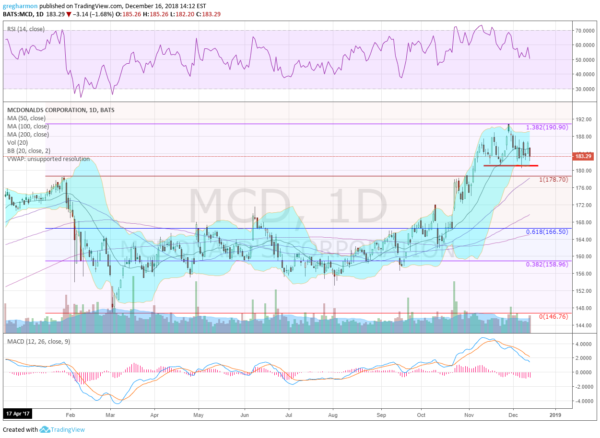

McDonald’s (NYSE:MCD) made a top in January and fell back to a low at the beginning of March. It bounced from there, quickly retracing 38.2% of the move lower. It continued to a 61.8% retracement before stopping, and then bounced in a channel between the two Fibonacci’s for a total of about 8 months. It pushed over the top for good in October and completed a full retracement, continuing up to a 138.2% extension of the move. The fall from there found support at recent levels and has been consolidating.

The RSI is pulling back and is now at the mid line while the MACD is falling but remains positive. There is support lower at 181.25 and 178.70 then 173.30 and 168.40 before 166.50 and 163. There is resistance at 188 and 190.90 above. Short interest is low at 1%. The company is expected to report earnings next on January 28. It pays a dividend yielding 2.58% but just recently began trading ex-dividend.

The December options chain shows the biggest open interest at the 190 strike above, with some size at the 185 call and the 165 put as well. January options see the biggest open interest at the 165 put and then the 190 put. On the call side it is biggest from 185 to 200. February options, covering the next report, are still building open interest but it is focused at 160 and 170 on the put side, and 195 on the call side.

- Trade Idea 1: Sell the stock short on a move under 181 with a stop at 184.

- Trade Idea 2: Sell the stock short on a move under 181 and buy a January 11 Expiry 185 Call ($3.65) for protection.

- Trade Idea 3: Buy a January 11 Expiry 182.50 Put ($3.70).

- Trade Idea 4: Buy a January 11 Expiry 182.50 Put ($3.70) and sell a February 165 Put ($1.47) to lower the cost.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday, which heading into December Options Expiration and the last full trading week of the year sees equity markets continue to look weak, and getting weaker.

The Broader Markets

Elsewhere, look for gold to pause in its uptrend while crude oil consolidates in its downtrend. The US Dollar Index looks to pause in its uptrend while US Treasuries consolidate in their short-term rise. The Shanghai Composite continues in broad consolidation in its downtrend and Emerging Markets are pausing in their move lower.

Volatility looks to remain elevated, keeping in the new higher range. This continues to keep the bias lower for the equity index ETFs SPY, IWM and QQQ. Their charts show the pressure with the IWM leading markets lower, the SPY breaking a range to join it and the QQQ dropping to the bottom of recent trading, hanging on by a fingernail. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.