Over the weekend, I got a few tweets talking about some technical analysis currently being passed around the Internet suggesting the S&P 500 is about to make a significant move towards 2400. While anything is certainly possible, the problem with the analysis is the lack of fundamental underpinnings to support such a move higher, namely, economic growth and corporate profitability.

Of course, the issue ultimately comes down to valuations. At a price of 2400, based on current earnings per share of $86.92, the market would be trading at the second highest level of valuations in history with a P/E of 27.61.

However, as I was tweeted yesterday morning:

Let’s assume for a moment the $133 EPS estimate was accurate. This would put the forward P/E ratio at just 18x earnings – still well above the long-term historical average P/E of 15.

However, in Paolo’s attempt to justify the bullish meme, the forward earnings estimate is no longer $133/share but, according to S&P, just $122.15 through the end of 2017. IF we assume those estimates are correct, now the forward P/E rises to 19.64x earnings. Certainly not cheap.

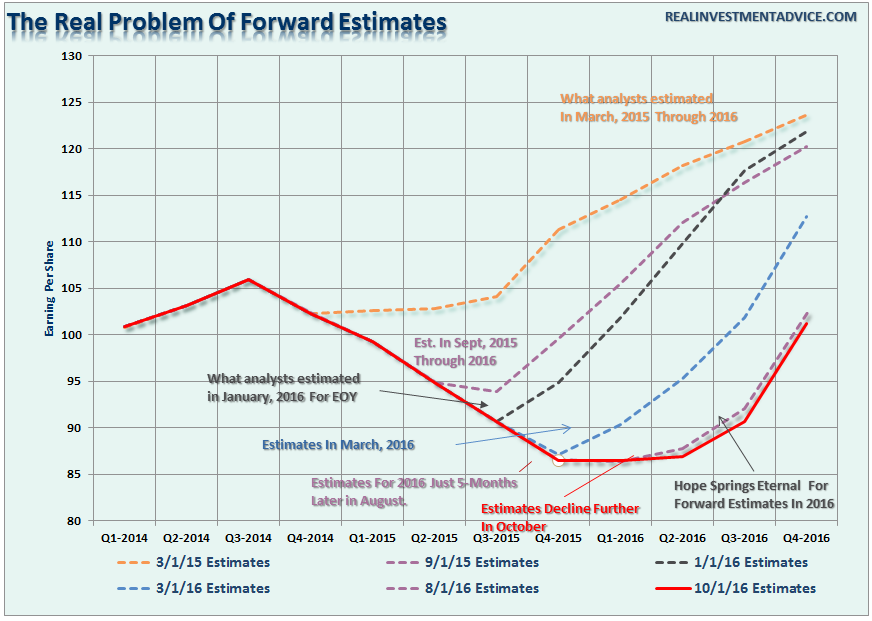

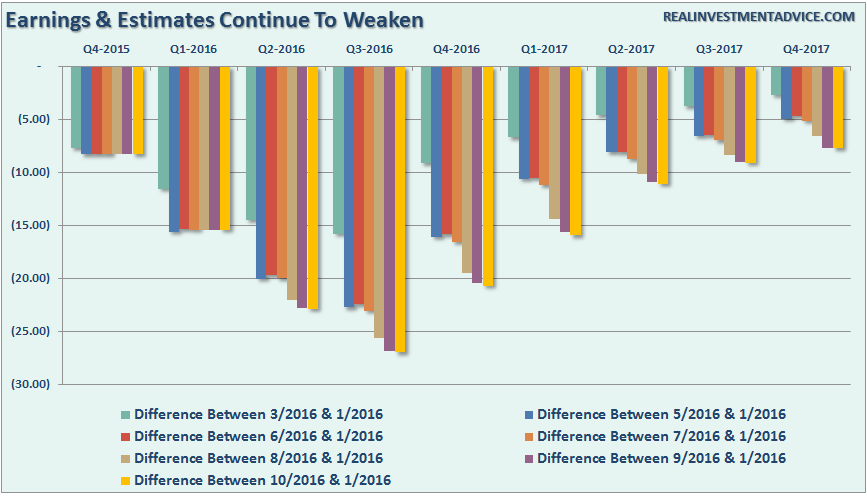

But even those estimates are a likely a fantasy. Throughout history, earnings are consistently overstated by roughly 33%. This overstatement of estimates can be clearly seen in the chart below.

