- The stock market reached new records recently before pulling back slightly.

- So, finding underpriced stocks with strong upside potential can provide significant returns for investors.

- As such, I used the InvestingPro stock screener to find high-quality, undervalued stocks to buy now with strong upside ahead.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for just 60 cents a day!

With the stock market rallying to dizzying new heights, identifying undervalued stocks with strong upside potential can provide significant gains for investors.

As such, I used the InvestingPro advanced stock screener to find underpriced gems that not only have strong growth prospects but are also highly regarded by analysts.

By leveraging the InvestingPro stock screener's robust features - including advanced filters, and comprehensive financial metrics - investors can identify stocks with the potential for significant growth, strong fundamentals, and favorable market trends.

You can harness the power of InvestingPro to pick out underpriced stocks poised to deliver significant returns.

Our predictive AI stock-picking tool can prove a game-changer in that respect. For less than $9 a month, it will update you every month with a timely selection of AI-picked buys and sells, giving you a significant edge over the market.

Subscribe now and position your portfolio one step ahead of everyone else!

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

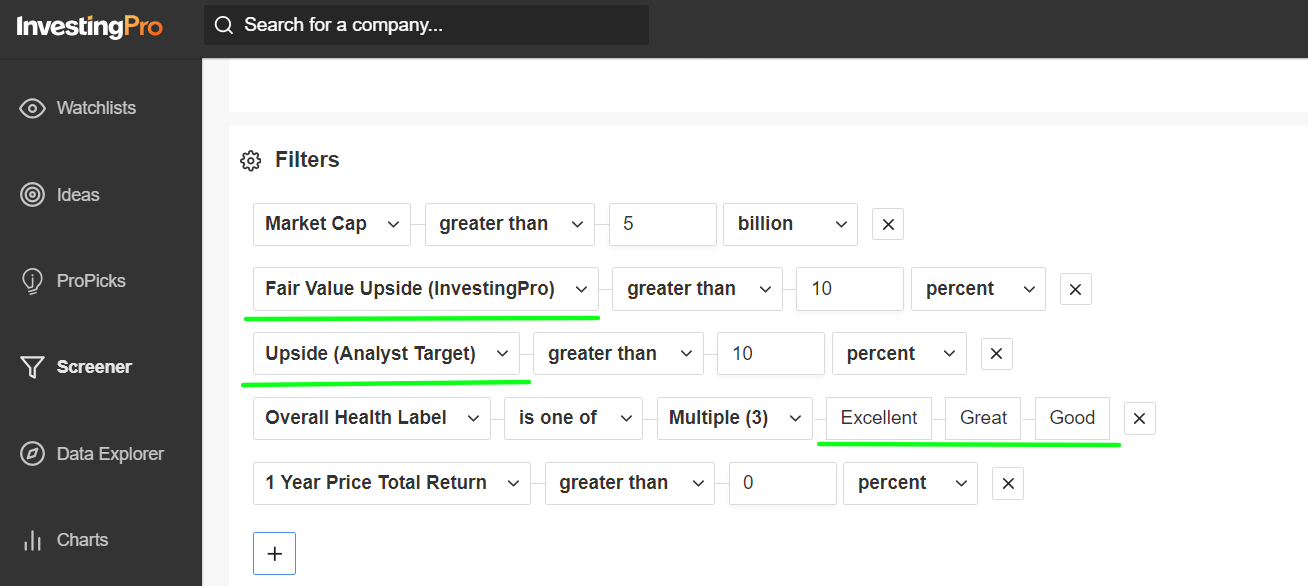

Now, while trying to identify potential winners, I first scanned for companies with both an InvestingPro ‘Fair Value’ Upside greater than 10%.

I then filtered for names whose InvestingPro Overall Health Label was either ‘Excellent’, ‘Great’, or ‘Good’.

Source: InvestingPro

And those companies with a market cap of $5 billion and above made my watchlist. Once the criteria were applied, I was left with a total of 99 companies.

