Eagle Bancorp, Inc. (NASDAQ:EGBN) is a solid bet now, backed by its organic growth strategies which have placed it well for future. Also, a strong capital and liquidity profile will support the company’s profitability.

Further, analysts seem to be optimistic about the company’s prospects as the stock has been witnessing upward estimate revisions. Over the past 60 days, the Zacks Consensus Estimate for 2017 has risen 3.5% to $3.27. Backed by these upward estimate revisions, the company currently carries a Zacks Rank #2 (Buy).

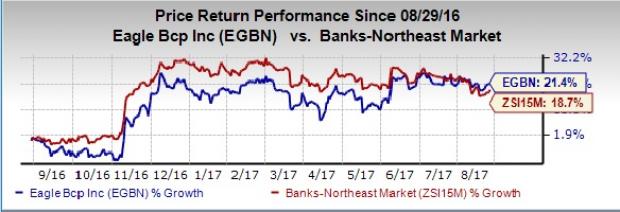

Also, its shares have rallied 21.4% in a year’s time, outperforming the industry’s gain of 18.8%.

Why the Stock is an Attractive Choice?

Earnings Strength: Eagle Bancorp recorded earnings growth rate of 17.9% over the last three to five years. Retaining the earnings momentum, the earnings growth rate for the current year is anticipated to be 14.2% compared with the industry average of 10.9%. Good news is that the company recorded an average positive earnings surprise of 6.29% over the trailing four quarters.

Revenue Growth: Organic growth remains strong at Eagle Bancorp. Revenues witnessed a compound annual growth rate of 17.7% over the last five years (2012-2016). Further, the top line is projected to increase 9.2% in 2017 and 12.5% for 2018.

Superior Return on Equity: Eagle Bancorp has a return on equity of 12.17% compared with the industry average of 8.57%. This indicates that the company reinvests more efficiently compared to its peers.

Strong Leverage: Eagle Bancorp has debt/equity ratio of 0.24 compared with the industry’s 0.55. This reflects relatively robust financial health of the company, which will help it perform better than its peers under a dynamic business environment.

Other Stocks to Consider

Some other top-ranked stocks in the same space are FB Financial Corporation (NYSE:FBK) , LPL Financial Holdings Inc. (NASDAQ:LPLA) and Salisbury Bancorp, Inc. (NASDAQ:SAL) . All the stocks carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

FB Financial’s earnings estimates were revised 3.2% upward for 2017, in the past 60 days. Also, its share price has surged 67.3% in a year’s time.

LPL Financial’s earnings estimates for 2017 have been revised 4.1% upward, over the last 60 days. Further, in a year’s time, the company’s shares have jumped 58.2%.

Salisbury Bancorp witnessed a 2.4% upward earnings estimates revision for the current year, in a month’s time. Moreover, in the past year, its shares have gained 46.4%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Eagle Bancorp, Inc. (EGBN): Free Stock Analysis Report

FB Financial Corporation (FBK): Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA): Free Stock Analysis Report

Salisbury Bancorp, Inc. (SAL): Free Stock Analysis Report

Original post

Zacks Investment Research