If we held Wall Street analysts to their estimates at the beginning of this year, much less the beginning of the previous quarter, 100% of companies would have missed earnings during the second quarter of this year. In fact, in just the past three months, analysts have now ratcheted down their estimates for the third quarter to their lowest levels yet.

In other words, in order for companies to win the “beat the estimate game,” they need the bar lowered far enough to ensure they can clear it.

The problem is actually worse than just Wall Street analysts consistently lowering earnings estimates to make company reports look better, corporations themselves have been using four primary tools to boost earnings per share as well.

Inherent Conflict Of Interest

There is an inherent conflict between Wall Street, corporate executives, and individual investors. Today, more than ever, corporate executives are compensated by stock options, and other stock-based compensation, which is tied to rising stock prices. There are billions at stake and the game of “beat the Wall Street estimate” is critical in keeping corporate stock prices elevated. Unfortunately, this leads to a wide variety of gimmicks to boost bottom line profitability which is not necessarily in the best interest of long-term profitability or shareholders.

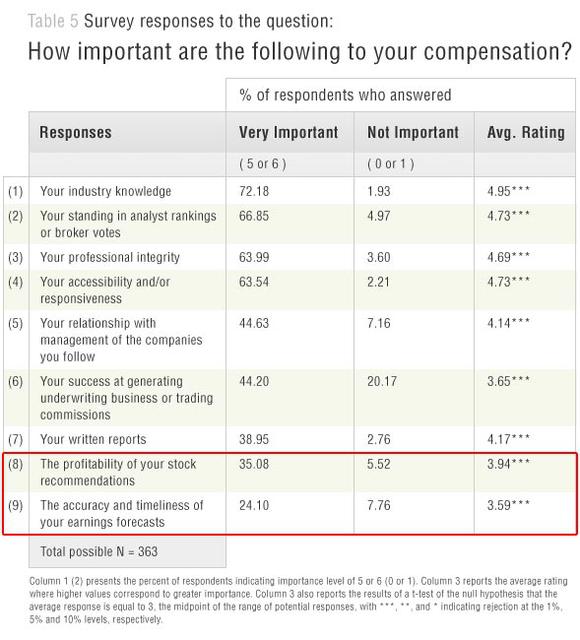

In a study by Lawrence Brown, Andrew Call, Michael Clement and Nathan Sharp it is clear that Wall Street analysts are clearly not that interested in your financial well-being. The study surveyed analysts from the major Wall Street firms to try and understand what went on behind closed doors when research reports were being put together.

In an interview with the researchers John Reeves and Llan Moscovitz wrote:

“Countless studies have shown that the forecasts and stock recommendations of sell-side analysts are of questionable value to investors. As it turns out, Wall Street sell-side analysts aren’t primarily interested in making accurate stock picks and earnings forecasts. Despite the attention lavished on their forecasts and recommendations, predictive accuracy just isn’t their main job.”

The chart below is from the survey conducted by the researchers which show the main factors that play into analysts compensation. It is quite clear that what analysts are “paid” to do is quite different than what retail investors “think” they do.

“Sharp and Call told us that ordinary investors, who may be relying on analysts’ stock recommendations to make decisions, need to know that accuracy in these areas is ‘not a priority.’

‘The part to me that’s shocking about the industry is that I came into the industry thinking [success] would be based on how well my stock picks do. But a lot of it ends up being ‘What are your broker votes?’

A ‘broker vote’ is an internal process whereby clients of the sell-side analysts’ firms assess the value of their research and decide which firms’ services they wish to buy. This process is crucial to analysts because good broker votes result in revenue for their firm. One analyst noted that broker votes ‘directly impact my compensation and directly impact the compensation of my firm.'”

