Here is your Bonus Idea with links to the full Top Ten:

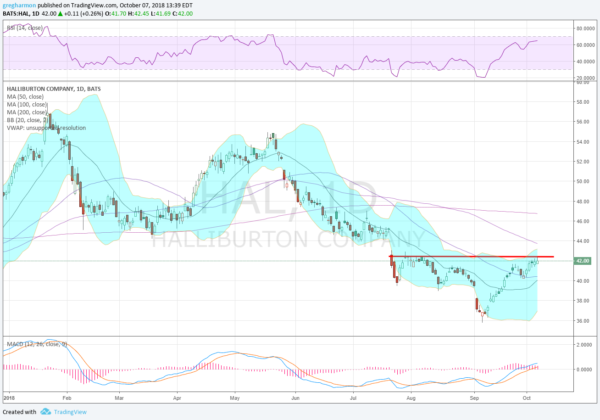

Halliburton (NYSE:HAL), pulled back with the market in January. It found support at the 200 day SMA and consolidated there for 2 months before a move to the upside. That fizzled out at a lower high in May and it reversed lower again. It eventually found a bottom at the beginning of September. Since then it has moved back up and is pausing at resistance.

The RSI is rising and back into the bullish zone with the MACD crossed up, and positive. Both support more upside. The Bollinger Bands® have also shifted back higher. There is resistance at 42.50 and then a gap to fill to 44.50 followed by 46 and 48.50 then 51.25 then a gap to 52 and the May top at 54.85. Support lower comes at 41.50 and 40. Short interest is low at 1.6%. The company is expected to report earnings on October 22nd.

The October monthly options chain shows the biggest open interest at the 42.50 call strike, with size in the puts at 40 and 37.50. The October 26 Expiry chain, the first covering the earnings report, has lower open interest but the spikes are at the 42 call and 40 and 38.50 puts. The November options have very large open interest at the 35 put and then size at the 45 call. December options have biggest open interest at the 35 put and 45 call.

Halliburton, Ticker: $HAL

Trade Idea 1; Buy the stock on a move over 42.50 with a stop at 40.

Trade Idea 2: Buy the stock on a move over 42.50 and add an October 26 Expiry 42/40 Put Spread (70 cents) to protect it through earnings. Sell the November 45 Calls (57 cents) to cover the cost of protection.

Trade Idea 3: Buy the November 42.50/October 43 Call Diagonal ($1.00).

Trade Idea 4: Buy the December 37.50/45 bull Risk Reversal (40 cents).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which after one week of October sees the equity markets have given up strength with some sectors bleeding red in the shorter frame while holding key levels on the longer timeframe.

Elsewhere look for Gold to consolidate in the downtrend while Crude Oil pauses in its move higher. The US Dollar Index is moving higher in consolidation while US Treasuries are trending lower. The Shanghai Composite comes back from vacation looking like a possible reversal to the upside but Emerging Markets resumed their downtrend.

Volatility perked up and may continue, making it more difficult for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ). The IWM is in full blow short term downtrend but at support on the longer timeframe. The QQQ are consolidating on the longer timeframe but also leaking in the shorter view. The SPY looks the strongest on that longer timeframe but is also dipping to retest the January highs in the short run. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.