Tobacco is known to cause cancer and heart diseases. Per media sources, it causes more than 480,000 deaths annually in the United States. Governments around the world have been imposing stringent restrictions on tobacco companies to lower cigarette consumption. In July 2017, the U.S. Food and Drug Administration (FDA) proposed to lower nicotine levels in cigarettes, as tar and other substances inhaled through smoking is detrimental to health.

Not only this, the FDA has made it mandatory for tobacco companies to use precautionary labels on cigarette packets to dissuade customers from smoking. The European Union and the FDA have proposed a ban on menthol in accordance with the Tobacco Control Act. Per the act, menthol has an adverse effect on health and thus should not be used in any product.

Amid increasing government restrictions and declining smoking rates, the tobacco giants have introduced e-cigarettes and Reduced Risk Products to mitigate losses. However, the FDA also imposed several restrictions on e-cigarettes.

The FDA made it mandatory for all tobacco makers to seek marketing authorization for any tobacco product introduced after Feb 15, 2007. The law was extended to include e-cigarettes, pipe tobacco, cigars and hookah. The FDA has currently deferred its reviews for products like cigars and hookah tobacco until 2021 and e-cigarettes until 2022.

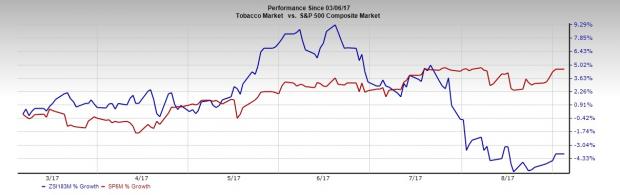

Share Price Performance: Industry Versus S&P 500

Given the aforementioned turmoil, it is not at all surprising that the Zacks Tobacco industry is currently placed at the bottom 36% out of the 265 Zacks Industries. The industry has slumped 3.9% in the last six months, against the S&P 500 market’s 4.6% growth.

4 High-Yield Tobacco Picks Despite Industry Woes

Despite these factors investing in tobacco stocks can be a wise decision. Historically, these stocks have maintained earnings growth consistently by trimming expenses and undertaking judicious mergers and acquisitions.

The tobacco stocks listed below have dividend yields of more than 3.5% and carry a Zacks Rank #2 (Buy) or #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Altria Group Inc. (NYSE:MO) is engaged in the manufacture and sale of cigarettes in the United States. Altria Group, with a Zacks Rank #3, is the parent company of Philip Morris International and the owner of the world’s most popular cigarette brand, Marlboro. The company has a dividend yield of 3.85%. Altria Group’s 5-year historical dividend growth rate is 8.17%.

Philip Morris International Inc. (NYSE:PM) has been increasing its dividend every year since 2008. The Zacks Rank #3 stock has a dividend yield of 3.56%. Philip Morris’s 5-year historical dividend growth rate is 4.77%.

Vector Group Ltd. (NYSE:VGR) carrying a Zacks Rank #3, has a dividend yield of 7.41%. Its 5-year historical dividend growth rate is 4.81%.

British American Tobacco (LON:BATS) p.l.c. (NYSE:BTI) has a dividend yield of 3.61%. The Zacks Rank #2 company also has a 5-year historical dividend growth rate of 0.58%.

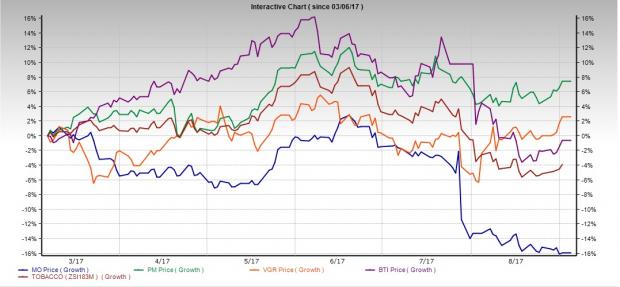

That being said, let’s take a closer look at how these tobacco stocks have performed in comparison to the industry.

While Philip Morris and Vector Group have gained 7.4% and 2.6%, respectively in the last six months, British American and Altria Group have declined 0.7% and 15.9%, respectively in the said time frame.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Altria Group (MO): Free Stock Analysis Report

Philip Morris International Inc (PM): Free Stock Analysis Report

British American Tobacco p.l.c. (BTI): Free Stock Analysis Report

Vector Group Ltd. (VGR): Free Stock Analysis Report

Original post

Zacks Investment Research