Here is your Bonus Idea with links to the full Top Ten:

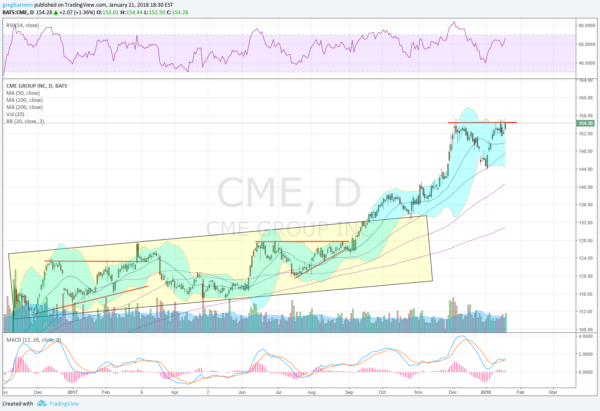

CME Group (NASDAQ:CME), $CME, stock was in a lazy grind higher for most of 2017. Three steps higher, then 2 steps back, maintaining within a rising rectangle. Just after Labor Day it printed 3 wide range days, and then the stock took off to the upside. It broke out of the rectangle by mid-month and then came back to retest the break out area. That retest held and it moved higher quickly to a top at the beginning of December. A pullback to the 50 day SMA held and it moved in a ‘V’ recovery back to the prior high.

The RSI is rising in the bullish zone and making a higher high while the MACD is also rising and bullish, having just avoided a cross down. The longer SMA’s continue to trend higher with the 20 day SMA now level, like the Bollinger Bands®. There is no resistance above 154.50 and a Measured Move would give a target to 164.50. Support lower comes at 151.50 and 148 followed by 144. Short interest is low at 1.5%. The company will report earnings next very soon on February 1st.

The weekly options chain shows open interest on the call side that may play a role as it is biggest from 150 to 155. For the February 2 expiry the 155 Puts and 152.50 Calls are the biggest, but neither is very large. In the February monthly options the 155 Calls have notably large open interest. The same can said for the March monthly options.

Trade Idea 1: Buy the stock on a move over 154.50 with a stop at 151.50.

Trade Idea 2: Buy the stock on a move over 154.50 and add a February 2 Expiry 152.50/150 Put Spread ($1.05). Sell a February monthly 160 Covered Call ($1.25) to pay for the protection.

Trade Idea 3: Buy the January 26 Expiry/February 155 Call Calendar ($2.40).

Trade Idea 4: Buy the March 155/165 Call Spread ($3.30) and sell the February 2 Expiry 150 Put ($1.00) to lower the cost.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with January Options Expiration behind, sees the Equity markets looking extremely strong and perhaps overheated.

Elsewhere look for Gold to pause in its uptrend while Crude Oil slows as it hits resistance as well. The US Dollar Index looks destined to move lower while US Treasuries are biased lower in consolidation. The Shanghai Composite and Emerging Markets are poised to continue to new multi-year highs.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). They are lining up on both the shorter and longer timeframe now with the SPY overheated and at extreme momentum levels, the QQQ also overbought but not quite extreme, while the IWM is just getting going. This could easily lead to rotation into the IWM from the other Indexes. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.