The S&P 500 has just traded through all time highs after fourteen months of volatility. The bears tried their best, but couldn’t break the bull market that has continued since the financial crisis.

When markets are at highs investors like to buy the stocks that are leading the way. Stocks repeatedly making 52-week highs have the momentum to follow through and go even higher. Below I discuss four stocks that are taking out highs and are either a Zacks Ranks #1(Strong Buy) or #2 (Buy)

Amazon (NASDAQ:AMZN) (AMZN)is Zacks Rank #2 (Buy) thatengages in the retail sale of consumer products in North America and internationally. It operates through the North America, International, and Amazon Web Services (AWS) segments. The Seattle based company was founded in 1994 and has over 230,000 employees.

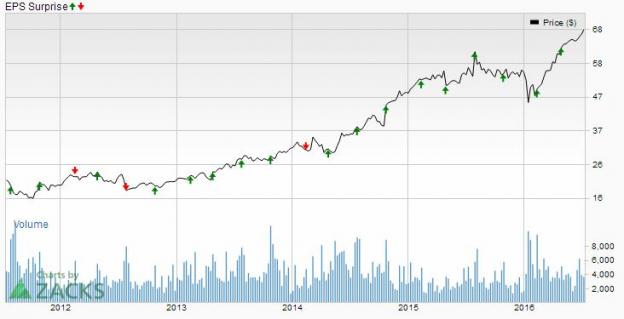

Amazon has had a tremendous run and continues to be one of the best performing stocks out there after hitting all time highs over $755 a share. The stock sports a Zacks Style Score of “A” in Growth and a VGM score of “B”. The company doesn’t pay a dividend but has a 3-5 year EPS growth rate of 43%.

Last quarter Amazon posted an EPS beat of 75%. This beat was the fifth beat out of the last six quarters, which has cause the stock to move from $300 all the way to the current levels above $750.

Amazon reports July 28th when the company will go for another beat and a run at $800 a share. Analysts have been revising estimates higher for the quarter, with revisions of 21% over the last 90 days. In addition, the current fiscal year has been revised 16% for that same time period.

Alarm.com (ALRM) is Zacks Rank #1(Strong Buy) that offers interactive security solutions for home and business owners. The Company offers security systems which include image sensor, crash and smash protection, web control, mobile access and video monitoring.

The Virginia based company was founded in 2000 and has over 500 employees. Alarm has a market cap of $1.25 billion with a Forward PE of 65.This high PE is the reason the stock sports a Zacks Style Score of “F” in Value. However, it sports a “C” in growth and has an expected EPS growth of 15%. This growth will be an important driver of the stock price as the company grows into its valuation.

Since becoming a publically traded company the stock has beat 3 out of 4 times and the stock has now doubled off of 2015 lows. The company next reports on August 4th.

VCA (WOOF) is Zacks Rank #2(Buy) thatoperates as an animal healthcare company in the United States and Canada. It operates in two segments, Animal Hospital and Laboratory. The Los Angeles based company was founded in 1986 and has 12,700 employees.

VCA has a market cap over $5 Billion and a Froward PE of 24. The stock sports a Zacks Style Score of “B” in Value and Momentum and “A” in Growth.

The company reports on July 27th and estimates for EPS are being revised higher. In addition, the company will go for its tenth straight EPS beat since early 2014. This green streak has caused the stock to more than double since 2014. Look for it to continue along with the stocks momentum.

NetEase (NTES) is Zacks Rank #1 (Strong Buy) that is an Internet technology company engaged in the development of applications, services and other technologies for the Internet in China. It provides online gaming services that include in-house developed massively multi-player online role-playing games and licensed titles. NetEase also provides online advertising, community services, entertainment content, free e-mail services and micro-blogging services.

Netease has a market cap of $24 Billion and a Froward PE of 17. The company also pays a dividend of 1.27%. The stock sports a Zacks Style Score of “C” in Momentum and “B” in Growth.

Estimate revisions continue to be taken higher for the company. This while the stock marches to $200 a share. Expect this level to be broken and the momentum to continue higher when the company reports on August 10th.

In Summary

If markets start to breakout investors will be rewarded if they are in the right stocks. Keep an eye on those stocks that are making 52-week highs and consider top ranked stocks in this category. Strength and momentum can fuel more buyers and can lead to big returns.

Note: Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

VCA INC (WOOF): Free Stock Analysis Report

NETEASE INC (NTES): Free Stock Analysis Report

AMAZON.COM INC (AMZN): Free Stock Analysis Report

ALARM.COM HLDGS (ALRM): Free Stock Analysis Report

Original post

Zacks Investment Research