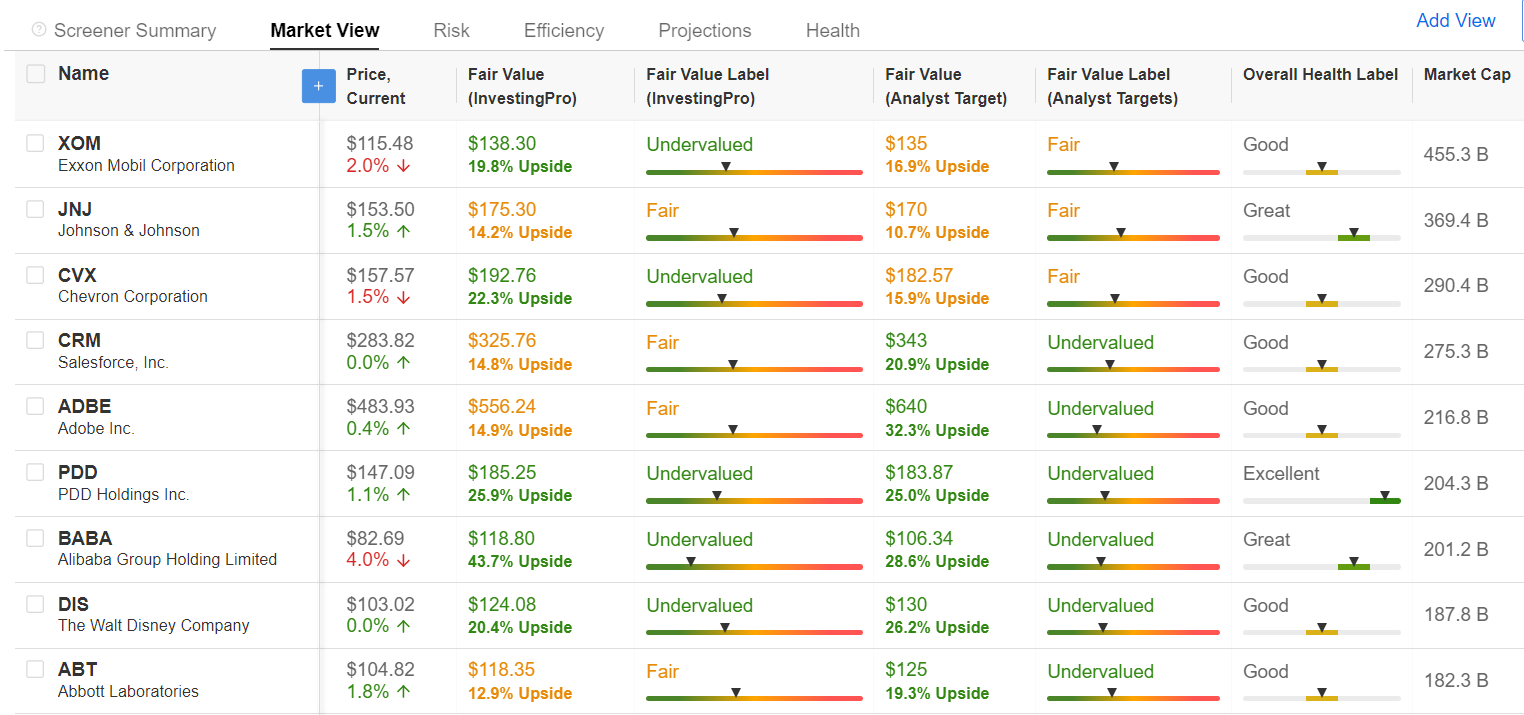

Source: InvestingPro

Of those, ExxonMobil (NYSE:XOM), Adobe (NASDAQ:ADBE), and Cencora (NYSE:COR) were the three that stood out the most to me.

Each of these companies boasts an above-average InvestingPro 'Company Financial Health Score' and holds significant upside potential based on InvestingPro's AI-powered 'Fair Value' estimates and analyst price targets.

