The improving rate environment comes as good news for life insurers as they are sensitive to interest rates. Following the presidential election, the Fed has hiked the rates three times, reflecting President Trump’s bias for higher interest rates. This also emphasizes Fed’s confidence in the improving U.S. economy.

The insurers have suffered spread compression on products like fixed annuities and universal life due to persistently low rates. However, they have gradually shifted to riskier asset like equities only to fetch more returns from the policyholders’ claims and even lowered exposure to interest-sensitive product lines.

Life insurers have redesigned and re-priced products which should help them write higher premiums.

Stronger corporate bonds and improving real estate market might help curtail the credit-related investment losses. Also, improving economy and higher inflation induced bonds look to yield good returns. Life insurers might gain from this favorable trend if it continues in the long run. In fact, progressing economy indicates more disposable income with people opting for more insurance coverages.

On a positive note, the Life Insurance industry is currently ranked at #29, which represents the top 12% of the Zacks Industry Ranks. It has significantly climbed up from last week’s rank #171. The industry has outperformed the S&P 500 in a year by registering a gain of 4.27% quarter to date. The index on the other hand has inched up only 0.92%.

Assured Picks

We have zeroed in on the following Buy-rated stocks with estimates having moved north over the last 60 days. Investors might add these stocks to their portfolio.

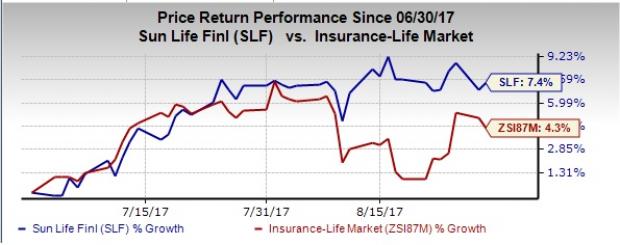

Sun Life Financial Inc. (TO:SLF) provides protection and wealth products and services to individuals, businesses and institutions worldwide. The stock flaunts a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate has moved up 9.8% for 2017 and 8.6% for 2018 over the last 60 days. Sun Life also surpassed estimates in three of the last four quarters with an expected long-term earnings growth rate of 7.0%. You can see You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here..

Shares of the company have gained 7.4% quarter to date, outperforming the industry’s 4.3% rise.

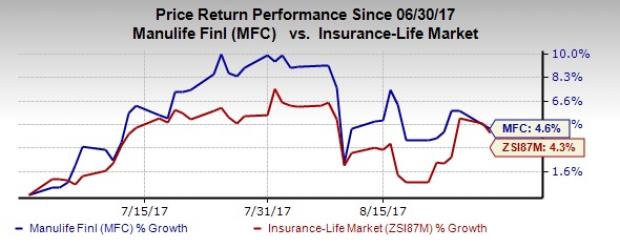

Manulife Financial Corporation (NYSE:MFC) provides financial advice, insurance, and wealth and asset management solutions for individuals, groups and institutions in Asia, Canada and the United States. The stock has a Zacks Rank #2 (Buy). The Zacks Consensus Estimate has moved up 11.3% for 2017 and 8.5% for 2018 over the last 60 days. Manulife also surpassed expectations in the last four quarters and has an expected long-term earnings growth rate of 9.5%.

Shares of the company have gained 4.6% quarter to date, outperforming the industry’s growth of 4.3%.

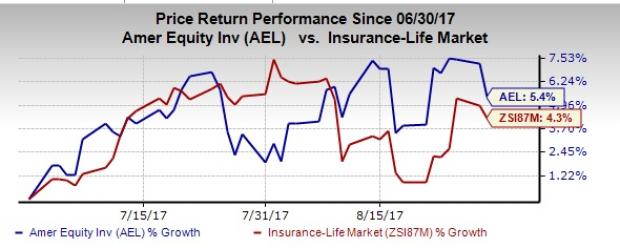

American Equity Investment Life Holding Company (NYSE:AEL) develops and sells fixed index and fixed rate annuity products in the United States. The stock carries a Zacks Rank #2. The Zacks Consensus Estimate has moved up 6.1% for 2017 and 3.1% for 2018 over the last 60 days. American Equity Investment also outpaced expectations in three of the last four quarters.

Shares of the company have gained 5.4% quarter to date, outperforming the industry increase of 4.3%.

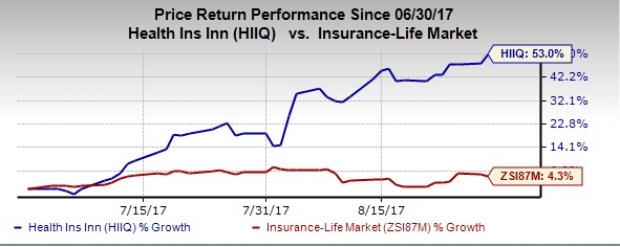

Health Insurance Innovations, Inc. (NASDAQ:HIIQ) develops, distributes and administers cloud-based individual health and family insurance plans besides supplemental products in the United States. The stock sports a Zacks Rank #1. The Zacks Consensus Estimate has moved up 6.8% for 2017 and 5.7% for 2018 over the last 60 days. Health Insurance Innovations also surpassed expectations in the trailing four quarters.

Shares of the company have surged 53.3% quarter to date, thus outperforming the industry growth of 4.3%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars. This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Manulife Financial Corp (MFC): Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL): Free Stock Analysis Report

Health Insurance Innovations, Inc. (HIIQ): Free Stock Analysis Report

Sun Life Financial Inc. (SLF): Free Stock Analysis Report

Original post

Zacks Investment Research