Here is your Bonus Idea with links to the full Top Ten:

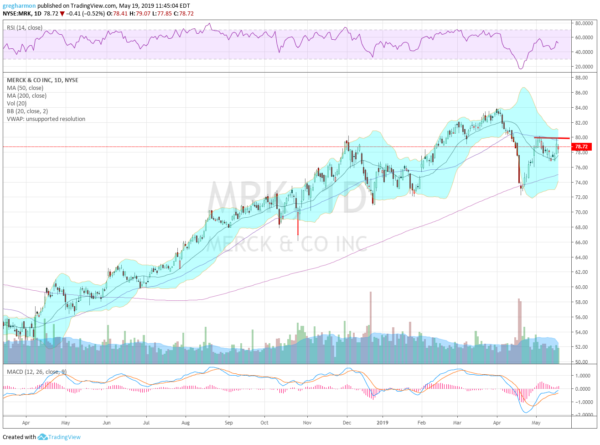

Merck (NYSE:MRK), $MRK, had a long move higher culminating in a top at the beginning of April. It pulled back hard and fast from there finding support at the 200 day SMA less than 3 weeks later. That was a drop of nearly 14%. Since then it has recovered and moved up to the 50 day SMA. It stalled there and has been consolidating for the past 3 weeks.

Coming into the week it is curling up in consolidation with the Bollinger Bands® squeezed. It has a RSI on the verge of a move into the bullish zone with the MACD rising and about to cross to positive. There is resistance at 80 and 82 then 84. Support lower comes at 77 and 75.70 before 72.50. Short interest is low under 1%. The dividend yield on the stock is nearly 2.8% and it started trading ex-dividend last on March 14th. The company is expected to report earnings next on July 30th.

The May 31 Expiry options chain shows sizable open interest at the 80 call strike. Moving out to the June Expiry shows the biggest open interest at the 82.50 call followed by the 80 call and then the 75 put. In July the 82.50 call is also the largest open interest with 80 and 85 also big. Finally the August Expiry, the first to include the next earnings report, will be freshly opened this week.

Merck, Ticker: $MRK

Trade Idea 1: Buy the stock on a move over 80 with a stop at 77.

Trade Idea 2: Buy the stock on a move over 80 and add a June 77.50/72.50 Put Spread ($1.00) while selling the September 85 Call ($1.00 credit).

Trade Idea 3: Buy the July/September 82.50 Call Calendar ($1.00) and sell the July 72.50 Puts (70 cent credit).

Trade Idea 4: Buy the July 72.50/80/82.50 Call Spread Risk Reversal for 20 cents.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which saw equities continued to experience some setbacks as the markets closed out May options expiration.

Elsewhere look for Gold to continue its pullback while Crude Oil resumes the uptrend. The US Dollar Index looks to drift higher while US Treasuries are also biased to the upside. The Shanghai Composite remains stuck in its pullback while Emerging Markets continue the downtrend.

Volatility looks to continue to moderate easing the pressure on the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts show intra-week strength in the pullbacks of the SPY and QQQ with the IWM stuck in a range. All 3 look weaker on the daily charts. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.