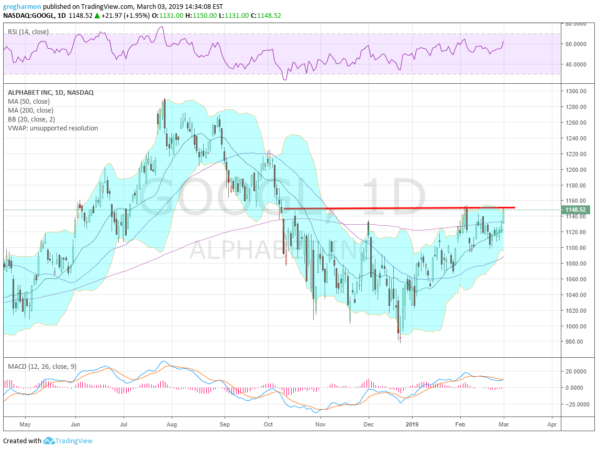

Alphabet (NASDAQ:GOOGL), made a top in July and started trailing lower. It continued with a couple of steps to a low at the end of December. Since then it has been moving higher. The entire price action from October through to now is rounding out a bottom and reversal against resistance at about 1150. The RSI is into the bullish zone and rising with the MACD positive and now turning to cross up.

The Bollinger Bands® squeezed in and Friday started to open as the price reached up to resistance. There is resistance at 1150 and 1190 then 1215 and 1265 before 1290. Support lower comes at 1133 and 1100 then 1066 and 1026 before 980. Short interest is non-existent. The stock does not pay a dividend and the company is expected to report earnings next on April 22.

The March options chain shows the biggest open interest on the put side at the 1100 strike with size at 1140 and some lower. The call side is biggest at 1140 and 1200 with size at 1150 as well. In April the 1120 puts and calls are biggest. The May options are the first to cover the earnings report and show a smaller size. June options have bigger open interest and it is largest at 1000 and 1100 on the put side, but 1100 and 1150 on the call side.

Alphabet, Ticker: $GOOGL

Trade Ideas

- Buy the stock on a move over 1150 with a stop at 1125.

- Buy the stock on a move over 1150 and add a May 1130/1050 Put Spread ($23.50) and sell a May 1220 Call ($19.20) to fund most of the protection.

- Buy the April/May 1250 Call Calendar ($10) and sell the May 1000 Put for $3.

- Buy May 1050/1175/1200 Call Spread Risk Reversal for $1.

Elsewhere

Look for Gold to continue its recent pullback while Crude Oil stalls in its uptrend. The U.S. Dollar Index remains in broad consolidation while U.S. Treasuries are trending lower in the short term. The Shanghai Composite and Emerging Markets remain in uptrends, but with Emerging Markets consolidating the move.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all experienced consolidation this week at key levels on the short time frame, a healthy pause. On the longer timeframe, possible reversal candles will look to next week to see if confirmation of long term uptrends is given or reversal confirmation at a lower high. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.