The U.S. renewable energy industry has been experiencing solid growth over the last several years. In fact, reports suggest that U.S. renewable energy capacity has grown threefold since 2008, reaching a record 141 gigawatts at the end of 2016, according to the Business Council for Sustainable Energy.

Zeroing in on the solar energy space under the vast renewable energy universe, a report by the Scientific American suggests that the U.S. Energy Information Administration estimates wind and solar energy will produce 10% of U.S. electricity by 2020. In fact, alternative energy sources, especially wind and solar, have been the two major sources of electricity in the United States for some time now.

Republican Stance on Clean Energy

The aforementioned data hardly have made any difference to the already-casual stance of Republicans who have long been at war with clean energy (renewable energy). The recent upheaval to Obama’s Clean Power Plan and the United States' participation in the Paris climate agreement earlier this year shows that President Trump doesn’t have an encouraging stance toward renewable energy.

His so-called ‘Chinese Hoax’ theory of global climatic change resulted in the annulment of the Clean Power Plan that promised to curb carbon emissions to 32% below 2005 levels by 2030.

We note that the annulment will lift the ban on coal leasing on federal lands. This will also decimate regulations that were specially formulated to curb methane emissions from oil and gas production. Undoubtedly, the move will prove detrimental to the clean energy space.

Apart from this, the solar stocks have been grappling with other issues since last year. Dwindling demand from China, lowered Japanese tariffs and the expiration of the tax credits at the end of last year (which were ultimately extended to 2021) added to the woes of the industry.

Factors to Drive Solar Sector in Next 5 Years

Since 2014, when electric utilities throughout the United States closed a number of aging coal-fired generators, wind and solar have been the two major sources of electricity. Let’s take a look at a couple of factors that might lend the solar energy space a competitive edge amid the unfavorable policy changes.

First, although the federal government has been strengthening nonrenewable, cost-intensive coal resources, electric-power companies prefer pocket-friendly renewable sources (as the cost of electricity generation from these sources is relatively low). And in terms of cost effectiveness, solar power will always have an upper hand over the other sources of energy.

Secondly, simply following the China model for solar industry growth can be a prudent move, as China has been a clear-cut global leader in this aspect. In this regard, under China's 13th Five-Year Plan, the country has set a target of attaining 150 gigawatts to 200 gigawatts of solar photovoltaic capacity by 2020.

China is followed closely by Japan and Germany. In latest developments, China created the huge Longyangxia Dam Solar Park that covers 10 square miles, generating 850 megawatts of power for 200,000 households. We certainly believe following China's leadcan lend the U.S. solar space a competitive edge over the long haul.

Solar Stocks in Focus

Given the emerging prospects in the solar power industry, we think it will be prudent for investors to consider a few solar stocks. The goal is to focus on stocks that have solid fundamentals, and stellar earnings and revenue growth.

Based on certain parameters, we have selected four solar stocks which are poised for impressive returns over the next five years. These stocks boast a Zacks Rank #1 (Strong Buy) or #2 (Buy), and boast strong financial metrics.

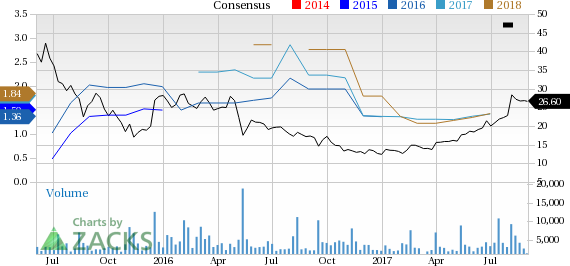

SolarEdge Technologies, Inc. (NASDAQ:SEDG) : SolarEdge promises a long-term expected earnings growth rate of 24%. The stock has a compelling fundamental growth story, with revenues and earnings seeing a CAGR of 7.5% and 10.2%, respectively, over the last three years. The stock sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

SolarEdge designs, develops, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Israel, and throughout Europe. Management at SolarEdge continues to see positive momentum in emerging markets such as Japan, Australia and India, where the company’s newly-established team is engaged in developing large commercial opportunities.

In the last reported quarter, SolarEdge announced the launch of an S-Series Power Optimizer which is expected to be available in 2018. Furthermore, the company recently launched Three Phase Inverters with larger capacities that provide smart energy management control. SolarEdge’s continued emphasis on fortifying its foothold in the solar space makes it a compelling pick for the long term.

