- Three US banks have failed so far in 2023, marking the second, third, and fourth largest bank failures in history.

- But, certain stocks have outperformed the market despite the challenging environment.

- Investors would have made triple-digit returns if they had invested in these stocks.

We officially have 3 US banks that have failed so far in 2023, occupying 2nd, 3rd, and 4th place on the list of largest bank failures in history.

- Washington Mutual in Seattle, Washington, in 2008.

- First Republic Bank in 2023 in San Francisco, California.

- Silicon Valley Bank in 2023 in Santa Clara, California.

- Signature Bank in 2023 in New York, New York.

US Treasury Secretary Janet Yellen warned on Monday that the country could default on its national debt on June 1 and urged Congress to approve a suspension of the debt ceiling as soon as possible.

She estimates that the executive branch will be unable to meet its government obligations "in early June, possibly on June 1, if Congress does not raise or suspend the debt limit before then."

The current debt ceiling is $31.4 trillion and was reached on January 19. That same day the Treasury activated "extraordinary measures" to pay the bills, but even then, it was stressed that the use of those special financial tools extended only until June 5.

Yellen warned that similar situations in the past have shown that waiting until the last minute to suspend or raise the debt ceiling can cause serious damage to business and consumer confidence, increase short-term borrowing costs for taxpayers and negatively affect the U.S. credit rating.

Although the current situation may seem bleak, certain stocks have outperformed the market despite the challenging environment. So, let's examine the four winning stocks and the top performer in each month using the InvestingPro tools.

If we had the ability to see into the future and invested in these stocks, we would have made a triple-digit return, which is not bad considering the S&P 500 is up +8.4%.

1. January: Warner Bros Discovery

Warner Bros. Discovery Inc (NASDAQ:WBD) is an American media and entertainment conglomerate headquartered in New York City.

It was formed by the merger of WarnerMedia and Discovery, completed on 8 April 2022.

The company's name is a combination of WarnerMedia's flagship property, the Warner Bros. film studio, and the Discovery Channel pay-TV network.

Warner Bros. Discovery reports its quarterly results on May 5 and is expected to report revenues of $10.77 billion.

Source: InvestingPro

It was one of the top performers in January, rising by +56.3%.

Having failed to break through its resistance, it is taking a breather and has dropped to Fibonacci levels. A break above $15.94 would be a sign of strength and the rally's continuation.

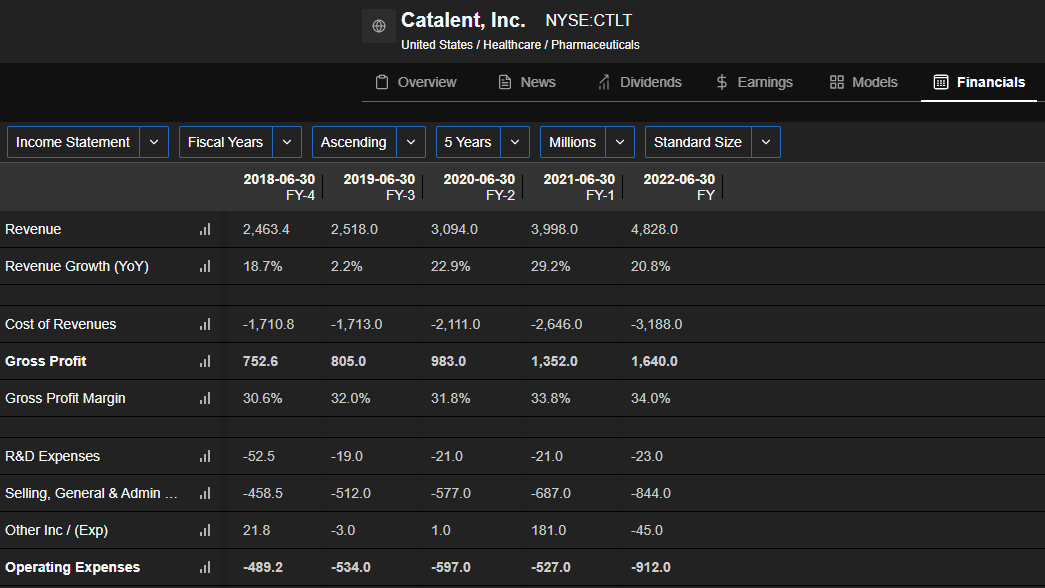

2. February: Catalent

Somerset, N.J.-based multinational company Catalent (NYSE:CTLT) is a global provider of drug delivery, development, and manufacturing technologies, gene therapies, and consumer healthcare products.

It was formed in April 2007 and, in 2014, became a publicly traded company on the New York Stock Exchange.

It reports its quarterly results on May 9 and is expected to report EPS of $0.52 per share.

Source: InvestingPro

It was one of the best performers in February, rising +25.6%.

