The airline industry has been struggling of late, especially from the back-to-back impact of Harvey and Irma. The airline stocks are lying low as investors begin to worry over their ability to recoup losses incurred from the onslaughts of successive calamities.

Another source of pessimism surrounding the stocks comes in the form of persistent high labor costs. The rise in fuel costs is also worrisome for airlines.

Harvey & Irma Impacts

Hurricanes Harvey and Irma have had devastating effect on the airline industry. Thousands of flights were canceled and fuel costs inflated. As was widely expected, United Continental Holdings (NYSE:UAL) , the parent company of United Airlines, was the worst hit from Harvey as Houston is the carrier’s second-largest hub. More than 7,400 flights were called off at George Bush Intercontinental Airport, with operations suspended at the airport due to the inclement storm for more than four days.

With the onset of Irma on the other hand, JetBlue Airways Corp. (NASDAQ:JBLU) is expected to be the worst hit. This Zacks Rank #3 (Hold) company has two hubs at Orlando and Fort Lauderdale, apart from Puerto Rico. Following Irma, the carrier cancelled more than 860 flights. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bleak Third-Quarter Forecasts

Several airlines companies have trimmed their third-quarter outlook, primarily due to the impact of the natural disasters.

Most recently, American Airlines (NASDAQ:AAL) lowered guidance for the third quarter due to Irma’s devastating strike. The company now anticipates third-quarter 2017 total revenue per available seat mile (TRASM) in the range of flat to up 1% year over year. Previous projection had called for a 0.5-2.5% rise in the metric. Due to higher fuel costs for the quarter, the company currently estimates third-quarter 2017 pre-tax margin, excluding special items, to vary between 8.5-10.5%. The prior view was in the range of 10-12%.

Other major airline companies like United Continental Holdings, Southwest Airlines Co. (NYSE:LUV) , Spirit Airlines (NASDAQ:SAVE) , JetBlue Airways Corporation and Delta Air Lines (NYSE:DAL) have also reduced projections for the third quarter.

Persistent High Labor Costs

Steep labor costs have been hurting the airline stocks for quite some time now. In fact, the future scenario also seems grim and might hurt the third-quarter results as well.

Zacks Industry Rank Highlights the Drab Scenario

The Zacks Industry Rank of 160 (out of 250 plus groups) carried by the Zacks Airline industry further highlights the woes of airlines. This unfavorable rank places the companies in the bottom 38% of the Zacks industries.

We classify our entire 250-plus industries into two groups: the top half (i.e. industries with the best average Zacks Rank) and the bottom half (the industries with the worst average Zacks Rank).

Over the last 10 years, using a week’s rebalance, the top half beat the bottom half by a factor of more than 2 to 1.

Click here to know more: About Zacks Industry Rank

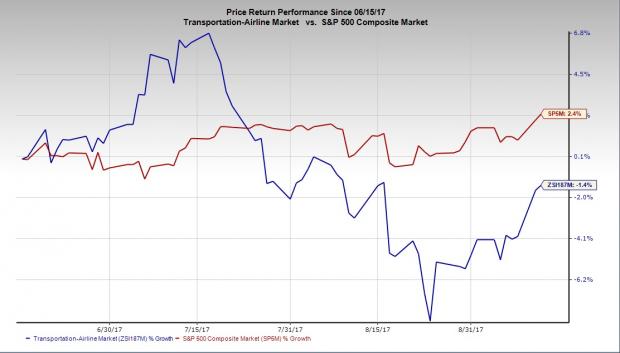

Price Performance

The dull outlook of the airlines is evident from the fact that the Zacks Airline Industry has underperformed the broader market in the last three months. While the S&P 500 Index has gained 2.4%, the industry declined 1.4%.

4 Airline Stocks to Dump

Keeping the above-mentioned headwinds in view, we have zeroed in on four stocks that investors would do better to eliminate from their portfolio.

Spirit Airlines, Inc. operates an airline based in Fort Lauderdale, providing travel opportunity principally to and from South Florida, the Caribbean as well as Latin America. The company based in Miramar, FL currently carries a Zacks Rank #5 (Strong Sell) and has a VGM Score of C. The earnings per share growth rate for the next five years is 8% for the company. The reading compares unfavorably with the industry’s 9.1%.

The stock has seen the Zacks Consensus Estimate for current-quarter earnings being reduced 35.9% in the last 60 days. For full-year 2017, the same has been lowered 22.6% during the same period.

Also, the company has been lately grappling with pilot related dispute. Consequently, the carrier had to withdraw multiple flights resulting in customer dissatisfaction.

Alaska Air Group, Inc. (NYSE:ALK) is a holding company of primarily Alaska Airlines, Virgin America and Horizon Air Industries. The company based in SeaTac, WA carries a Zacks Rank #5 and a Momentum Score of F. The earnings per share growth rate of the company for the next five years is 6.3%. The reading compares unfavorably with the reading of 9.1% for the industry.

The Zacks Consensus Estimate for current-quarter earnings has been cut 9.6% in the last 90 days. For full-year 2017, the same has been slashed 4% over the same period.

LATAM Airlines Group S.A. offers domestic and international passenger plus cargo air services. The Santiago, Chile-based company carries a Zacks Rank #5 and a VGM score of D.

The company’s Zacks Consensus Estimate for full-year 2017 earnings has been decreased 34.1% in the last 90 days.

International Consolidated Airlines Group (LON:ICAG) SA is the holding company for British Airways and Iberia, catering to scheduled passenger and cargo airline services. The company based in Harmondsworth, United Kingdom, carries a Zacks Rank #4 (Sell). The carrier’s earnings per share growth rate for the coming five years is 5.2%, which too compares unfavorably with the industry’s 9.1% increase.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Southwest Airlines Company (LUV): Free Stock Analysis Report

JetBlue Airways Corporation (JBLU): Free Stock Analysis Report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

United Continental Holdings, Inc. (UAL): Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

American Airlines Group, Inc. (AAL): Free Stock Analysis Report

Alaska Air Group, Inc. (ALK): Free Stock Analysis Report

Original post

Zacks Investment Research