Here is your Bonus Idea with links to the full Top Ten:

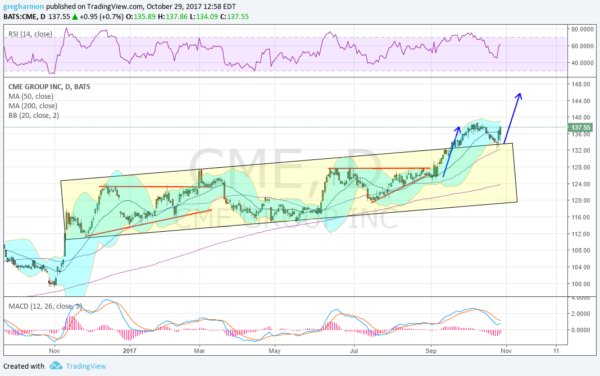

CME Group (NASDAQ:CME), $CME, has had several short term consolidations, followed by a small break out and then retracement. In a broader context these can be put into a slightly rising long term consolidation like the yellow box below. It broke above that consolidation in September reaching a top in early October before pulling back to retest the break out. That held last week and started higher.

A Measured Move gives a target to 146 above. The RSI is rising in the bullish zone and the MACD is turning towards a cross up. The Bollinger Bands® are also starting to open to allow a move up. There is resistance at 138.50 and then no prior price history. Support lower may come at 134 and 127.60. Short interest is low at 1.3%. The company is not expected to report earnings again until February 5th 2018.

The weekly options chain shows low open interest and an options implied move of about $2.30 this week. The November monthly chain shows largest open interest at the 140 Call Strike above and then some size at the 135 Put and 144 and 145 Calls. December options indicate flat to higher with open interest larger on the Call side and from 125 to 160. The January chain has very large open interest at the 115 Strike and then from 130 to 155. And finally March options, the first covering the next earnings report, are building but biggest on the Call side at the 140 Strike.

CME Group, Ticker: $CME

Trade Idea 1: Buy the stock now (over 134) with a stop at 132.

Trade Idea 2: Buy the stock now (over 134) and add a November 137/133 Put Spread ($1.50) covering the option implied move to the downside, and selling the January 145 Calls ($1.00) to pay for most of the protection.

Trade Idea 3: Buy the November 138/140 Call Spread ($1.25) looking for a draw to the large open interest there, and sell the November 135 Puts ($1.00) with large open interest to fund the call spread.

Trade Idea 4: Buy the November/March 140 Call Calendar ($3.20) and sell the November 135 Put ($1.00) to start funding it. As the November calls reach expiry look to sell out of the money December calls to further reduce the basis.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the last days of October the equity markets look.

Elsewhere look for Gold to continue lower in the short run while Crude Oil looks for new 52 week highs. The US Dollar Index has renewed strength and looks to continue higher while US Treasuries are biased lower but at long term support. The Shanghai Composite continues to make higher highs as it approaches 2 year highs and Emerging Markets are holding on a retest of break out levels.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts also look better higher on both the short and intermediate timeframe, though the IWM may need a kick in the pants to get out of consolidation. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.