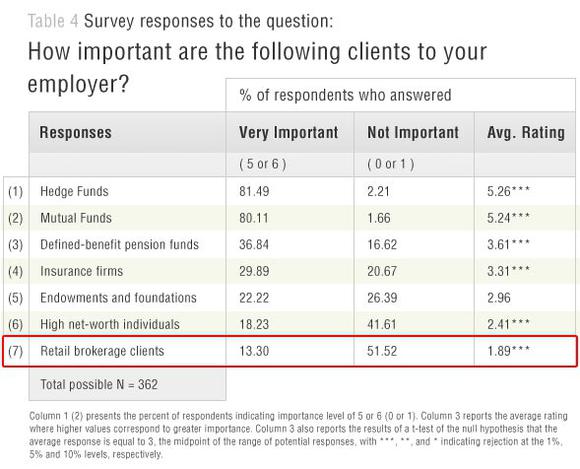

The question really becomes then “If the retail client is not the focus of the firm then who is?” The survey table below clearly answers that question.

Not surprisingly you are at the bottom of the list. The incestuous relationship between companies, institutional clients, and Wall Street is the root cause of the ongoing problems within the financial system. It is a closed loop that is portrayed to be a fair and functional system; however, in reality, it has become a “money grab” that has corrupted not only the system but the regulatory agencies that are supposed to oversee it.

However, the analysts are only one-half of the equation, the other half comes from the outright manipulations of earnings per share by corporations to obfuscate weak revenue growth.

How Do They Do It

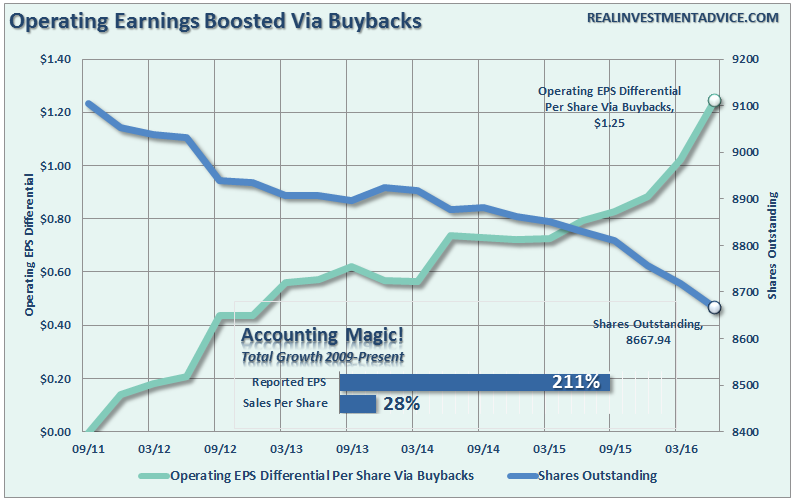

As shown below, since 2009, the reported earnings per share of corporations, the bottom line of the income statement, have increased by a total of 211% which is the sharpest, post-recession, increase in reported EPS in history. However, at the same time, reported sales per share, which is what happens at the top line of the income statement, has only risen by a marginal 28% during the same period.

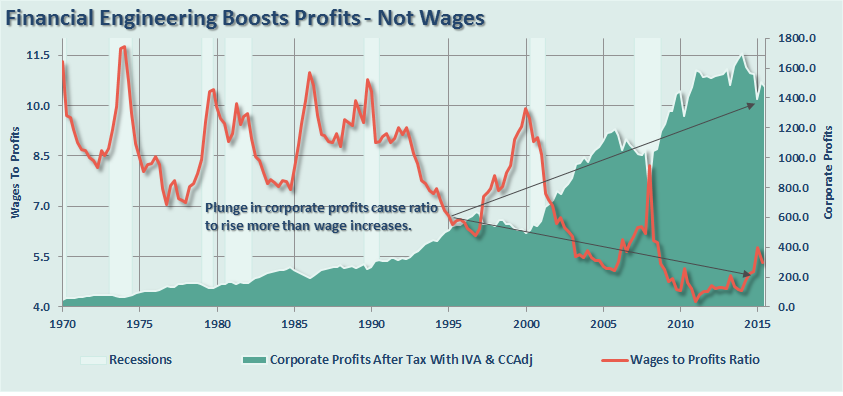

In order for profitability to surge, despite rather weak revenue growth, corporations have resorted to four primary weapons: wage reduction, productivity increases, labor suppression and stock buybacks. The problem is that each of these tools creates a mirage of corporate profitability. Furthermore, as I will discuss below, each has a negative impact on investors and/or the economy.

