The cloud-gaming space is heating up with China-based Tencent (OTC:TCEHY) recently jumping on the bandwagon of tech companies exploring this rapidly-growing space.

Cloud gaming, also known as “Netflix (NASDAQ:NFLX) of games” or “gaming on demand”, has become an attractive space due to stellar growth projections in consumer spending. Per IHS Markit, quoted by CNBC, consumer spending on cloud gaming content subscriptions is expected to grow from $234 million in 2018 to $1.5 billion by 2023.

However, the biggest roadblock behind the adoption of cloud gaming is latency, which is the lag time between pressing a button on a controller and the responding action occurring on screen. Having local servers and better wireless controller hardware can solve the issue.

This is why cloud-computing providers, like Alphabet (NASDAQ:GOOGL) division Google, Microsoft (NASDAQ:MSFT) , Amazon (NASDAQ:AMZN) and Tencent, have significant growth opportunities in the cloud-gaming market.

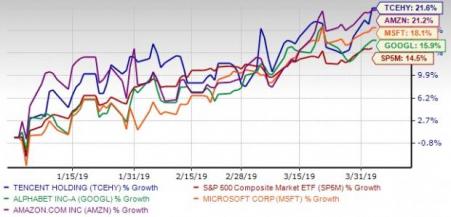

Year-to-date Performance

Let’s dig deep to find out what these giants are doing to gain a foothold in this promising space.

Google & Microsoft Racing Ahead

Google unveiled Stadia, previously called Project Yeti, at its 2019 Game Developers Conference (GDC). The gaming platform will be available to users later this year.

Stadia will enable users to stream games online on any device, such as smartphones, laptops, desktops and tablets. Moreover, users can play games on televisions with the aid of the Chromecast media stick connection.

Google is banking on its cloud-computing strength to offer a superior player experience by lowering latency. Additionally, it has developed a dedicated Stadia controller that connects to the internet directly via Wi-Fi, thereby, further lowering latency. Alphabet carries a Zacks Rank #3 (Hold), currently.

Meanwhile, Microsoft is gearing up to launch a beta version of its cloud-gaming platform — XCloud — later this year. The platform will be available on anything, including phones, tablets, set-top-boxes, TVs, which has a screen and an Internet connection. The platform is planned to be a complementary service to Microsoft’s Xbox One games consoles.

Microsoft has data centers around 54 different regions, globally. The company is relying on its Azure cloud-server network to serve players request locally, which will help reduce latency by shortening the distance between the end user and the data center.

Tencent, Amazon in the Fray

Tencent is one of the biggest gaming companies in China. Per CNBC, the company has started testing its cloud-gaming platform. Reportedly, the company has partnered with Intel (NASDAQ:INTC) for a new cloud gaming service called “Tencent Instant Play”.

Tencent can leverage its own cloud infrastructure to stream games. Moreover, this Zacks #3 Ranked stock holds rights to some of China’s biggest gaming titles.

Further, Amazon, which already offers video-game streaming services via its Twitch platform, is aggressively pursuing the development of a cloud-gaming service to be rolled out in 2020. Reportedly, this Zacks Rank #3 stock has been on the lookout for engineers to work on its cloud game platform.

Notably, Amazon is a dominant name in the cloud-computing market courtesy it’s Amazon Web Services (AWS), which offers significant leverage. Currently, Amazon has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Original post