- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

5 Bank Stocks To Avoid Despite Favorable Rate Environment

At present, the Fed interest rate is 1.25% and there is a very high chance of a hike at the end of the two-day Federal Reserve Open Market Committee (FOMC) meeting tomorrow. The market seems to have already factored in 25 basis points rise to 1.50%.

Now what matters most is the Fed’s forecast for pace of interest rate raise in 2018 and its response to the tax reform bill.

The current FOMC meeting will be the last one for outgoing Fed Chair Janet Yellen, and the Fed is likely to keep its interest rate forecast intact (three hikes next year), as lagging inflation (still below 2%) remains a concern. Thus, it is less likely that the central bank will pull up any surprises ahead of the transition to Jerome Powell as the next Fed chair in early 2018.

But again, big changes are expected next year in the form of expected stimulus from the implementation of tax legislation. Following the massive tax rate cuts (from 35% to 20%) for U.S. businesses, the unemployment rate is likely to decline further from the present 4.1%, driven by the assumption of more job creation.

Also, the Fed’s concern related to low inflation will diminish as new jobs along with higher wage rate growth will likely lead to a rise in inflation rate to more than 2%. Given these two favorable factors, there is a chance that the Fed may move the interest rate higher at a faster pace as economic growth improves further.

Nonetheless, whether it is three interest rates hikes or four, the finance sector as a whole (except REITs) benefits from the rising rates, with banks being the biggest beneficiaries. A steeper yield curve helps banks to increase revenues. Also, rising rates show an improving economy. As the banking industry is largely dependent of the nation’s economy, this further supports profitability.

Bank Stocks to Avoid Now

While several rate sensitive banks witnessed an uptick in net interest income and net interest margin following the hike in June, another rate hike will modestly support banks’ top-line growth, which has been under pressure amid a tough operating environment.

Profitability of banks was challenged by several matters including rising expense base (huge legal costs to resolve legacy issues and investments in technology upgrades). Further, for banks with global exposure, factors like negative interest rates in Japan and continued weakness in emerging markets have contributed to growth concerns.

Therefore, to overcome these challenges, banks continue to undertake defensive measures like slashing jobs, curtailing unprofitable/non-core businesses and reducing footprint. They are looking for avenues to diversify revenue sources. However, these are not adequate to generate stable returns in the near term. So, a rate hike is not likely to be enough to mitigate the larger woes in the banking industry.

Amid such a tough operating backdrop, we suggest avoiding certain banking stocks that don’t look attractive even if there is a favorable rate hike environment going forward.

While it’s not easy to select such stocks from the vast banking sector universe, we have taken the help of Zacks Stock Screener to make this task relatively simpler.

We have shortlisted five banking stocks with a market capitalization of at least $3 billion and a VGM Score of D or F. Further, these stocks carry a Zacks Rank #4 (Sell) or 5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

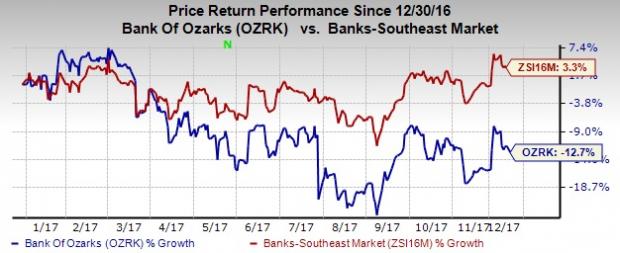

Little Rock, AR-based Bank of the Ozarks (NASDAQ:OZRK) currently has a Zacks Rank #4 and VGM Score of D. The Zacks Consensus Estimate for earnings has declined marginally for 2017 and 2018, over the last 60 days. Further, so far this year, the stock has lost 12.7% against industry’s rise of 3.3%.

F.N.B. Corporation (NYSE:FNB) , headquartered in Pittsburgh, PA, has a Zacks Rank #4 and VGM Score of D. Over the last 60 days, the Zacks Consensus Estimate for earnings has declined 3.2% and 5.5% for 2017 and 2018, respectively. Also, the stock has lost 13.2% so far this year, against industry’s gain of 3.3%.

IBERIABANK Corporation (NASDAQ:IBKC) , based in Lafayette, LA, currently carries a Zacks Rank #5 and has a VGM Score of D. The Zacks Consensus Estimate for earnings has decreased 7.6% and 5% for 2017 and 2018, respectively, over the last 60 days. Further, so far this year, the stock has declined 8.6% against industry’s rally of 3.4%.

Headquartered in Kansas City, MO, Commerce Bancshares, Inc. (NASDAQ:CBSH) currently has a Zacks Rank #4 and VGM Score of F. The Zacks Consensus Estimate for earnings has declined marginally for 2017 and has been stable for 2018, over the last 60 days. Further, so far this year, the stock has lost 0.1% against industry’s growth of 5.8%.

Hato Rey, PR-based Popular, Inc. (NASDAQ:BPOP) has a Zacks Rank #5 and VGM Score of D. Over the last 60 days, the Zacks Consensus Estimate for earnings has decreased 27.1% and 4.7% for 2017 and 2018, respectively. Also, the stock has lost 17.8% so far this year, against industry’s gain of 3.3%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Commerce Bancshares, Inc. (CBSH): Free Stock Analysis Report

Popular, Inc. (BPOP): Free Stock Analysis Report

Bank of the Ozarks (OZRK): Free Stock Analysis Report

IBERIABANK Corporation (IBKC): Free Stock Analysis Report

F.N.B. Corporation (FNB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.