Stock Buybacks Create An Illusion Of Profitability

One of the primary tools used by businesses to increase profitability has been through the heavy use of stock buybacks. The chart below shows outstanding shares as compared to the difference between operating earnings on a per/share basis before and after buybacks.

The problem with this, of course, is that stock buybacks create an illusion of profitability. If a company earns $0.90 per share and has one million shares outstanding – reducing those shares to 900,000 will increase earnings per share to $1.00. No additional revenue was created, no more product was sold, it is simply accounting magic. Such activities do not spur economic growth or generate real wealth for shareholders.

Working For Two

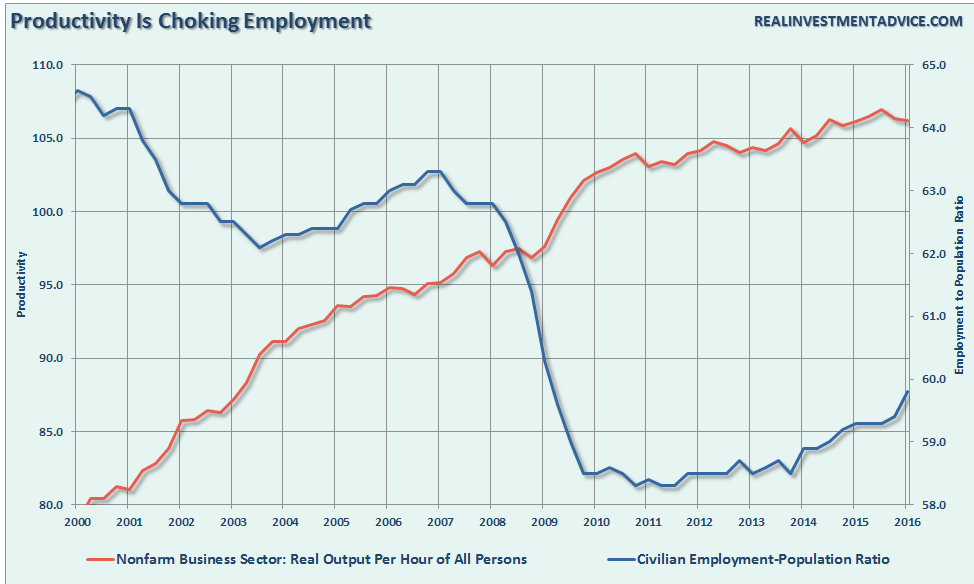

Since the end of the financial crisis, corporations have been able to markedly boost profitability through increases in productivity. In any business, the highest single expense is the cost of labor which includes benefits like health care costs which have been surging since the onset of the Affordable Care Act. Therefore, increases in productivity can reduce the need for employment. The first chart below shows non-farm business sector output (ie productivity) as compared to the employment to population ratio.

As productivity increases the need for employment is reduced. Automated answering systems have been used to replace receptionists, automated billing systems, outsourced help desks, etc. have allowed for lower head counts for businesses while increasing output per person. Higher output, and lower costs have led to the highest profit per employee in history as shown in the chart below.

Note: It is worth noting increases in the wages/profits ratio has been a good leading indicator of the onset of recessions. Just sayin’.

What? You Want A Raise?

While increasing productivity will increase profitability – a large and available labor pool, which creates competition for existing jobs, keeps wages suppressed. Suppressed wage growth, combined with increases in productivity have created massive profitability for businesses. The chart below shows average hourly earnings which remain well below the recession peak.

The spike in 2012, is deceiving because the entirety of the increase came in the 4th quarter as corporations panicked prior to the “Fiscal Cliff.” After that one-time effect passed wages once again fell going into 2015. However, beginning in 2015 the impact of higher health care costs began to set in and as companies reached the limit of employee reductions, wages were forced to increase. With profitability now under pressure, it is unlikely that we will see any significant increases in compensation in the near term particularly as real unemployment remains elevated. This does not support the economic recovery story.