Looking at the estimate revision trend for the next year, in the last two months, estimates increased 28.7% to $1.84 per share.

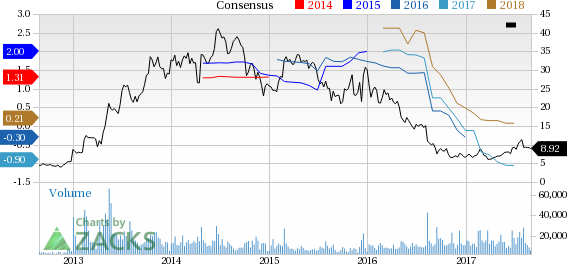

SunPower Corporation (NASDAQ:SPWR) : SunPower is a strong stock, with revenues seeing a CAGR of 25.7% over the last three years. Over the last four quarters, the company delivered positive earnings surprises averaging 29.2%. The stock boasts a Zacks Rank #2.

SunPower develops, manufactures and delivers solar solutions worldwide. The company is well positioned in the European and Japanese markets, and continues to grow in other emerging markets as well. In the last reported quarter, SunPower announced plans to invest in software to make buying, selling, installing and owning of SunPower facilities easier.

Estimate revision trends for the next year look promising, with estimates increasing 10.5% to 21 cents per share in the last month.

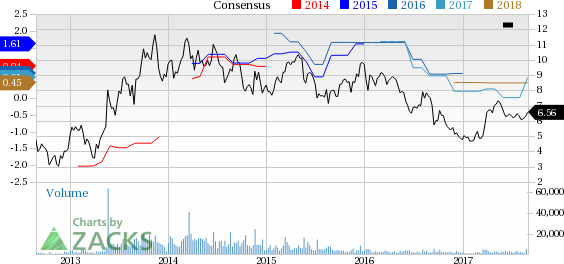

JA Solar Holdings Co., Ltd. (NASDAQ:JASO) : The stock boasts solid fundamentals with revenues multiplying at a CAGR of 10.9% over the last three years. The stock has delivered positive earnings surprises in the last four quarters, averaging 716.67%. The stock has a Zacks Rank #2.

JA Solar develops, manufactures and sells solar power products based on crystalline silicon technologies. We note that the company has raised its shipment outlook for full-year 2017. JA Solar expects total sales and module shipments in the range of 6.5 to 7 gigawatts, up from 6 to 6.5 gigawatts guided previously. Solid demand from India, Europe and China is likely to strengthen the company’s top line.

In this regard, 2018 estimates remained stable at 45 cents per share over the last three months.

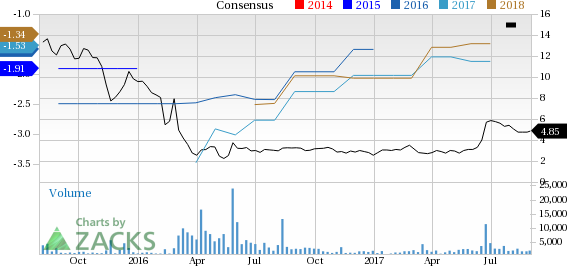

Vivint Solar, Inc. (NYSE:VSLR) : Vivint Solar’s revenues have multiplied at a CAGR of 80.7% over the last three years. A Zacks Rank #2, the stock promises long-term earnings growth of 19.1%.

The company’s ability to adapt to changing market conditions, evolving technology, regulatory considerations and counter cutthroat competition is noteworthy. Vivint Solar provides distributed solar energy to residential, commercial, and industrial customers in the United States. In early June, Vivint Solar rolled out a company-wide change in ITS selling processes, both from a technical automation perspective as well as fundamental ways of working with customers to process the sale and installation of solar systems. These are likely to fortify the company’s footprint over the long haul.

In fact, the estimate revision trend for the next year seems favorable, as losses narrowed almost 16 cents over the last two months.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

JA Solar Holdings, Co., Ltd. (JASO): Free Stock Analysis Report

SunPower Corporation (SPWR): Free Stock Analysis Report

Vivint Solar, Inc. (VSLR): Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG): Free Stock Analysis Report

Original post

Zacks Investment Research