If you can predict the future with certainty, then stop reading. This article isn’t for you.

But if you’re simply human, like the rest of us, you shouldn’t construct your portfolio as if you’re Nostradamus. After all, the point of a diversified portfolio is to protect us from both known risks and unforeseen outcomes.

The problem is that the financial markets are complex – there are thousands of securities and an infinite number of potential investment allocations. Consequently, many investors struggle to construct sound portfolios.

And worst of all, most do-it-yourself investors only realize their mistakes after suffering debilitating losses. With that in mind, I’ve identified four very common – but misguided – allocations that retail investors gravitate towards.

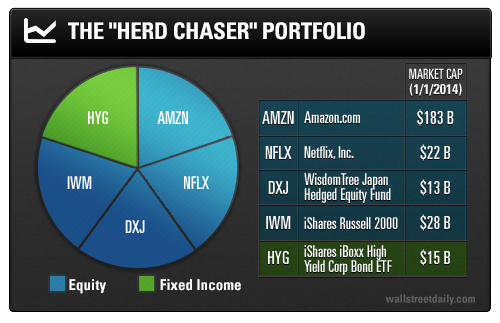

1. The “Herd Chaser” Portfolio

Buying nothing but the most popular stocks or exchange-traded funds is one of the worst mistakes you can make as an investor – yet it’s also one of the most common.

The thing is, the investing herd might actually be right for a time, which could give you a false sense of confidence. But in the end, the herd will always end up being massively wrong at the worst time.

Indeed, all of the investments in the “herd chaser” portfolio were extremely popular at the beginning of 2014, as you can see by their market capitalizations and fund assets.

But the average 2014 total return for the securities in the “herd chaser” portfolio is -7%, more than 10% worse than that of the S&P 500.

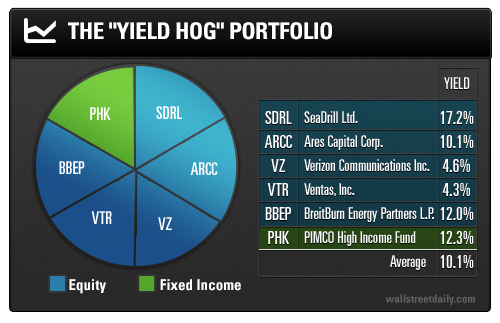

2. The “Yield Hog” Portfolio

Many investors live for high yield and fat payouts. And, understandably, they take comfort in seeing cash hit their accounts on a regular basis.

However, yield hogs miss the point that total return – not just yield – is what matters. Total return includes both dividend yield and capital appreciation.

The securities listed below have an average yield of 10.1%.

Unfortunately, the securities in the “yield hog” portfolio have also underperformed, with an average 2014 total return of -4%.

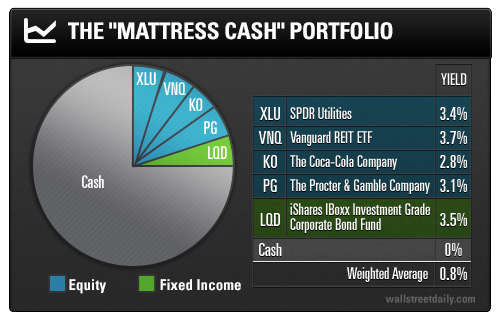

3. The “Mattress Cash” Portfolio

The Baby Boomers suffered through the tech and housing bubbles during crucial stages of their investing lives. It’s not surprising, therefore, that most Boomers are conservative with their portfolios.

In fact, a typical Baby Boomer allocation might look something like the one below:

The problem is, a cash-dominated portfolio won’t provide a positive real rate of return (return after adjusting for inflation) in an era of zero-interest rate policy. Instead, it’s going to suffer a loss of purchasing power over time.

And even though this portfolio has held up much better than the previous two this year, it’s far too conservative… something the Millennial generation, which may be too financially conservative itself, should keep in mind.

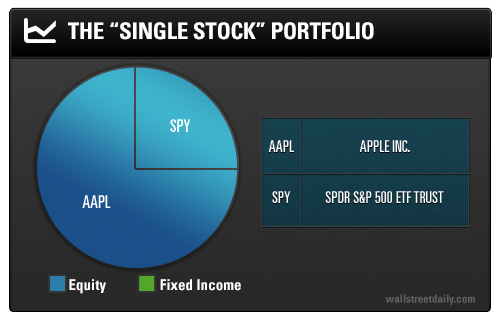

4. The “Single Stock” Portfolio

The portfolio below can hardly be considered a portfolio.

The problem, of course, is a lack of diversification, leaving the investor exposed to a high level of stock-specific risks. It’s really more like gambling than investing… Yet many investors still find themselves with unacceptable exposure to a single, high-conviction holding.

Now, your own portfolio won’t look exactly like any of the above (I hope), but the reality is that most investors do fall into some of the traps illustrated in these hypothetical examples.

Besides the problems I’ve already discussed, all of these misguided portfolios suffer from a lack of international diversification (equity home bias), and are significantly underexposed to fixed-income.

Ideally, a well-diversified portfolio would include U.S. stocks, foreign stocks, preferred stocks, corporate bonds, and Treasuries in proportions appropriate for the investor’s risk tolerance.

With that in mind, I’ll discuss a more balanced approach in my next article.