The support formed in November 2022 is holding very well, it has been touched in December 2022 and April 2023 and has always prevented further declines and enabled bounces to the upside. At $41.11, we could see another bounce.

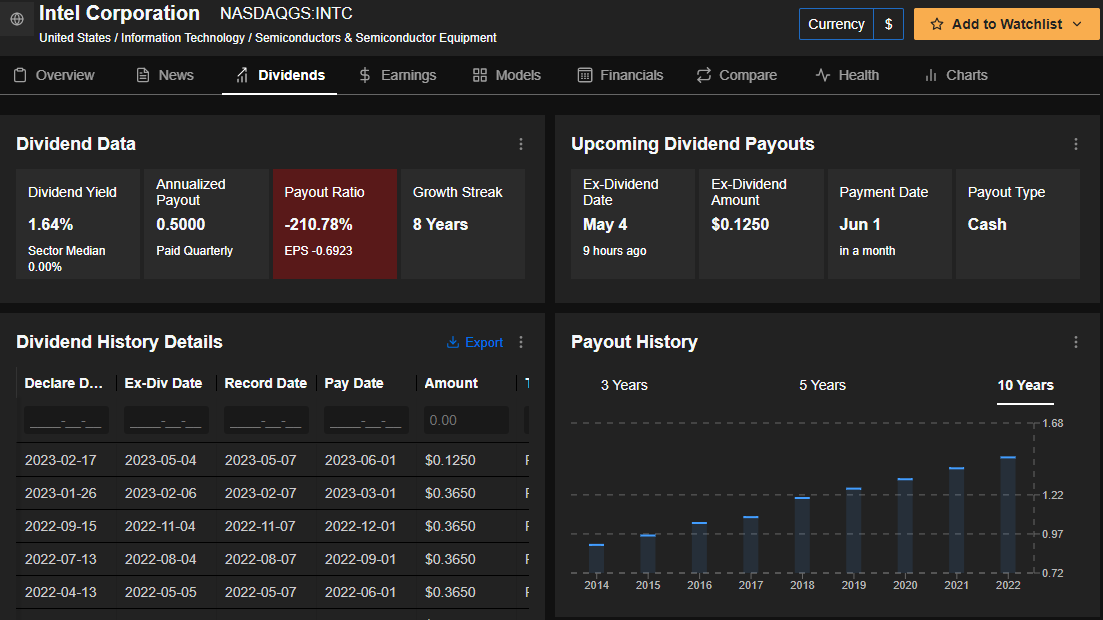

3. March: Intel

Intel Corporation (NASDAQ:INTC) is the world's largest integrated circuit manufacturer by annual revenue. The US company is the inventor of the x86 series of processors, which are found in most computers. It was founded on July 18, 1968, as Integrated Electronics Corporation.

Source: InvestingPro

It pays a dividend on June 1, and to receive it shares must be held before May 4.

It will present its quarterly results on the 27th of July and is expected to post revenue of $11.73 billion.

It was a star performer in March, rising 28.7%.

The support formed in October 2022 was tested quite successfully in February this year. A pullback to $24.73 would be an interesting buying opportunity.

A break of $33.10 would be a bullish sign.

