- Shares of UnitedHealth are up around 3% since the beginning of 2022.

- It has grown through organic and acquisition growth

- Long-term investors could consider buying shares now

Shareholders in the Minnesota-based UnitedHealth Group (NYSE:UNH), which provides healthcare insurance and benefits services, have seen the value of their investment increase over 26% over the past 52 weeks.

By comparison, the Dow Jones Health Care Index and the Dow Jones Insurance Index are down 9.7% and 3.5% so far in 2022.

On Apr. 14, UNH shares went over $553, hitting a record high.

Recent metrics suggest UnitedHealth commands a 12% share in US health insurance market. Followed by Elevance Health (NYSE:ELV), which was previously known as Anthem, Centene (NYSE:CNC), and Humana (NYSE:NYSE:HUM).

How Recent Metrics Came

UnitedHealth reported Q1 metrics in mid-April. Revenue was up 14.2% year-over-year to $80.1 billion.

While revenue from UnitedHealthcare grew 13.6% YoY to $62.6 billion, Optum's—the health information technology and services arm—top line increased 18.9%. The insurer’s earnings from operations in Q1 also were also up by 4.4% to $7 billion, translating into adjusted earnings of $5.49 per share.

Management, led by CEO Andrew Witty, was pleased with the results and raised full-year adjusted net earnings guidance from $21.20 to $21.70 per share.

Prior to the release of the Q1 results, UNH stock was around $540 but slide to $517.40 which supports a dividend yield of 1.28%.

What To Expect From UNH Stock

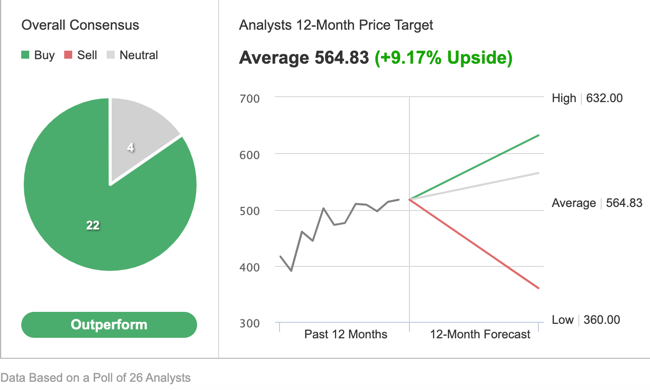

UNH has an "outperform" rating from 26 analysts polled via Investing.com and a 12-month median price target of $564.83, 9.17% higher than current levels.

Source: Investing.com

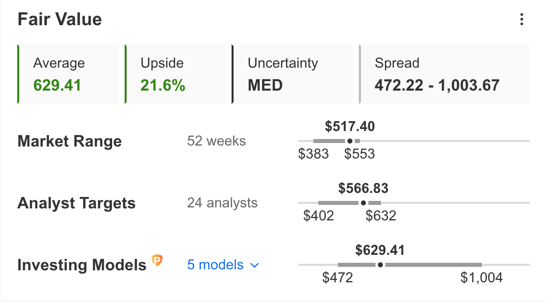

The average fair value for UNH stock on InvestingPro stands at $629.41.

Source: InvestingPro

We can also look at UNH’s financial health as determined by ranking more than 100 factors against peers in the healthcare sector.

In terms of profit and price momentum, it scores 4 out of 5.

Despite the recent share price decline, UNH’s P/E, P/B, and P/S ratios are 27.8x, 7.14x, and 6.7x which is on the high side compared to peers which stand at 8.5x, 1.3x, and 0.7x.

We expect UNH to trade in a wide range and build a base between $490 and $520 in the coming weeks and then the shares could potentially start a new leg up.

Adding UNH Stock To Portfolios

Bulls who are not concerned about short-term volatility could consider investing now or maybe buy an exchange-traded fund (ETF) that has UNH stock as a holding such as:

- iShares U.S. Healthcare Providers ETF (NYSE:IHF)

- Global X Dow 30 Covered Call ETF (NYSE:DJIA)

- Health Care Select Sector SPDR® Fund (NYSE:XLV)

- Global X Telemedicine & Digital Health ETF (NASDAQ:EDOC)

- Amplify CWP Enhanced Dividend Income ETF (NYSE:DIVO)

Or investors could consider setting up a bull call spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on UNH stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bull Call Spread On UnitedHealth Group Stock

UNH Price At Time Of Writing: $517.40

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price in UNH with the same expiration date.

In a bull call spread, both the potential profit and the potential loss levels are limited. The trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the Sept. 16 expiry 520 strike call for $25.60 and selling the 530 strike call for $20.50.

Buying this call spread costs the investor around $5.10 or $510 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the UNH stock price at expiration is below the strike price of the long call (or $520 in our example).

To calculate the maximum potential gain, we can subtract the premium paid from the spread between the two strikes, and multiply the result by 100. In other words: ($10.00 – $5.10) x 100 = $490.

The trader will realize this maximum profit if the UnitedHealth stock price is at or above the strike price of the short call (higher strike) at expiration (or $530 in our example).

Bottom Line

UNH stock has come under profit-taking pressure recently and the slide has improved the margin of safety for buy-and-hold investors. Alternatively, experienced traders could also set up an options trade to benefit from a potential run-up in the price.