Artificial intelligence has been a hot area of investment for so long now that it's virtually impossible to uncover AI names that haven't seen their stock prices soar. As a result, many investors have been looking to alternative sectors where certain companies are tapping into AI technology for a variety of use cases.

Biotechnology may be one relatively overlooked sector that's been using AI and machine learning to improve operations and uncover new treatments and products. In fact, McKinsey described AI-driven drug discovery as "the future of biotech."

Notably, the 2024 Nobel Prize in Chemistry was awarded to three researchers recognized for how they used AI to predict the structure of proteins, which is needed to better understand the role of a protein and then design more targeted drugs.

Artificial Intelligence and Machine Learning in Biotech

According to one estimate, the AI in biotechnology market is expected to be worth $2.1 billion in 2024 and projected to reach $7.11 billion in 2031, representing a compound annual growth rate of 19% over that period.

AI shows significant promise in biotechnology because of the sheer number of diseases that have unmet medical needs. It's no secret that finding and developing an effective medicine takes years and hundreds of millions or billions of dollars.

However, AI and machine learning could change all of that. McKinsey has identified over 250 companies working in the AI-driven drug discovery industry, which continues to grow.

"The best of these companies will fully integrate AI into research workflows…" McKinsey said. "By putting AI at the center of the research engine, companies can transform research at scale — and bring about dramatic improvements in patient outcomes."

Ultimately, experts believe AI in drug discovery will lead to better drugs being developed faster. Here are four AI-oriented stocks in the biotech sector.

1. Absci

With a market capitalization of around $452 million, Absci (NASDAQ:ABSI) falls firmly into small-cap territory. The company describes itself as a "generative AI drug creation company" with a simple mission: to "create better biologics for patients faster." Absci uses data to train its model, AI to create antibodies, and a wet lab to validate its discoveries.

According to Absci, most drug discovery for biologics use existing antibody libraries to uncover improvements. However, the company recently showed how it can "design de novo antibodies 'from scratch'" via computers.

Absci says its "zero-shot AI approach" designs antibodies without previous learning about the specific target, resulting in drug candidates that aren't anything like those found in existing databases. Thus far, the company has a candidate for inflammatory bowel disease in the IND (investigational new drug)-enabling stage. IND-enabling studies evaluate potential toxicities in humans and estimate starting doses for clinical trials.

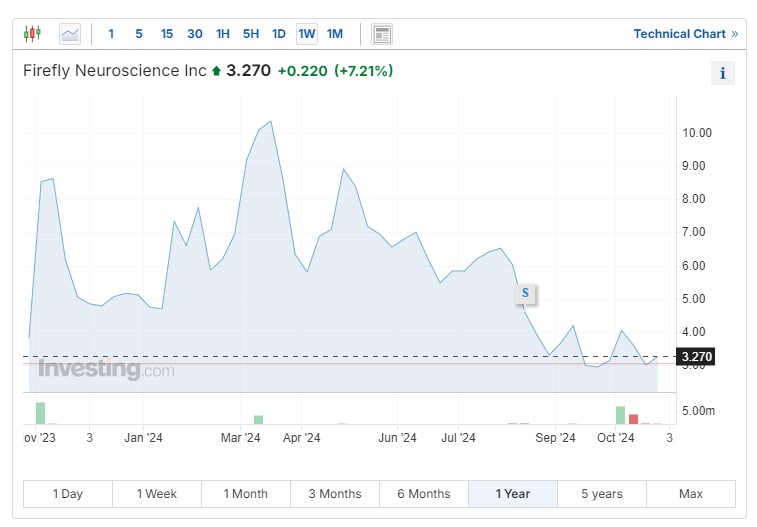

2. Firefly Neuroscience

Firefly Neuroscience Inc (NASDAQ:AIFF) has developed an AI-driven and FDA-cleared analysis platform called Brain Network Analytics (BNA). The platform taps Firefly's proprietary database of more than 77,000 EEG scans across 12 neurological disorders, enabling early, accurate detection of "subtle neurological deviations" via advanced AI.

Firefly's technology starts with the collection of EEG data using BNA "tasks" by placing electrodes on the patient's scalp to measure their brain's electrical activity and neural signals in real time. Next (LON:NXT), Firefly's signal processing techniques process the raw EEG data and prepares it for analysis.

