- The S&P 500 made a fresh all-time high on an intraday basis, yet closed back beneath the 3258.10 high. It’s not quite a bearish hammer, but it does show a hesitancy to break higher for now. Still, E-mini futures posted an elongated, bullish hammer and Asia prices are sniffing at the record highs. With Middle East tensions on the back burner (for now) and the potential for a phase one trade deal on Wednesday, we favor the index to break to new highs. However, if it’s to break beneath 3200 then a correction is underway.

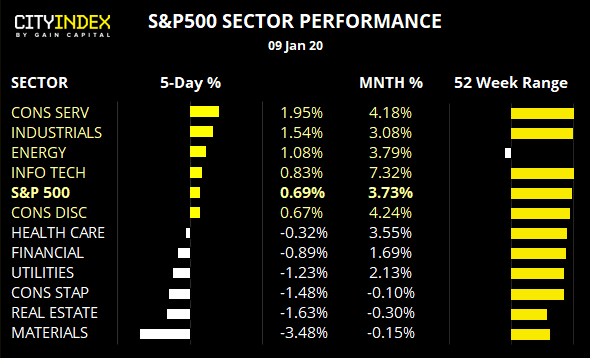

- Info-tech, consumer services and industrials have been the strongest performers over the past 52-weeks. Yet measured from the December 2018 low, the clear winner is the real estate sector having racked up +17.3%. In fact, over this period the only other sector to gain is the communications sector at +2.9%.

- The energy sector remains effectively rangebound, much like crude oil after its failure to break out of its 9-month high. It’s also the only sector to trade lower over the past 52-weeks, and trail other sectors performance by a long shot.

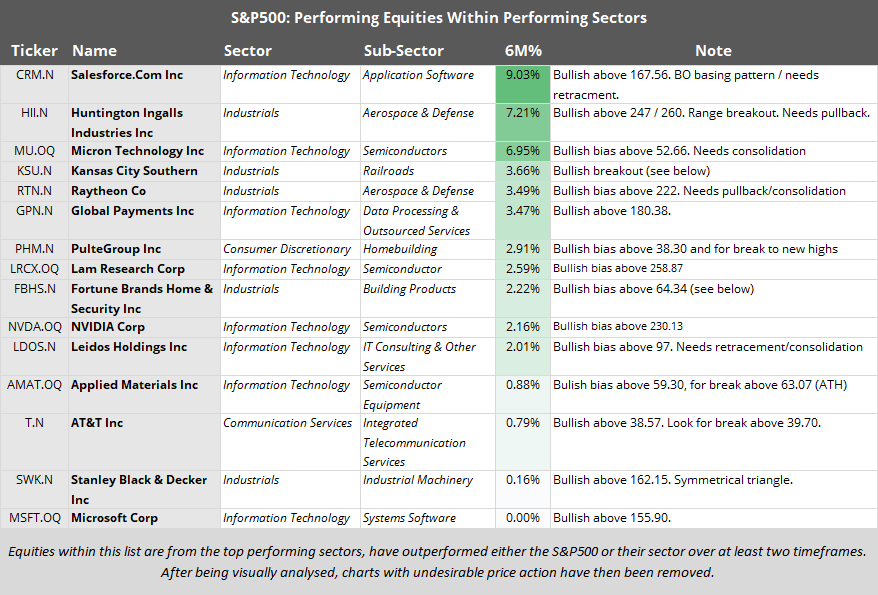

1. Fortune Brand Home & Security (NYSE:FBHS): A breakout to new highs has been supported by a strong trend structure, following a period of consolidation at the highs. Furthermore, the breakout was seen in higher than average volume but. The trend remains bullish above 66.34 but traders could seek bullish setups above 66.15.

2. Kansas City Southern (NYSE:KSU): After consolidating for over two months around record highs, we finally saw a bullish breakout on a strong close to fresh highs. It also appears to have confirmed an inverted head and shoulders pattern, which is a continuation pattern in an uptrend. Moreover, the breakout was on high volume to show strength coming into the move. Whilst the daily trend remains bullish above the 148.28 wing low, momentum traders could look for closer areas of support to aid with risk management.

3. Salesforce.com (NYSE:CRM): Monday saw a breakout from an 8-month basing pattern on high volume. If The pattern projects a target just below 20, if successful. Ultimately, we remain bullish above the 167.56 breakout level, but we’d prefer to see a pullback towards this key level or a period of consolidation.

4. Dollar Tree (NASDAQ:DLTR): The dead cat has bounced and is now rolling over once more. Following a 13% gap lower in late November, it spent best part of December trying (but ultimately failing) to lift itself from the lows. Bearish momentum has clearly returned and the correction appears to have ended at 94.94.