Here is your Bonus Idea with links to the full Top Ten:

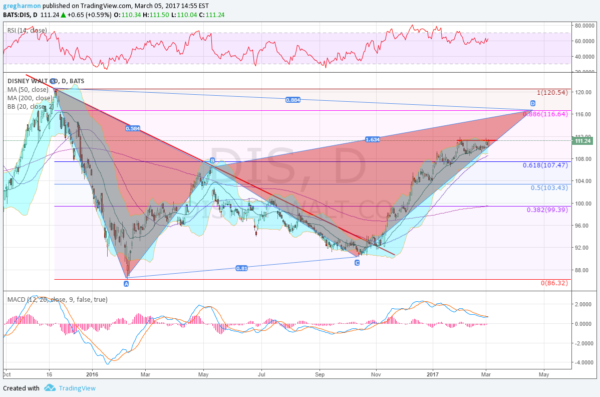

Walt Disney Company (NYSE:DIS), stock started moving lower in November 2015. It found a bottom with the market in February 2016, but unlike the broader market did not really rebound. It retraced nearly 61.8% of the move lower and then fell back, establishing falling trend resistance that held until October 2016. At that point the stock started back higher. It crossed its 200 day SMA in November and then rode the 20 day SMA higher to this point.

The price has been moving sideways recently in consolidation under 111.25. As it does so, the Bollinger Bands® have squeezed in, foretelling a move soon. The RSI has continued to hold over 60 in the bullish zone and the MACD is leveling and near a positive cross. Momentum supports another move higher.

The chart shows a bearish Bat harmonic, with a Potential Reversal Zone (PRZ) above at 116.64. There is resistance at 111.25 and 113.50 followed by 115 and 117.50 then 120.50. Support comes below at 109.65 and 108.75 then 106.65. Short interest is low at 1.0%. The company is expected to report earnings next on May 9th and it pays a semi-annual dividend which is not expected until early July.

The options chains show a focus on the call side this week at 112, at-the-money, and smaller and spread lower on the put side. For March monthly big open interest is found at both the 110 and 115 call strikes with smaller amounts at the 105 and 110 put strikes. April options also have bigger open interest on the call side, from 105 to 120. The May options, the first after the next earnings report, shows a 4:1 size advantage to the calls, focused at 115, with the puts at 110.

Walt Disney

Trade Idea 1: Buy the stock on a move over 111.25 with a stop at 109.

Trade Idea 2: Buy the stock on a move over 111.25 with an April 110 Put ($1.60) for protection and selling a May 115 Covered Call ($1.87 credit) to fund it.

Trade Idea 3: Buy the May 110/115 Call Spread ($2.38) and sell the May 105 Put ($1.22 credit).

Trade Idea 4: Buy the April/May 115 Call Calendar ($1.11) and sell the May 105 Put ($1.22 credit).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the first full week of March sees the equity markets have entered more like a lion than a lamb.

Elsewhere look for Gold to continue the pullback in its uptrend while Crude Oil consolidates with a bias for a break to the downside. The US Dollar Index looks to continue higher short term while US Treasuries continue to consolidate in their downtrend. The Shanghai Composite continues to drift higher while Emerging Markets pullback in their uptrend.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show continued strength in the SPY and QQQ, especially on the longer timeframe, with the IWM in consolidation mode again on both timeframes. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.