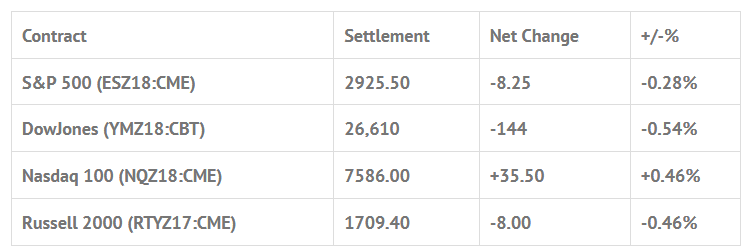

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp -0.58%, Hang Seng -1.62%, Nikkei +0.29%

- In Europe 13 out of 13 markets are trading higher: CAC +0.30%, DAX +0.28%, FTSE +0.60%

- Fair Value: S&P +5.20, NASDAQ +27.77, Dow +24.56

- Total Volume: 1.14mil ESZ & 181 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes FOMC Meeting Begins, Redbook 8:55 AM ET, S&P Corelogic Case-Shiller HPI 9:00 AM ET, FHFA House Price Index 9:00 AM ET, Consumer Confidence 10:00 AM ET, Richmond Fed Manufacturing Index 10:00 AM ET, and State Street Investor Confidence Index 10:00 AM ET.

S&P 500 Futures: #ES Drop And Chop

Yesterday, after gapping lower on globex and trading down to a 2923.25 low, then bouncing up to 2930.25 at 6:00 am, the S7P 500 futures started to show weakness into the RTH open and printed 2927.25, down 6.00 handles, on the 8:30 bell. From there, the benchmark futures sold off down to 2923.00, before bouncing up to a 2929.00 double top high of day just before 9:00 when the headlines broke that Deputy Attorney General Rosenstein was going to retire. Once the news was out, the news algos helped the ES dumped down to a 2917.25 low of day in short order. From there, the futures stabilized heading into 10:00, and then bounced mid morning up to 2926.00.

The late morning saw a higher low retest of 2919.25 around noon, followed by a bounce up to a 2926.50 high just after 2:00 pm in what was a slow afternoon. In the final hour as the MOC built up to $417 million to sell, the ES went nowhere, ending the day in a 4 handle trading range for the afternoon, printing 2924.50 at 3:00, and settling at 2925.75, down -8.00 handles, or -0.27%.

In the end it was a much slower day than I thought it would be. After the initial drop down to 2917.75, it took all day for the ES to make a MrTopStep 10 handes rule. There just didn’t seem to be that much interest. In terms of the days overall trade, it was slow. In terms of the markets overall tone, the ES did rally, but most of the push back up was short covering going into the later parts of the day.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.