Here is your Bonus Idea with links to the full Top Ten:

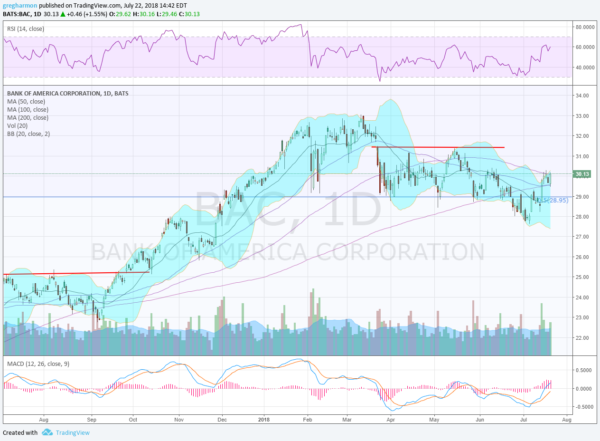

Bank of America (NYSE:BAC) started higher in September, breaking over consolidation at the end of the month. It continued higher to a top at the end of January before a pullback. That reached down to the 50 day SMA and just above the 50% retracement of the move lower from the Financial Crisis. It bounced fast from there and made a higher high in March before another setback. It consolidated over the 50% retracement for nearly 3 months before the 200 day SMA rose to meet it and then it dropped lower. Last week it pushed back up over the 200 day SMA and consolidated under the 100 day SMA.

This is the second minor leg up and a break out of the current consolidation gives a target to 31.20, about where it has stalled since April. The RSI is rising in the bullish zone with the MACD crossed up, rising and positive. There is resistance at 30.25 and 31.40 then 33. Support lower comes at 29.60 and 28.95 then 27.75. Short interest is low at 1.1%. The company is expected to report earnings on October 15th next. Look for the stock to go ex-dividend near the end of August or early September.

The July 27 Weekly options chain shows the biggest open interest at the 30 strike with some size at 32 on the call side and smaller size at 29.50 and 28.50 on the put side. The August chain is also biggest at the 30 strike but has large size at the 31 and 33 call strikes as well, then the 27 put. In the September chain open interest on the call side is spread from 29 to 33, and on the put side it grows from 24 to 30, but is much smaller. Finally in the October chain, which is the first to cover the next earnings period, open interest is biggest at the 30 call strike then tails higher to 35. On the put side it is small and found at 28.

Bank of America, Ticker: $BAC

Trade Idea 1: Buy the stock on a move over 30.25 with a stop at 29.50.

Trade Idea 2: Buy the stock on a move over 30.25 and add an August 29 Put (22 cents) as protection. Sell the October 34 Call (15 cents) to cover most of the cost of protection.

Trade Idea 3: Buy the August/October 31 Call Calendar (59 cents). As August Calls expire roll up and out to September.

Trade Idea 4: Buy the October 28/31/33 Bullish Call Spread Risk Reversal (12 cents, buy the 31 calls and sell the other 2 pieces)

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with July options expiration behind, sees the equity markets continue to look strong, holding at key levels into the heart of earnings season.

Elsewhere look for Gold to possibly pause in its downtrend while Crude Oil pulls back in the uptrend. The US Dollar Index continues to consolidate in the uptrend while US Treasuries pull back in broad consolidation. The Shanghai Composite is building a possible reversal higher after a long pullback and Emerging Markets are also starting to show signs of a possible reversal higher.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show a mixed big in the short run with the SPY moving higher while the IWM consolidates its move and the QQQ digests moving slightly lower. All three look great on the longer timeframe, so maybe the short term was options expiration games. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.