1. ExxonMobil

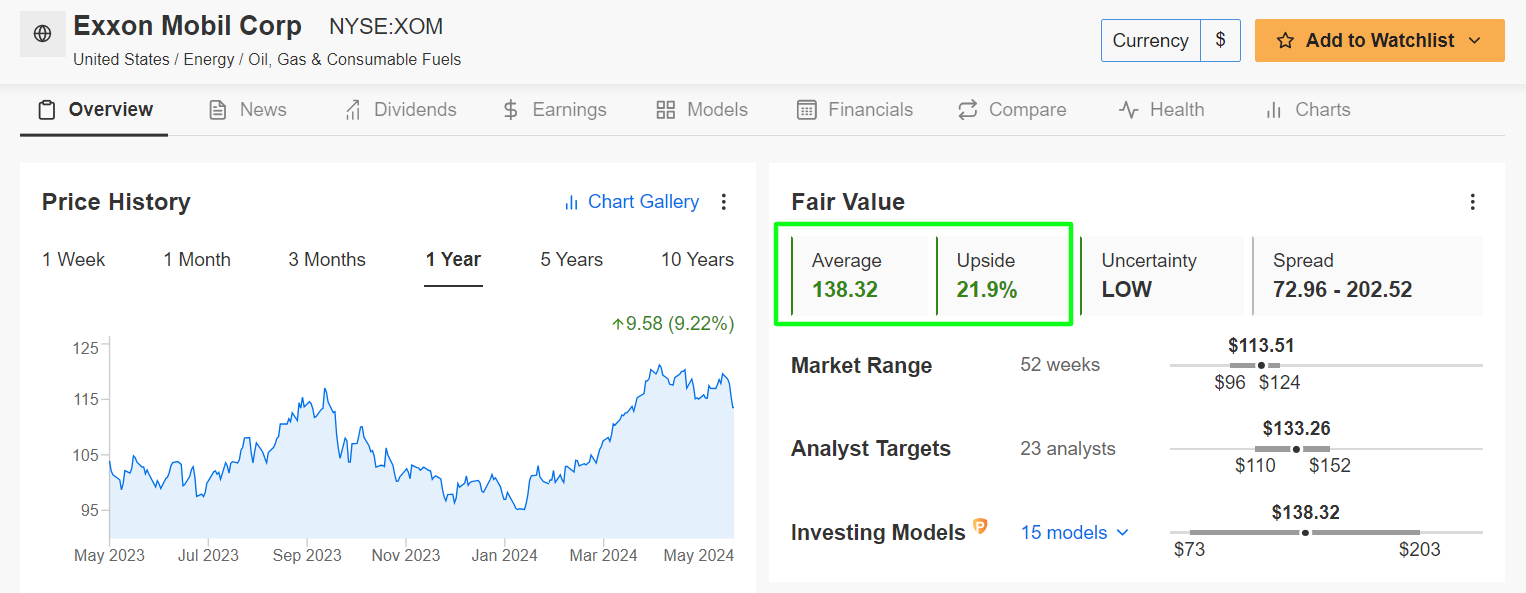

- Thursday’s Closing Price: $113.51

- Fair Value Estimate: $138.32 (+21.9% Upside)

- Market Cap: $447.5 Billion

ExxonMobil is one of the largest publicly traded energy companies in the world, involved in the exploration, production, and distribution of oil and natural gas products. The company also operates a significant chemical division.

With a robust portfolio of upstream and downstream assets, ExxonMobil is seen benefiting from rising global energy demand and higher crude oil prices. Additionally, the ‘Big Oil’ company’s recent strategic acquisitions and investments in renewable energy projects further underscore its growth potential.

It is also worth mentioning that ExxonMobil’s strong dividend yield and share repurchase program offer additional returns to investors, making it a compelling choice in the energy sector.

- ‘Fair Value’ Price Target:

Current ‘Fair Value’ price target estimates indicate that XOM stock is trading at a bargain valuation. InvestingPro’s AI models predict a 21.9% potential upside from the current market value of $113.51.

Source: InvestingPro

That would bring shares closer to their ‘Fair Value’ price of $138.32, making it an attractive investment.

In addition, Wall Street remains optimistic about the oil-and-gas behemoth, as per an Investing.com survey, which revealed that 16 analysts have a ‘Buy’-equivalent rating on the stock vs. 11 ‘Hold’-equivalent ratings and zero ‘Sell’-equivalent rating.

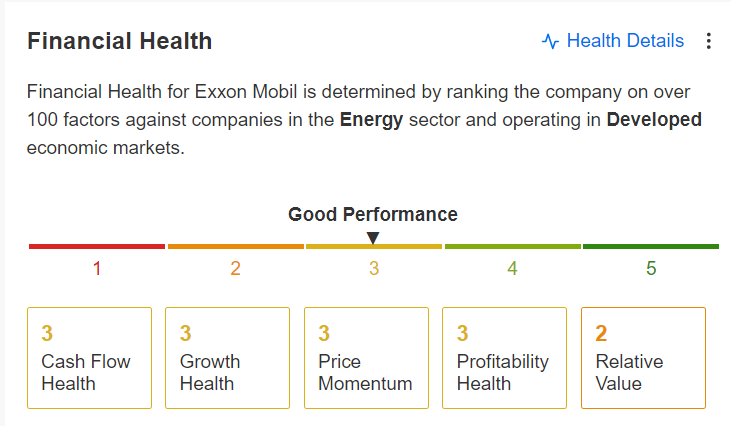

- Company Health Score:

ExxonMobil’s 'Company Health Score', as assessed by InvestingPro, reflects its excellent financial position, strong balance sheet, robust cash-generating capabilities, and promising earnings and sales growth trajectory.

Source: InvestingPro

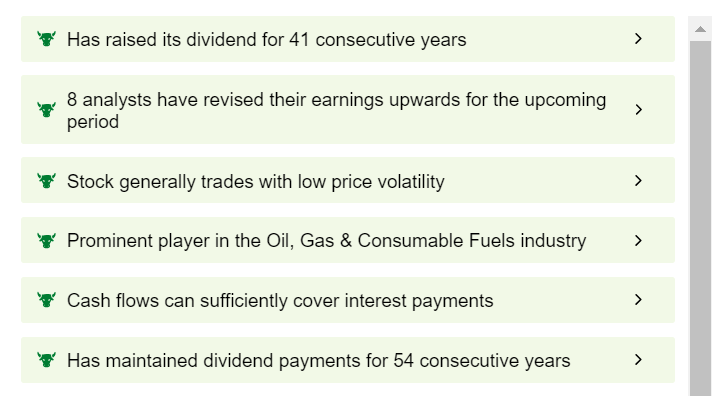

Furthermore, ProTips also mentions that ExxonMobil has raised its annual dividend payout for 41 consecutive years, a testament to its continuous effort to return capital to shareholders.