Sorry, We Aren’t Hiring Full-Time

The reason that I state the real unemployment remains elevated is that despite increases in employment in recent months it has been a function of population growth rather than an improved outlooks by businesses. The issue of population growth is ignored by most analysts and economists when discussing employment, but should not be. As I discussed in “Why Baby Boomers Can’t Retire:”

“Recent employment increases, while encouraging, have been little more than a function of population growth. As the population grows, incremental demand increases caused by that increase in population will create employment needs in areas most impacted by that population growth. This is why job formation has been primarily focused in retail, service and hospitality areas.”

In other words, based on population growth, there has ACTUALLY been a NEGATIVE growth rate in employment of nearly 5-million individuals.

In order to keep costs minimized businesses have resorted to temporary hires rather than full-time employment which incurs additional costs of benefits and healthcare. The expectation is that temporary workers will eventually become full-time employees, however, with the impact of higher healthcare costs due to the Affordable Care Act, temporary hires may be the new normal. The chart below shows full-time employment relative to the population.

With full-time employment still near levels normally associated with recessions, it shows that businesses remain focused on the cheapest cost of labor possible. The chart above also shows jobless claims which have been steadily falling since the peak of the crisis. This is due to “labor hoarding” where businesses have literally run out of employees to terminate or fire. However, just because fewer people are being terminated it does not mean that greater levels of full-time employment are being created which is what is needed to create sustainable organic economic growth.

If You Can’t Make It, Fake It?

There is no doubt that corporate profitability has surged from the recessionary lows. However, if I am correct in my assessment, then the recent downturn in corporate profitability may be more than just due to an economic “soft patch.” The problem with cost cutting, wage suppression, labor hoarding and stock buybacks, along with a myriad of accounting gimmicks, is that there is a finite limit to their effectiveness.

More importantly, Wall Street knows this already and it should not come as no surprise that companies manipulate bottom line earnings. By utilizing “cookie-jar” reserves, heavy use of accruals, and other accounting instruments they can either flatter, or depress, earnings.

“The tricks are well-known: A difficult quarter can be made easier by releasing reserves set aside for a rainy day or recognizing revenues before sales are made, while a good quarter is often the time to hide a big “restructuring charge” that would otherwise stand out like a sore thumb.

What is more surprising though is CFOs’ belief that these practices leave a significant mark on companies’ reported profits and losses. When asked about the magnitude of the earnings misrepresentation, the study’s respondents said it was around 10% of earnings per share.“

As I stated at the beginning, the reason that companies do this is simple: stock-based compensation. Today, more than ever, many corporate executives have a large percentage of their compensation tied to company stock performance. A “miss” of Wall Street expectations can lead to a large penalty in the companies stock price.

As shown in the table, it is not surprising to see that 93% of the respondents pointed to “influence on stock price” and“outside pressure” as the reason for manipulating earnings figures.

Note: For fundamental investors this manipulation of earnings skews valuation analysis particularly with respect to P/E’s, EV/EBITDA, PEG, etc. Revenues, which are harder to adjust, may provide truer measures of valuation such as P/SALES and EV/SALES.

So, as we head into the third quarter earnings season, it is important to be aware of what is real, and what isn’t.

To win the “Beat The Estimate Game” focus on the quality, rather than the quantity, of earnings. As was pointed out previously by the WSJ:

“First and foremost, investors should keep an eye on cash flow: Strong earnings when cash flow deteriorates may be a sign of trouble. The advantage of this approach is that, unlike some of the other warning signs, it is easily measurable, arming the investors and analysts who do their homework with strong ammunition against management.

Secondly, stark deviations from the earnings recorded by the company’s peers should also set off alarm bells, as should weird jumps or falls in reserves.

The other potential problem areas are more subjective and more difficult to detect. When, for example, the chief financial officers urge stakeholders to be wary of ‘too smooth or too consistent’ profits or ‘frequent changes in accounting policies,’ they are asking them to look at variables that don’t necessarily point at earnings (mis)management.”

As the quarterly ritual of the earnings season approaches, executives and investors would do well to remember the words of the then-chairman of the Securities and Exchange Commission Arthur Levitt in a 1998 speech entitled “The Numbers Game.”

“While the temptations are great, and the pressures strong, illusions in numbers are only that—ephemeral, and ultimately self-destructive.”

Couldn’t have said it better myself.