Here is your Bonus Idea with links to the full Top Ten:

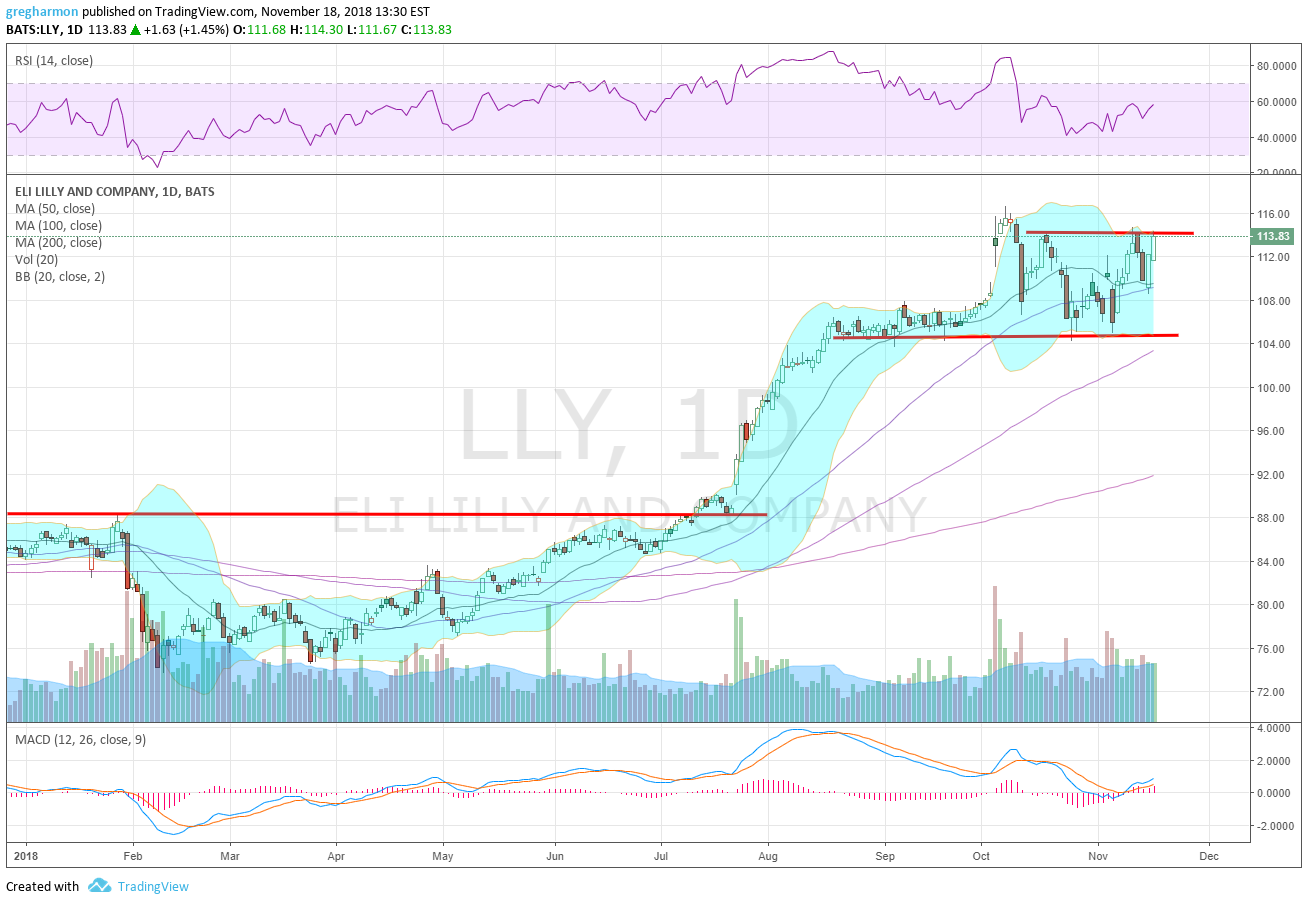

Eli Lilly (NYSE:LLY), $LLY, rose up out of a long flat consolidation in July. It continued higher until the middle of August when it paused to digest the move. At the beginning of October it started higher again, finding resistance quickly and pulling back. This marked a channel that has held the stock price ever since. Friday it had moved up to resistance again and looked strong.

The RSI is moving into the bullish zone with the MACD rising and positive. There is resistance at 114 and 116.35. The Measured Move on a break higher is to 130. Support lower comes at 109 and 107.50 then 104.50. Short interest is low at 1.1% and the company is expected to report earnings next on February 13th. The stock just began trading ex-dividend last week.

The December options chain shows biggest open interest at the 105 strike on the put side and 115 strike on the call side. In the January chain open interest is biggest at the 100 put and call. February chain, the first to cover the next earnings report, opens Monday. The April chain shows light open interest.

Eli Lilly, Ticker: $LLY

Trade Idea 1: Buy the stock on a move over 114 with a stop at 109.

Trade Idea 2: Buy the stock on a move over 114 and add a December 110/105 Put Spread (90 cents) as protection. Sell the April 130 Call ($1.15) to pay for the protection.

Trade Idea 3: Buy the April 115/December 120 Call Diagonal ($5.35).

Trade Idea 4: Buy the April 105/120 bullish Risk Reversal ($1.40).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with November Options Expiration in the rear view mirror and traders looking forward to a short Thanksgiving week, sees equity markets hinting at reversing higher.

Elsewhere look for Gold to continue in its short term uptrend while Crude Oil pauses in its downtrend. The US Dollar Index is resuming its move higher while US Treasuries continue to consolidate in their downtrend. The Shanghai Composite is staging a possible reversal while Emerging Markets are trying to buck their downtrend.

Volatility looks to remain slightly elevated but drifting lower, easing the downward pressure on the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts show some signs of reversing in the short timeframe, while on the longer timeframe the consolidation is more obvious. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.