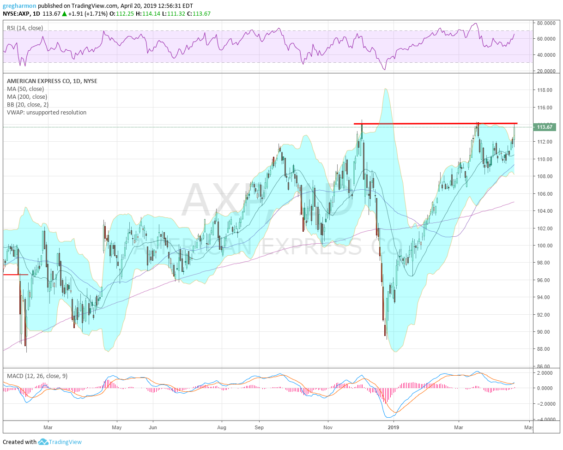

American Express (NYSE:AXP) was on a tear higher until it made a top in December. The pullback from there was sharp and swift to a bottom at the end of the month. Since then it has moved almost straight up. It reached the prior high in March and pulled back to a higher low and is now back at that top after reporting earnings.

As it gets there the Bollinger Bands® have opened after squeezing. The RSI is rising in the bullish zone and the MACD is crossing back up and positive. There is no resistance over 114.25. A Measured Move gives targets to 117 and 133. Support lower comes at 112 and 109.50 then 109 and 106.50. Short interest is low at 1%. The stock pays a small dividend and started trading ex-dividend April 4th. The company will report earnings next July 16th.

The May options chain shows the largest open interest at the 115 call strike. In July it is biggest at the 110 call but sizable from 100 to 120. The put side in July spikes at the 100 strike. Finally the September options are just building with activity focused from 110 to 120 on the call side and at 100 on the put side.

American Express, Ticker: $AXP

Four Trade Ideas

- Buy the stock on a move over 114.25 with a stop at 112.

- Buy the stock on a move over 114.25 and add a July 110/100 Put Spread ($1.90) while selling the September 125 Call ($1.35).

- Buy the May/July 115 Call Calendar ($2.30) and sell the July 100 Put (65 cents).

- Buy the July 100/120 bullish Risk Reversal (90 cents).

Elsewhere look for Gold to head lower while Crude Oil pauses in its move higher. The US Dollar Index looks to continue to move sideways while US Treasuries may be ending their pullback. The Shanghai Composite and Emerging Markets look to continue to move to the upside.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are a bit mixed though in the shorter timeframe with the QQQ strong and heading higher, the SPY consolidating and the IWM retrenching. All three look stronger in the weekly timeframe. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.