During the last earnings season, the Finance sector was one of the best performers. Despite inflation-related issues and increasing chances of political uncertainty, we can add some banking stocks to our portfolio based on their strong fundamentals and solid long-term growth opportunities.

Cohen & Steers Inc (NYSE:CNS) is one such stock that has been witnessing upward estimate revisions, reflecting analysts’ optimism about its future prospects. Over the last 60 days, the Zacks Consensus Estimate for 2017 and 2018 moved up 3.6% and 5.4%, respectively.

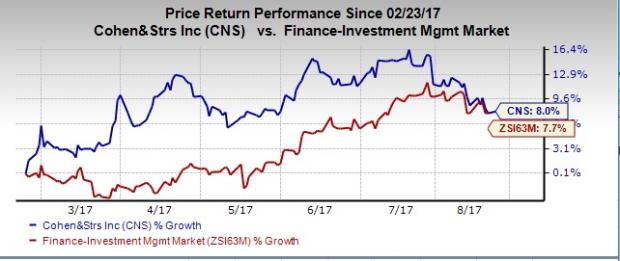

Further, this Zacks Rank #2 (Buy) stock has gained around 8% over the last six months, thereby edging past its industry’s 7.8% increase.

Notably, Cohen & Steers has a number of other aspects to make it an attractive investment option.

Why Cohen & Steers is a Must Buy

Revenue Strength: Cohen & Steers’ revenues saw a compound annual growth rate of 6.3% over the last five years (2012–2016). Further, the top line is expected to grow 7.27% in 2017, higher than the industry average of 4.71%.

Earnings Growth: Cohen & Steers witnessed earnings growth of 2.09% in the last three-five years. This earnings momentum is likely to continue in the near term as reflected by the company’s projected earnings per share (EPS) growth rate (F1/F0) of 8.38%.

Also, the company’s long-term (three to five years) estimated EPS growth rate of 6.09% promises rewards for investors in the long run. Good news is that the company recorded an average positive earnings surprise of 0.57% over the trailing four quarters.

Strong Leverage: Cohen & Steers debt/equity ratio is 0.00 compared with the industry average of 0.09, thus indicating a relative no-debt burden. The figure highlights the company’s financial stability despite a volatile economic environment.

Superior Return on Equity (ROE): Cohen & Steers’ ROE of 33.17% compared with the industry’s 11.74% average, highlights the company’s commendable position over its peers.

Other Stocks to Consider

LPL Financial Holdings Inc. (NASDAQ:LPLA) has been witnessing upward estimate revisions for the last 60 days. Over the past year, the company’s share price has soared more than 59%. It carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Raymond James Financial, Inc. (NYSE:RJF) has been witnessing upward estimate revisions for the last 60 days. Further, the stock has surged nearly 38% over the past year. It currently carries a Zacks Rank #2.

E*TRADE Financial Corporation (NASDAQ:ETFC) has been recording upward estimate revisions over the last 60 days. Additionally, the company’s shares have jumped nearly 58% in a year’s time. It currently holds a Zacks Rank #2.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

E*TRADE Financial Corporation (ETFC): Free Stock Analysis Report

Raymond James Financial, Inc. (RJF): Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA): Free Stock Analysis Report

Cohen & Steers Inc (CNS): Free Stock Analysis Report

Original post

Zacks Investment Research