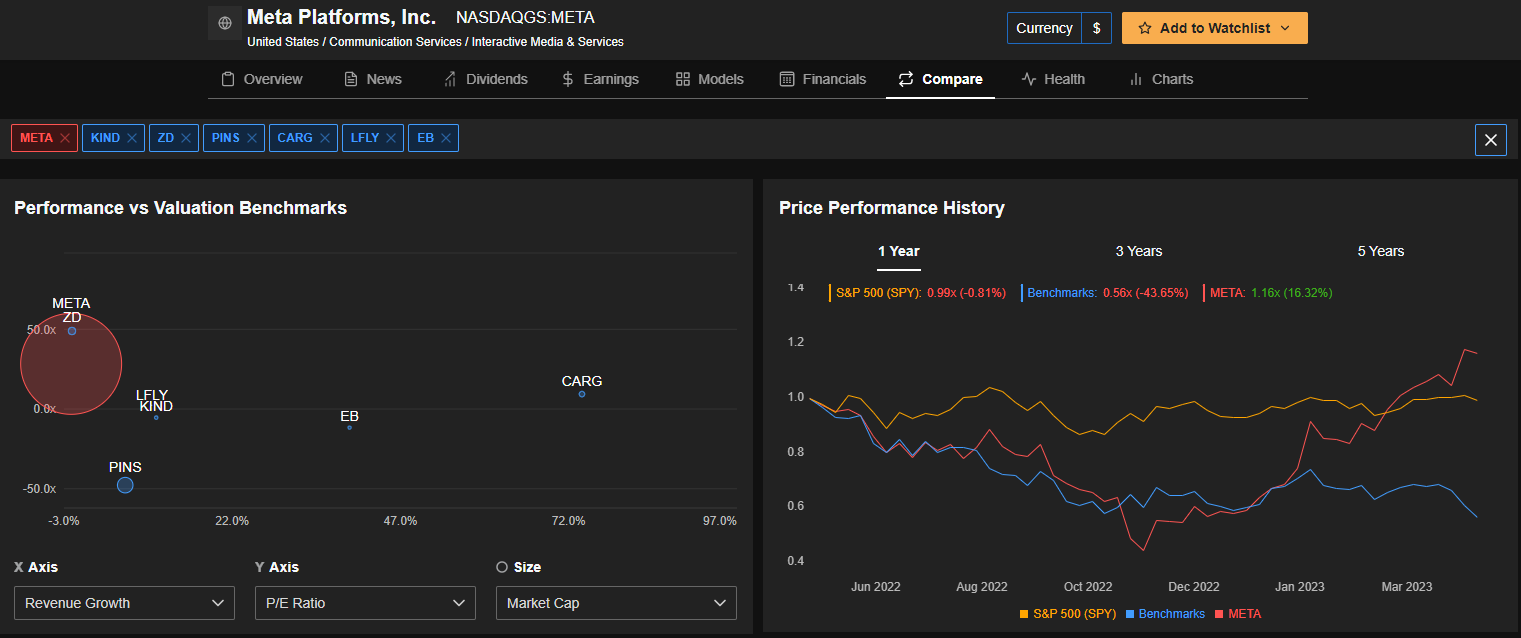

4. April: Meta Platforms

Meta Platforms (NASDAQ:META), formerly known as Facebook, is an American technology and social networking conglomerate with its headquarters in Menlo Park, California. It is the parent company of Facebook, Instagram, WhatsApp, and others.

It is one of the most valuable companies in the world. It is considered one of the five largest technology companies along with Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), and Alphabet (NASDAQ:GOOGL).

Source: InvestingPro

It reports its quarterly results on July 26 and is expected to report earnings per share (EPS) of $2.40 per share.

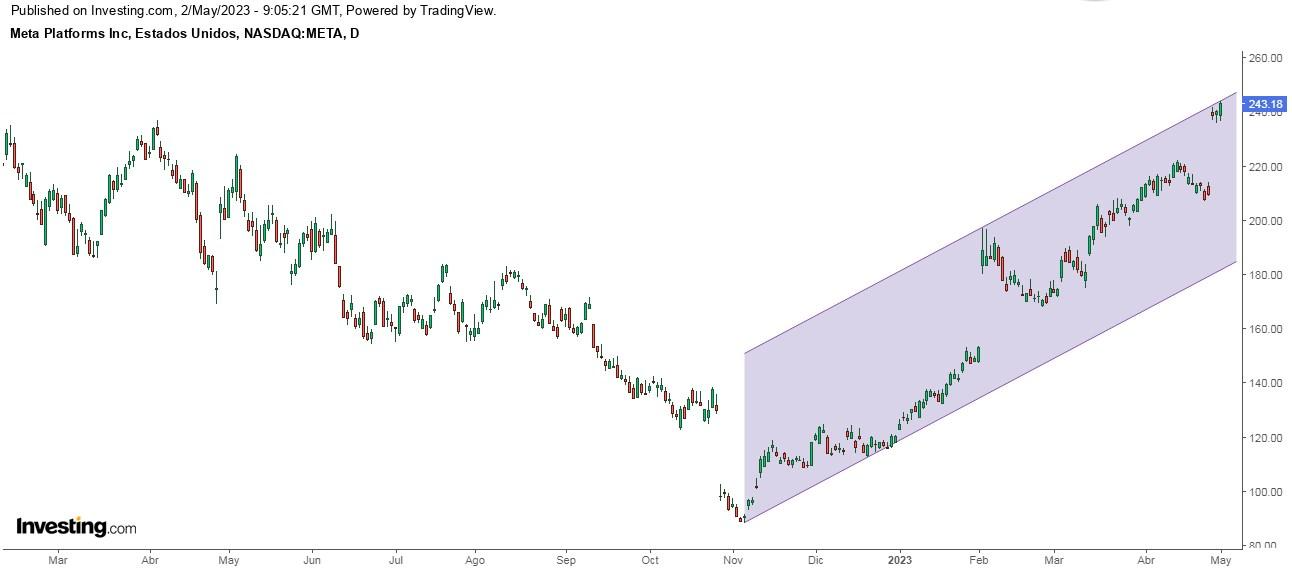

It was one of the kings of April, rising +97.9%.

Since its November 2022 low, it has done nothing but rally. It has accumulated two gaps that remain unfilled.

Investors have applauded two things:

- The company's cost reduction targets: the company has lowered its cost estimate for this year by $5 billion thanks to cost reduction measures.

- The share buyback plan: the company announced an additional $40 billion share buyback plan.

Disclosure: The author does not own any of the securities mentioned.