Here is your Bonus Idea with links to the full Top Ten:

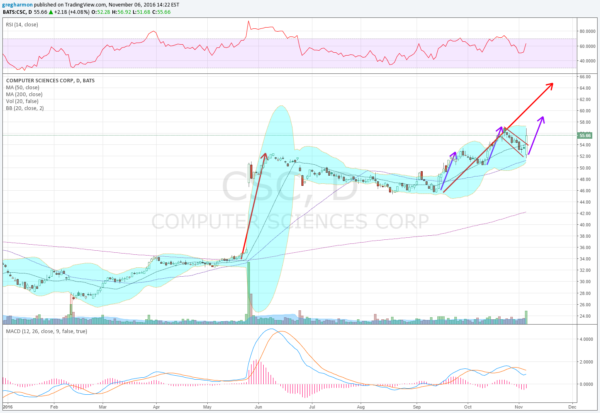

Computer Sciences Corporation (NYSE:CSC), did absolutely nothing for the 6 months into June this year. It gapped down at the start of December and sat there in a $4 range for 6 months. In May that all changed. Well it changed for a day. The stock gapped up 40%, but then held in a tight range again for 3 and a half months until mid September.

It started higher again then with a shorter trend followed by a pullback. That repeated in October and Friday looks to have started a third leg up. The bullish engulfing candle, on strong volume to start the third leg gives a target on a Measured Move to 59. But there is also a larger Measured Move to 65 above that.

The stock has positive momentum with the RSI moving up in the bullish zone while the MACD is turning back higher towards a cross up, and is positive. In the intermediate term the Bollinger Bands® have turned higher, but short term may still provide a cap as they are flat. The company will not report earnings again until February 9th and short interest is elevated at 7.6%.

The November options chain shows big open interest at the 57.5 strike on the call side. It is greater than the total open interest on the put side. The put side open interest is biggest at 50 and 52.50. This suggest a easier path higher. Longer dated options have been lightly traded thus far.

Computer Sciences Corporation

Trade Idea 1: Buy the stock now (over 54) with a stop at 52.

Trade Idea 2: Buy the stock now (over 54) with a December 55/52.5 Put Spread ($1.30) and selling a January 60 Covered Call (80 cents).

Trade Idea 3: Buy the December 52.5/55 bullish Risk Reversal ($2.00).

Trade Idea 4: Buy the November/January 55 Call Calendar ($1.10) and sell the December 52.5 Put (65 cents) for 65 cents.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the first full week of November and with the US elections Tuesday, sees the equity markets are weak and hemorrhaging.

Elsewhere look for Gold to continue higher in the short term while Crude Oil continues to move lower. The US Dollar Index looks to continue to the downside while US Treasuries are biased lower but consolidating. The Shanghai Composite should continue to drift higher while Emerging Markets are biased to the downside.

Volatility looks to remain elevated keeping the bias lower for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and NASDAQ:QQQ. Their charts agree and look better to the downside on both the daily and weekly timeframes. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.