil. Bottom line:

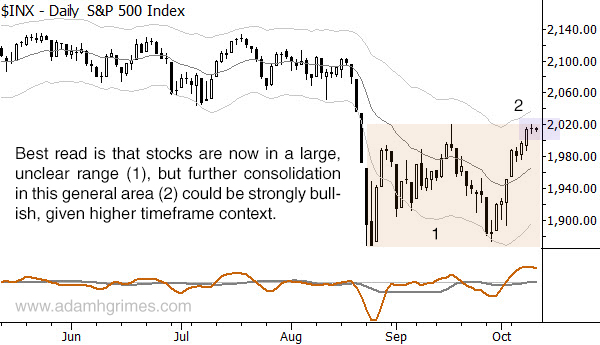

- Stocks failed to develop downward momentum. Further consolidation around current price levels could set up a strong rally.

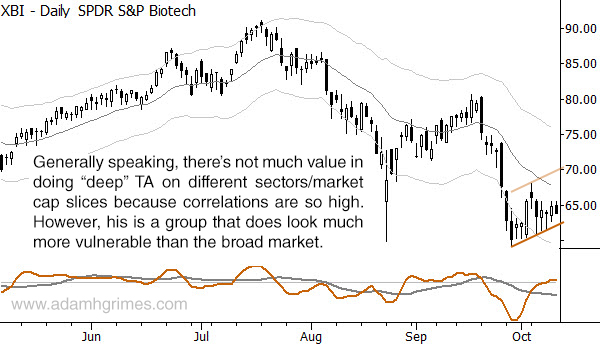

- Biotechs are one of the weakest groups in the market. Doing analysis on different sectors and market cap slices (or, the ultimate in silliness, analyzing different versions of the same index (e.g., S&P 500 cash, (N:SPY), and futures)) is not a good use of time, but it does pay to notice sectors in which flows are very different. Biotechs (N:XBI) demand a little attention.

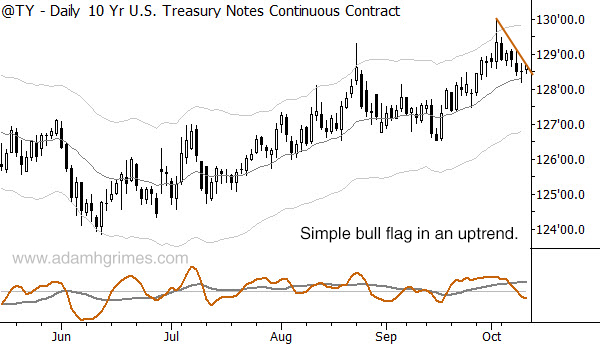

- Treasuries are in an uptrend. Go ahead and speculate all you want about Fed action, rate changes, impacts of those changes, but here’s a case where a quick glance at a chart can show you the true trend in Treasury futures. (Also, pricing in futures is not what you’d expect, so a rate increase wouldn’t necessarily send 10- and 30-year futures tumbling.)

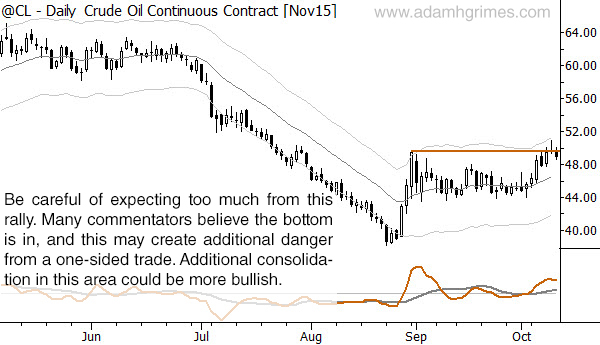

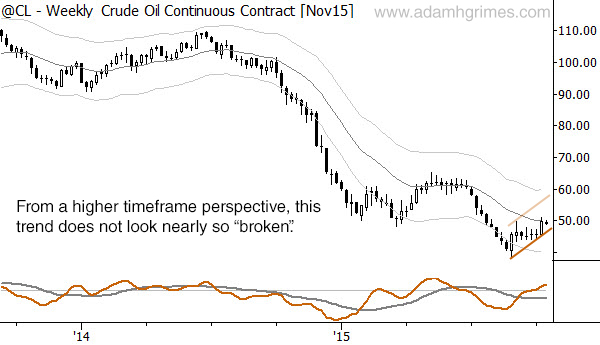

- Don’t get too excited about the “trend change” in crude oil. There’s an asymmetrical payoff in terms of people talking about and guessing about trend changes: everyone will remember when you’re right and forget when you’re wrong, so try to call the bottom as many times as possible. In reality, the upside from current prices is more questionable than many people expect.

Here are the charts: