-

Seasonal headwinds are setting in for stocks.

-

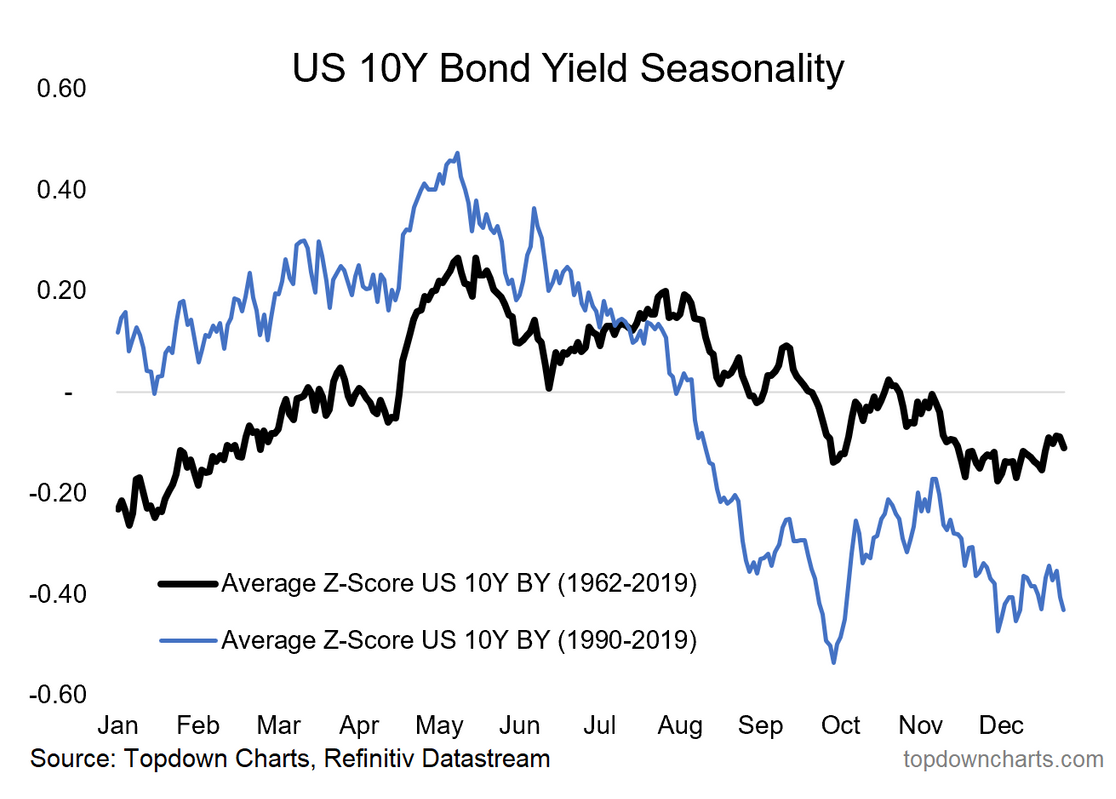

Looking across assets, risk assets tend to underperform from June-November, and defensive assets tend to outperform during that same period.

-

The internal consistency across markets makes intuitive sense and highlights the importance of seasonal patterns in market analysis.

-

That said, there are many exceptions to the rule, and thus seasonality should never be the primary component of an investment thesis.

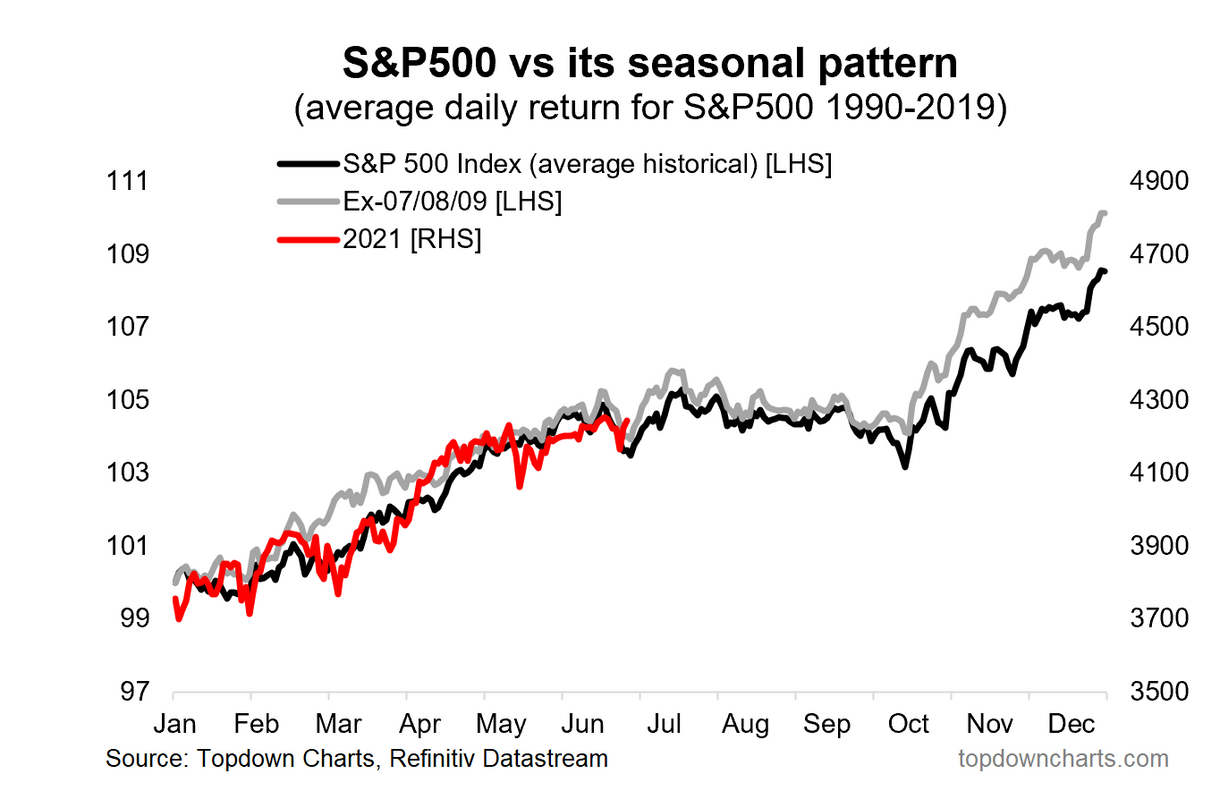

Seasonality in the stock market is a relatively well understood and widely researched phenomenon. There are a few different sayings such as “Sell in May“ or the “Halloween Effect," but all refer to the tendency for stocks to be dead money from around June through November.

So it’s timely to review the seasonal patterns in stock market returns as the seasons shift, but it’s also especially interesting to observe how a few other key markets also exhibit similar seasonality.

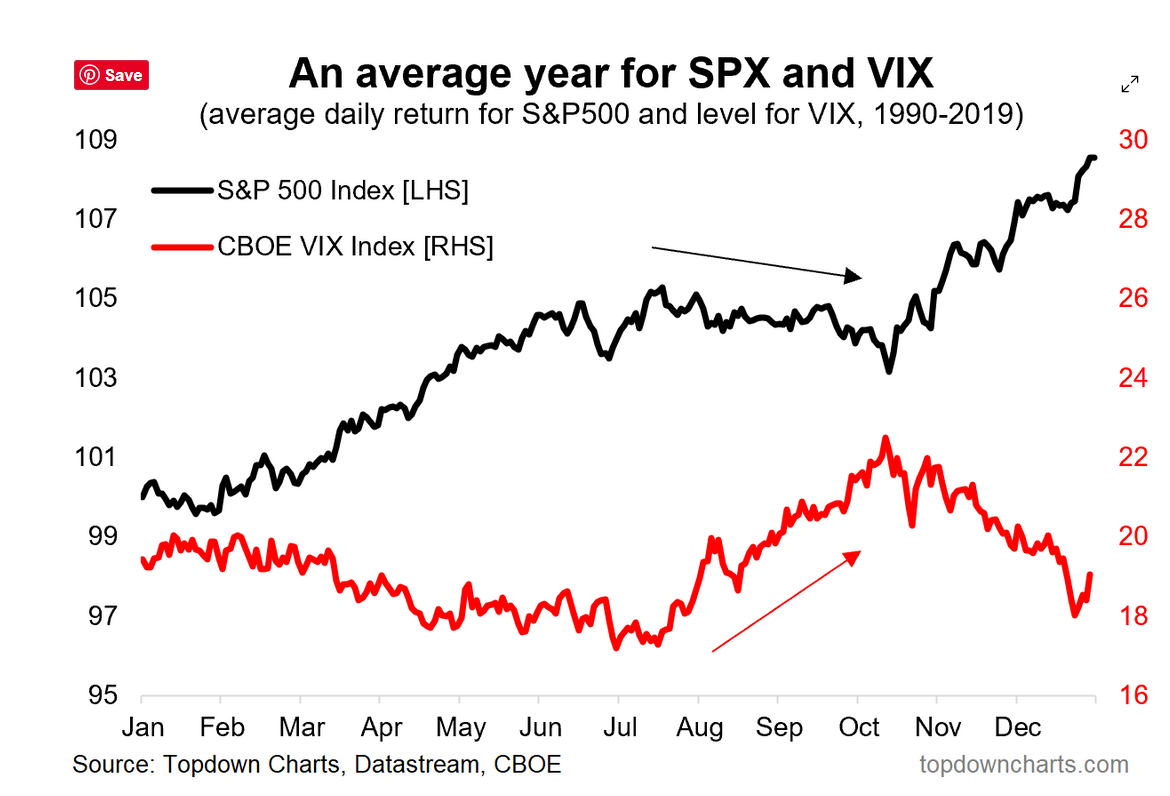

1. S&P 500: Sticking to the Script: A quick word on methodology; the seasonality lines in the chart below show the average daily change in the S&P 500 index by business day. As such it is a characterization of how the market has traded historically—and being an average it masks the fact that actual experience can wildly differ from historical tendencies. That said, the S&P 500 seems to be largely following the seasonal script so far this year…

Suggestions include: the impact of summer vacations (people sell/don’t buy during their down time), the possible existence of a self-fulfilling prophecy (if everyone expects it then they act on it and reinforce it), and a range of other possibilities such as the impact of the January effect, interest rates, political climate, weather climate, etc.

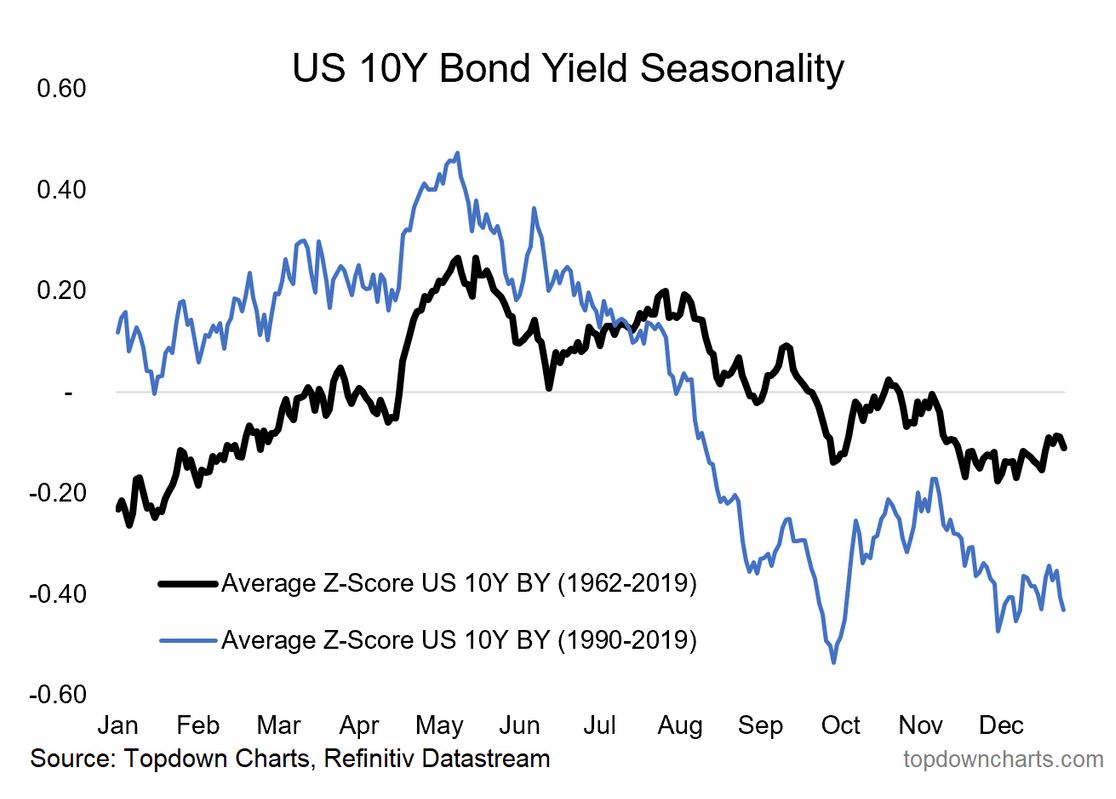

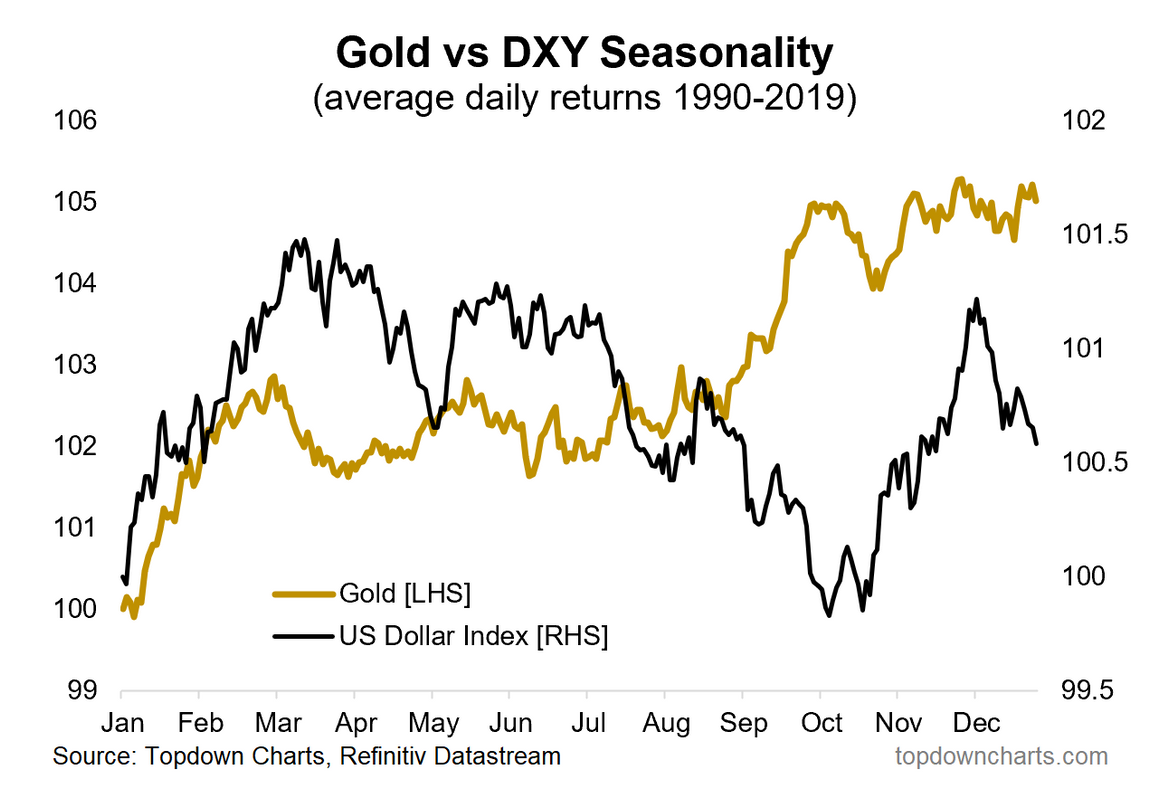

Interestingly, as the next two charts show, this time of the year also sees clear seasonal tendencies for the US dollar and Treasury yields.

One might be tempted to suggest that portfolio rebalancing could be partly to blame (since equities tend to outperform in the earlier part of the year). Either way, it’s interesting to see the internal consistency from a cross-asset standpoint.