Here is your Bonus Idea with links to the full Top Ten:

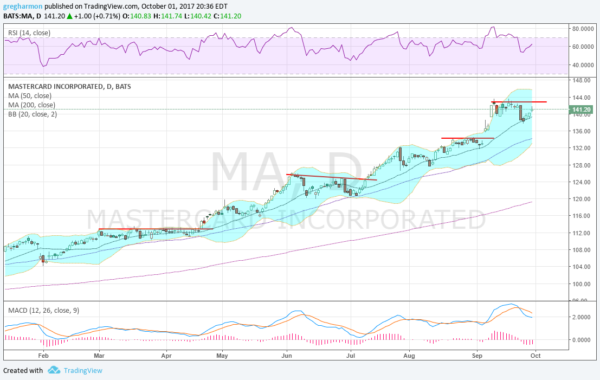

Mastercard Inc (NYSE:MA) is one of those stocks you wish that you owned a year ago. it has plodded higher ever since breaking out of consolidation in September 2016. It has given you a couple of chances to get in along the way. There was a consolidation in the spring before a leap higher in April. Another consolidation in June before a second push up. And a third consolidation at the end of August that it broke higher after Labor Day.

Now it seems to be giving you a fourth chance. After making a new high in early September it pulled back to its 20 day SMA. This has acted as a support area since March. The 20 day SMA as support is a sign of strength. And Friday it pushed up off of that support. It is approaching the prior high, and a break over it would be the buy signal. There is resistance at 143 above and support lower may come at 138 and 136 with a gap then to 134.40 and 132.50.

Momentum is supportive for more upside price action. The RSI is rising in the bullish zone. In fact the lower low in the RSI last week combined with a higher low in prices sets up a Positive RSI Reversal, and gives a target to 149. The MACD has leveled after resetting lower but positive. Short interest is low in the stock at just 1% and it trades ex-dividend starting October 5th. The company is expected to report earnings next on October 31st.

The options chain for this week shows a large open interest at the 135 put strike and a smattering of open interest on the call side, biggest at 144, if anything a bias lower, but 135 is a long way off. October monthly options are also biggest at the 135 strike and then big again at 140 on the call side. November 3 options, the first past the reporting date, are just building open interest. The November monthly options which were the only ones that could cover the report up until 2 weeks ago show large open interest at the 135 and 130 put strikes that matches the size at the 145 call strike. This smells of a large protective collar trade.

Mastercard, Ticker: $MA

Trade Idea 1: Buy the stock on a move over 143 with a stop at 138.

Trade Idea 2: Buy the stock on a move over 143 with a November 3 expiry 141/135 Put Spread ($2.10) and then sell the November 10 Expiry 147 Calls ($1.08) to pay for half of the protection.

Trade Idea 3: Buy the November 3 expiry 134/142/145 Call Spread Risk Reversal (7 cents).

Trade Idea 4: Buy the October/November 3 expiry 145 Call Calendar ($1.15) and sell the October 27 expiry 138 Put ($1.10).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as the book closes on the 3rd Quarter sees stocks are driving to new all-time highs and looking very strong.

Elsewhere look for Gold to continue its short term pullback while Crude Oil continues to trend higher. The US Dollar Index is consolidating after a long fall and maybe ready to reverse while US Treasuries are biased to continue lower in the short term. The Shanghai Composite continues to consolidate and Emerging Markets are consolidating in their uptrend.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all look fabulous in the longer timeframe. The IWM may need a breather after a strong run while the SPY and QQQ also look strong in the short run. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.