Here is your Bonus Idea with links to the full Top Ten:

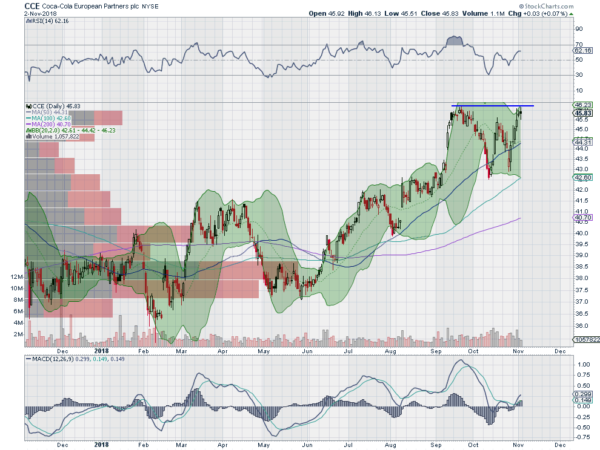

Coca-Cola (NYSE:KO) European Partners, $CCE, rose throughout the first 8 months of 2017. It then started a digestive pullback. It bottomed in February and has been making higher lows and higher highs since. This has resulted in a return to the 2017 high and the completion of a Cup and Handle pattern.

The price is now consolidating in the Handle piece and a break out to the upside gives a target to 53.50. The RSI is poking into the bullish zone with the MACD moving higher and positive. There is no resistance above 46.15. Support lower comes at 45.35 and 44.35 then 43.40 and 43 before 42. Short interest is low under 1%. The stock pays a dividend with 2.79% yield and it starts trading ex-dividend on November 8th. The company is expected to report earnings next on February 14th.

Looking at the options chains the November options show little activity to attract a pin for the end of next week. December options are just building as well. But the February options, covering the next earnings report, show a large open interest at the 47 Call strike above and smaller amounts at 48 and 49. There is also some open interest at the 42 strike on both sides and the 37 Put.

Coca-Cola European Partners, Ticker: $CCE

Trade Idea 1: Buy the stock on a move over 46.15 with a stop at 44.35.

Trade Idea 2: Buy the stock on a move over 46.15 and add a February 45/42 Put Spread ($1.00) while selling a May 50 Call (85 cents) to finance it.

Trade Idea 3: Buy the February 46/50 Call Spread ($1.55) and sell the February 42 Put (60 cents) to help finance it.

Trade Idea 4: Buy the February 42/48 bullish Risk Reversal for 45 cents.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as November begins sees the equity markets found support and bounced ahead of the elections Tuesday.

Elsewhere look for Gold to move higher in the short term while Crude Oil continues to pullback in its uptrend. The US Dollar Index is in a short term uptrend while US Treasuries are dropping lower. The Shanghai Composite and Emerging Markets are looking like they may be ready to reverse their downtrends.

Volatility remains elevated but has settled back into the teens keeping some pressure on equities but less than recently allowing some upward movement. The equity index ETF’s SPY (NYSE:SPY), IWM and QQQ reacted with positive weeks, the IWM the strongest. They are all showing signs they may reverse higher as well. That is good news as it was the IWM that led all markets lower. The new week should be interesting. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI