Here is your Bonus Idea with links to the full Top Ten:

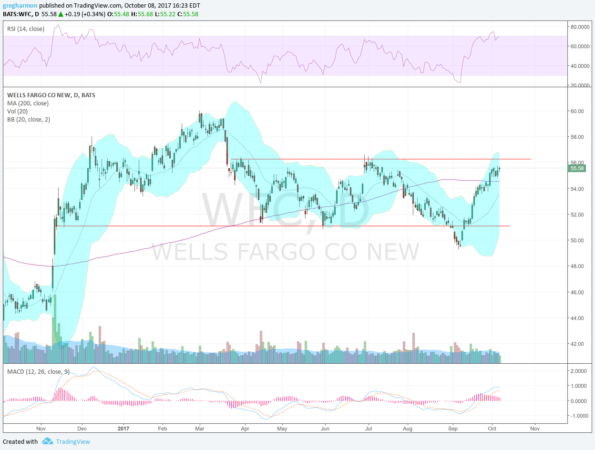

Wells Fargo (NYSE:WFC), $WFC, raced higher after the November election gaining 10% in only 2 days. It continued to move higher at a slower pace after that, reaching an ultimate top at the end of February. The pullback from there found support at the 200 day SMA and the price bounced. It settled into a sideways channel for through the end of August when it broke the channel to the downside. That proved to be a failed break down and it rapidly recovered back into the channel, but remained under the 200 day SMA. It ended September with a push back over the 200 day SMA and then consolidated there last week, near the top of the channel.

The Bollinger Bands® are shifted higher to allow a move up. The RSI is high in the bullish zone. The MACD is rising and bullish. All support more upside price action. A break of the channel at 56.30 would see resistance at 60, the prior top. Support lower sits at 54.75 and then 53.30. Short interest is low under 1% and the company is expected to report earnings Friday morning before the open.

The options chain for this week shows an expected $1.40 move by Friday or a range of 54.15 to 57. Open interest is biggest at the 54 strike this week with big size at the 53 put strike as well. October monthly options show biggest open interest at the 55 strike followed by 52.50. there is also big open interest at 57.5 and 60 above on the call side. In November the focus range is 52.50 to 55 and December spread more from 47.5 to 55. January 2018 options, after the following earnings report, show a focus of open interest on the call side from 50 to 60 and on the put side at 50 and 45.

Wells Fargo, Ticker: $WFC

Trade Idea 1: Buy the stock on a move over 56.30 with a stop at 54.50.

Trade Idea 2: Buy the stock on a move over 56.30 and add an October 13 Expiry 55.5/54 Put Spread (51 cents) as protection through earnings. Sell the December 60 Call (32 cents) to lower the cost of protection.

Trade Idea 3: Buy the October 13 Expiry/December 57.50 Call Calendar (80 cents).

Trade Idea 4: Buy the January 50/57.5 bullish Risk Reversal (78 cents).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the next week sees the SPY (NYSE:SPY) and iShares Russell 2000 (NYSE:IWM) looking ready to hand over the lead to the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) as they take a breather after strong runs.

Elsewhere look for Gold to continue lower while Crude Oil also moves to the downside. The US Dollar Index looks better to the upside short term while US Treasuries are biased lower. The Shanghai Composite and Emerging Markets are biased to the upside for the week.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all look great on the longer timeframe, while the SPY and IWM are extended in the shorter timeframe and could pause or pullback slightly. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.