Here is your Bonus Idea with links to the full Top Ten:

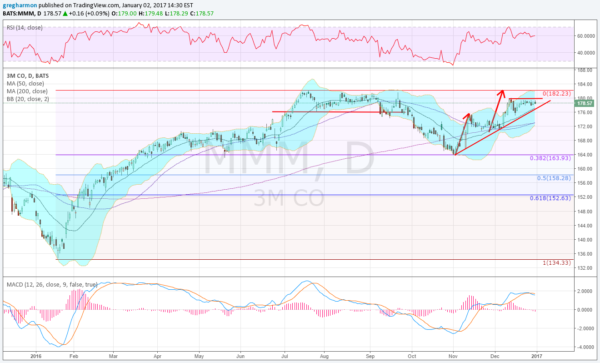

3M Company (NYSE:MMM), made a bottom with the market in January 2016. From there it rose with the market for 3 months and leveled out. The consolidation lasted 2 and a half months until another short drive higher to a top in July just over 182.It held in a tight range for another 2 months under that top acting as resistance. Then in October it dropped back, eventually retracing 38.2% of the full move higher.

Since then the stock has made 2 strong legs higher and finds itself entering the New Year consolidating under 180. A third leg would look for a move to about 190. But that would also be a new all-time high and add a long term target to 240.

All of the SMA’s are sloping higher now and the RSI is in the bullish range with the MACD flat but positive. There is resistance at 180 and 182.25 and then no price history to stop it. There is support lower 177.50 and 174 followed by 170.50 and 163.60. Short interest is low at 1.5%. The company is expected to report earnings next January 24th.

Options expiring this week show a slight bias to the upside with at-the-money (ATM) straddles looking for a about a $2.50 move this week. January monthly options also show an upward bias in open interest with ATM straddles suggest the stock will be confined to about a $5 range each side of the current price. The January 27th Expiry options, the first covering the earnings report, show small open interest but an expected $7.30 move in the price.

3M

Trade Idea 1: Buy the stock on a move over 180 with a stop at 175.

Trade Idea 2: Buy the stock on a move over 180 with a January 27 Expiry 180/172.5 Put Spread ($2.75) and selling a January 27 Expiry 185 Covered Call ($1.12 credit).

Trade Idea 3: Buy the January 180/185 Call Spread ($1.55) and sell the January 172.5 Put (73 cent credit).

Trade Idea 4: Buy the March 180/January 27 expiry 185 Call Diagonal ($3.55).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, with the calendar turning from 2016 to 2017 sees the equity markets retrenching in their uptrends.

Elsewhere look for Gold to continue its bounce in its downtrend while Crude Oil continues higher. The US Dollar Index looks to continue consolidation of the break out move while US Treasuries may have bottomed in their downtrend. The Shanghai Composite looks to continue to consolidate in the uptrend and Emerging Markets are consolidating the bounce in the downtrend.

Volatility looks to remain low but out of abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show short term pullbacks likely to continue within the long term uptrends. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.