Here is your Bonus Idea with links to the full Top Ten:

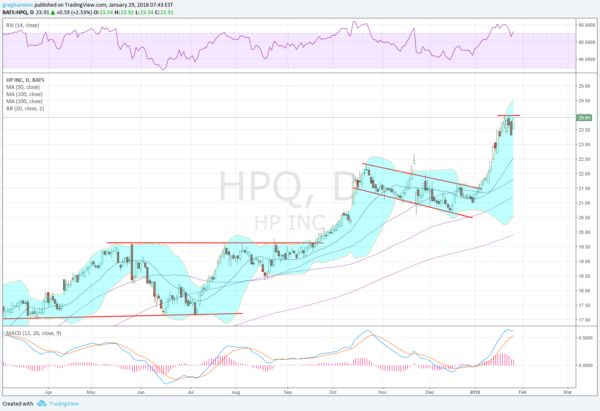

HP Inc (NYSE:HPQ), broke out of a consolidation zone to the upside in September. It continued to a short term top in October before pulling back. The pullback held in a channel except for a 2 day failed break out in November, and continued until the New Year started. Since then it has moved steadily higher. Last week it met resistance and consolidated just under 24. This is the site of the double top that formed from 2007 to 2010.

As it churns the RSI has reset out of technically overbought territory with the MACD flattening at a high level. A Measured Move to the upside out of the consolidation would target a run to 26.50. There is resistance above at 25.45 and 26.80 then 28.40 and 30.50, all from the Dotcom top in 2000. Support lower sits at 23.30 and 22.65 then 22.15 and 21.75 before 21 and 20.70. Short interest is low at 1.4%. The company is expected to report earnings next on February 20th.

The February options chain shows open interest on the put side spread from the 17 strike to 24. On the call side it is bigger and focused from 21 to 24. The February 23 Expiry, just after the earnings report, has its biggest open interest at the 24 call strike. The at-the-money straddle suggests options traders expect roughly a $1.40 move by that expiry. The March options show an open interest range from 21 to 25 in the calls, with the May chain giving a range from 20 to 24, both with the put side open interest focused below the current price.

HP Inc, Ticker: $HPQ

Trade Idea 1: Buy the stock on a move over 24 with a stop at 23.25.

Trade Idea 2: Buy the stock on a move over 24 and add a February 23 Expiry 24/22 Put Spread (66 cents) to protect the downside through earnings. Also sell the February 25 Calls (29 cents) to lower the cost of protection.

Trade Idea 3: Buy the March 22/24 Bull Risk Reversal (57 cents).

Trade Idea 4: Buy the February/March 25 Call Calendar (33 cents).

After reviewing over 1,000 charts, I have found some good setups for the week. This week’s list contains the first five below to get you started early. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the last days of January sees equity markets continue to drive higher and running hot.

Elsewhere begins look for Gold to continue in its uptrend while Crude Oil drives higher as well. The US Dollar Index continues to look weak and better to the downside while US Treasuries are biased lower in consolidation. The Shanghai Composite and Emerging Markets are poised to continue to make new highs.

Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts continue to show the SPY the most overheated with the QQQ only moderately so, and the IWM ready to take the reigns and lead the markets. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.