Here is your Bonus Idea with links to the full Top Ten:

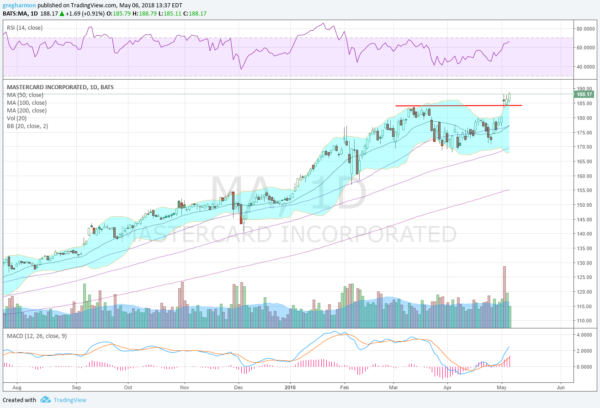

Mastercard, MA, was steadily moving higher until it made a top in March. It pulled back then to the 50 day SMA and held. It continued to move sideways then for a month, a period that ran up to its earnings report. After the report the stock gapped higher, over the March high, and it has consolidated there for most of 3 days. Friday afternoon it started to move to the upside and closed at a new all-time high.

The RSI is rising and bullish while the MACD is positive and moving higher. The Bollinger Bands® are also opening to the upside. There is no resistance above. Support lower comes at 184 and 180 then 172. Short interest is low under 1%. The company does not report earnings again until July 25th. The stock pays a small dividend that will likely also be declared for holders in early July.

The May options chain shows open interest biggest on the call side, with the 185 and 190 strikes the biggest. Put open interest is focused at the 185 strike. In June the open interest is biggest at the 180 call and spread to 195. The July chain sees open interest on the call side spread from 170 to over 210, but focused at the 150 put strike. You have to look to October to cover the next earnings report and the open interest there is biggest at the 195 call.

Mastercard, Ticker: $MA

Trade Idea 1: Buy the stock with a stop at 179.

Trade Idea 2: Buy the stock and add a June 185/175 Put Spread ($2.18) while also selling the July 200 Call ($2.25) to fund it.

Trade Idea 3: Buy the July 190/200 Call Spread ($3.90) and sell the July 175 Put ($2.15) to pay for most of it.

Trade Idea 4: Buy the October 190/June 195 Call Diagonal ($8.90). As June expires look to sell above the money July Calls, and repeat monthly.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as May begins sees the equity market continuing to move sideways in consolidation without any energy, but a slightly improving picture.

Elsewhere look for Gold to hold or bounce off of support in its range while Crude Oil continues higher. The US Dollar Index continues to show strength in the short term moving higher while US Treasuries are consolidating at a lower high, a possible Dead Cat Bounce. The Shanghai Composite is consolidating in a downtrend clinging to support while Emerging Markets continue to retrench in the uptrend.

Volatility looks set to remain low and more stable taking pressure off of the equity index ETF’s SPY, IWM and QQQ. Their charts all ended the week stronger on the shorter timeframe and in consolidation near the top on the longer timeframe. In the short term the QQQ and IWM look a bit stronger than the SPY. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.