Next up is the big data step, which involves comparing the processed EEG data against the company's FDA-cleared "normative age-matched database." That database serves as a reference point for the patient so that the BNA algorithms can spot subtle abnormalities in the patient's brain activity.

The technology then taps into AI to analyze the EEG data and provide actionable insights via machine learning, which continuously refines understanding of neurological patterns. Finally, BNA issues a report containing detailed insights into the patient's brain function and any detected abnormalities.

Earlier this month, Firefly Neuroscience completed successful research collaborations with Takeda Pharmaceutical (NYSE:TAK) and Novartis AG (NYSE:NVS, advancing its BNA technology for neuroscience drug development.

3. Korro Bio

Korro Bio (NASDAQ:KRRO) aims to "discover, develop and commercialize a new class of RNA therapies informed by human genetics and disease biology." The company uses machine learning to optimize oligonucleotides as part of its OPERA (oligonucleotide-promoted editing of RNA) platform.

Korro has pulled together a suite of technologies and capabilities to build out its RNA editing platform using machine learning, a deep understanding of ADAR biology, expertise in oligonucleotide chemistry, and fit-for-purpose delivery.

Earlier this month, Korro Bio announced a collaboration with Novo Nordisk (NYSE:NVO) to develop a pair of therapeutic candidates using Korro's OPERA platform. While the two targets are yet undisclosed, the candidates will be for cardiometabolic diseases.

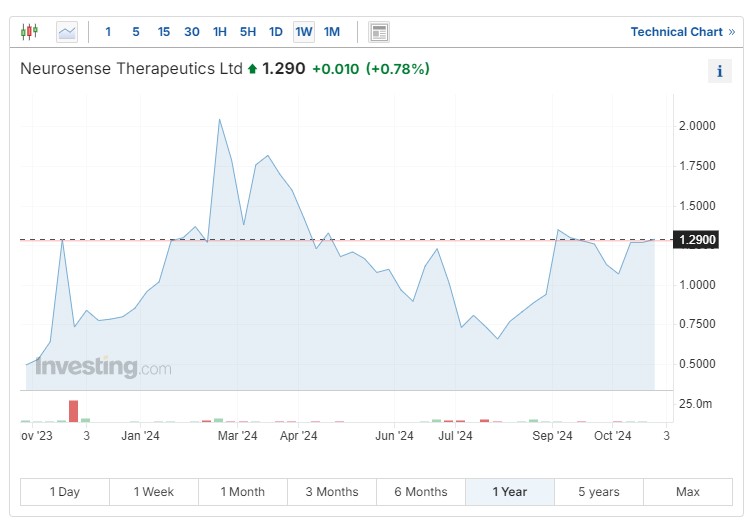

4. NeuroSense Therapeutics

Neurosense Therapeutics (NASDAQ:NRSN) is developing novel treatments for neurodegenerative diseases like amyotrophic lateral sclerosis, better known as ALS. The company recently partnered with PhaseV, which is pioneering causal machine learning for clinical trial analysis and optimization.

The two companies are teaming up by utilizing PhaseV’s ML technology for NeuroSense’s upcoming Phase 3 trial of PrimeC to treat ALS. The collaboration involved an independent analysis of NeuroSense’s PARADIGM Phase 2b trial by PhaseV using its ML technology.

That analysis predicts high chances of success in multiple subgroups for the Phase 3 study of PrimeC. Those results will inform study design and patient enrollment while ensuring the cost-effectiveness of the trial.

NeuroSense recently reported positive results from its Phase 2b trial of PrimeC, which showed a statistically significant 37% slowing of disease progression in ALS.

The drug candidate also showed a statistically significant 43% slowing of disease progression in high-risk ALS patients versus placebo following six months of treatment.

Investing in Biotech Stocks With an AI-Bent

Biotechnology stocks in general have had an excellent year, at least based on the Nasdaq Biotechnology Index (NBI).

Including a year-to-date gain of 7%, the index has soared 25% over the last year in a broader upswing that started in late October 2023.

Of course, investors are always advised to do their own due diligence before investing in any stock, idea or theme.