Wells Fargo, Ticker: $WFC

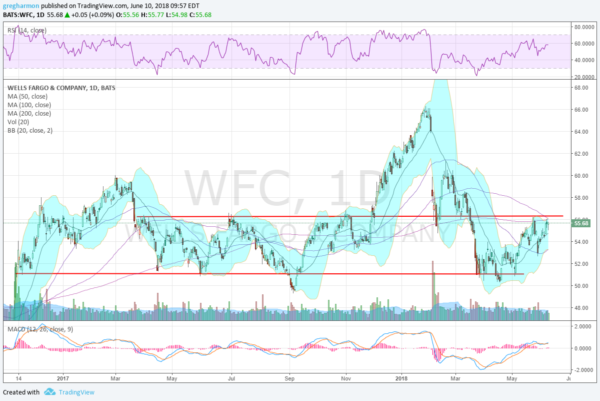

Wells Fargo ($WFC), moved higher at the end of 2016, pausing over 51, before continuing to a top in March 2017. It pulled back to 51 from there into April and began a sideways movement in a range between 51 and 56.40 that would last for 8 months, with only a minor false break down in September that year. The move higher from December to January 2018 seemed to have put that range far behind, but then it gapped down, and into the range, bounced and then fell back into it for good. It has been in the prior range for 3 months now.

Friday it ended at the top of the range, and just under the 100 and 200 day SMA’s. The RSI is in the bullish zone with the MACD crossing up and positive. These support a move higher. The Bollinger Bands® are shifting higher as well. There is resistance at 56.40 and 58.55 then 60 and 62 with a gap to fill to 64 and then 66. Support lower comes at 55.20 and 53.30 then 52.90 and 51. Short interest is low under 1% and the company is expected to report earnings next on Friday, July 13th.

The June monthly options chain shows the largest open interest is at the 55 strike on both sides so it is possible that it ends little changed this week. The weekly chains out to July 6 Expiry also show 55 as the biggest open interest. The July 13 Expiry, the first after the earnings report, shows the largest open interest at the 58 Call strike though. The July monthly chain falls back to the 55 strike as most popular. And finally the August chain shows the 60 Call as most popular, followed by the 55 Call.

Trade Idea 1: Buy the stock on a move over 56.40 with a stop at 55.

Trade Idea 2: Buy the stock on a move over 56.40 and add a July 55/52.50 Put Spread (70 cents) as protection. Sell the August 60 Call (44 cents) to lower the cost.

Trade Idea 3: Buy the July 13 Expiry 55.50/58 Call Spread ($1.05) and sell the July 13 Expiry 52 Put (31 cents).

Trade Idea 4: Buy the August 55/60 Call Spread ($1.88) and sell the August 52.50 Put (81 cents).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the FOMC June meeting and monthly Options Expiration sees the equity markets looking strong.

Elsewhere look for Gold to continue to consolidation around 1300 while Crude Oil consolidates after pulling back. The US Dollar Index looks to continue lower while US Treasuries are biased lower in broad consolidation. The Shanghai Composite is consolidating at 52 week lows and Emerging Markets remain in a pullback in the uptrend.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show the IWM the strongest and leading on the longer timeframe with the SPY and QQQ building strength as well. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.