The buzz about Obamacare or the Affordable Care Act (ACA) remains persistent in Capitol Hill. The lukewarm response to its replacement, The American Health Care Act (AHCA), has forced Republicans to continue to seek new avenues. In a bid to save its face, the Trump administration attempted a “skinny" repeal bill which failed to make any headway in the senate.

Going ahead, we believe the impasse is slated to continue as President Trump has always been an outspoken critic of the ACA. Our apprehension comes from the uncertainty regarding the outcome of a slew of events including the possibility of a rate hike by the Fed, a stronger dollar, debate over the fate of Cadillac tax (40% excise tax on high-cost healthcare plans) and the stance of healthcare insurance companies over ACA. These are expected to spark bouts of volatility. Added to these factors are the effects of Hurricane Harvey over the bourses and the reasons which are worrying investors.

Amid this uncertainty, finding investment options that are not perturbed by market gyrations is a tough decision.

Dividend Investing to the Rescue

As evident from the MedTech story, stocks can be volatile and are risky at times.. With uncertainty ruling the markets, it is not surprising that dividend investing has emerged as one of the most popular investing themes.

Dividend stocks are always investors’ preferred choice as they provide steady income and cushion against market risks. These stocks are generally less volatile in nature and hence, are dependable when it comes to long-term investment planning. They not only offer higher income in the current environment – where rates remain low despite expected hikes – but also provide relief in adverse market conditions.

Dividend stocks are a safe bet to create wealth, as the payouts generally act as a hedge against economic uncertainty and simultaneously provide downside protection by offering sizable yields on a regular basis.

How to Pick the Best Stocks?

Although the benefits of dividend investing cannot be stressed enough, one should keep in mind that not every company can keep up with its dividend paying momentum. Hence, investors need to be cautious in order to select the best stocks with the potential for steady returns.

We have used the Zacks Stock Screener to narrow down to four stocks that offer decent dividend yield and have a market cap of $1 billion or more. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our Choices

Abbott Laboratories (NYSE:ABT)

Abbott Park, IL-based Abbott Laboratories discovers, develops, manufactures and sells a diversified line of health care products. The company also has a large pharmaceuticals business and is a major player in the nutritionals and diagnostics markets. In 2016, Abbott generated revenues of $20.8 billion. The company's dividend currently yields 2.32% and its five-year historical dividend growth rate is 2.29%.

Cardinal Health Inc. (NYSE:CAH)

Headquartered in Dublin, OH, Cardinal Health Inc. is a nation-wide drug distributor and provider of services to pharmacies, healthcare providers and manufacturers. The company has two reporting segments – Pharmaceutical and Medical. The company generated revenues in excess of $130 billion in the last reported fiscal. Cardinal Health’s dividend currently yields 2.70% and its five-year historical dividend growth rate is 13.71%.

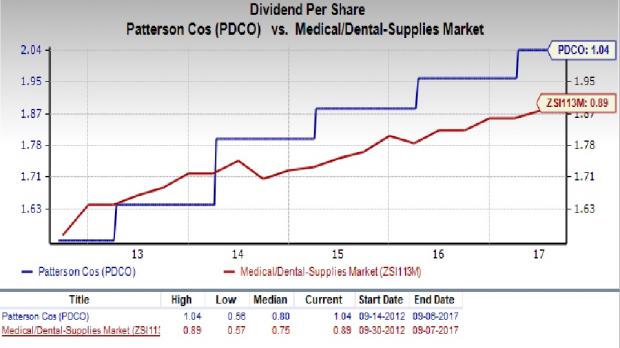

Patterson Companies Inc. (NASDAQ:PDCO)

Headquartered in St. Paul, MN, Patterson Companies is one of the leading distributors of dental and animal health products. The company distributes its products mainly through two subsidiaries – Patterson Dental and Patterson Animal Health. It reported revenues of $5.9 billion in fiscal 2017. The company's dividend currently yields 2.67% and its five-year historical dividend growth rate is 14.35%.

Owens & Minor Inc. (NYSE:OMI)

Based in Mechanicsville, VA, Owens & Minor is a global healthcare services company focused on providing supply chain services to healthcare providers and manufacturers of healthcare products. The company provides logistics services across the spectrum of medical products from disposable medical supplies to devices and implants. The company generated revenues in excess of $9 billion in the last reported fiscal. The company's dividend currently yields 3.62% and its five-year historical dividend growth rate is 2.90%.

Bottom Line

Amid the unpredictable MedTech setting, investing in these high-yielding dividend stocks might fetch you promising returns.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Abbott Laboratories (ABT): Free Stock Analysis Report

Owens & Minor, Inc. (OMI): Free Stock Analysis Report

Patterson Companies, Inc. (PDCO): Free Stock Analysis Report

Cardinal Health, Inc. (CAH): Free Stock Analysis Report

Original post

Zacks Investment Research