Source: InvestingPro

The Texas-based energy giant returned $32.4 billion to shareholders in 2023 through $14.9 billion in dividends and $17.4 billion in share buybacks.

2. Adobe

- Thursday’s Closing Price: $483.31

- Fair Value Estimate: $556.31 (+15.1% Upside)

- Market Cap: $216.5 Billion

Adobe is a leading software company known for its creative software products, including Photoshop, Illustrator, and Acrobat. It also offers a suite of marketing and document management solutions through its Adobe Experience Cloud.

Despite worries over an increasingly competitive landscape, Adobe continues to benefit from the ongoing digitization of businesses and the growing demand for digital content creation tools. Adobe’s subscription-based model provides a steady revenue stream, and its innovative product offerings keep it at the forefront of the industry.

Furthermore, Adobe's recent investments in artificial intelligence and machine learning are expected to enhance its product capabilities, driving further customer adoption.

- ‘Fair Value’ Price Target:

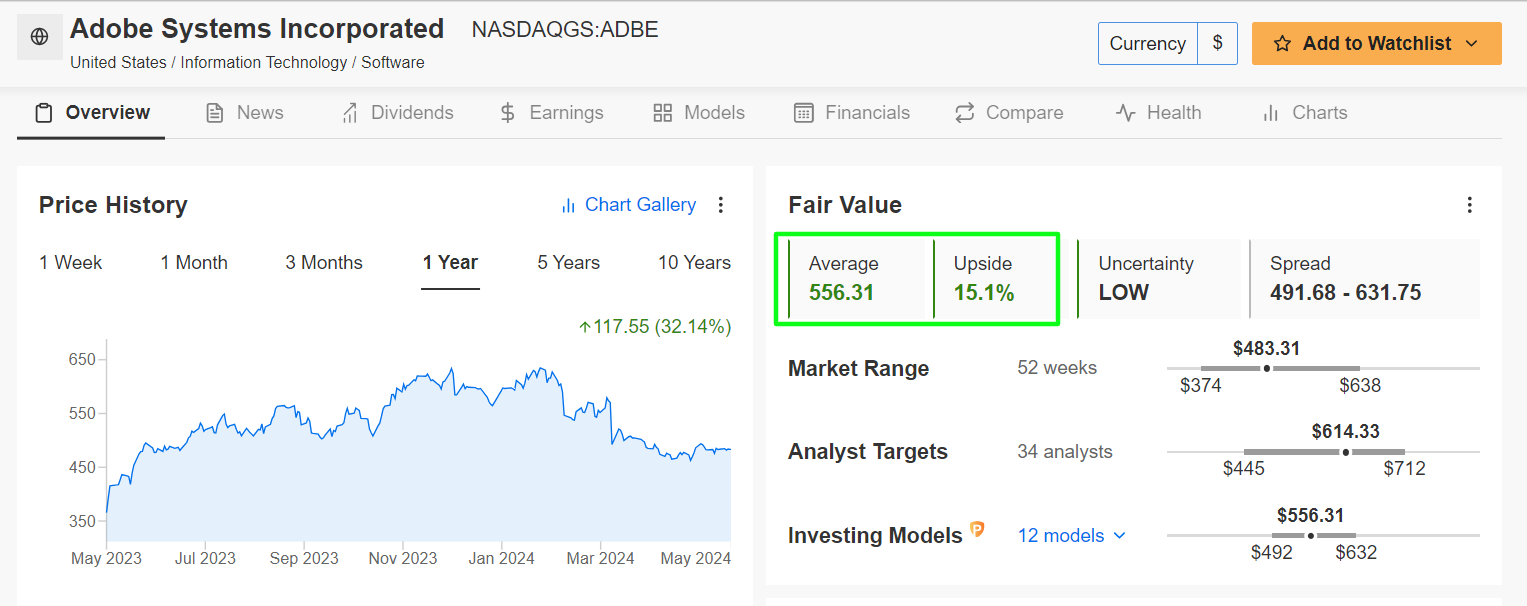

According to InvestingPro’s Fair Value estimates, ADBE stock has a potential upside of 15.1% from its current price of $483.31.

Source: InvestingPro

That would take shares within proximity of their ‘Fair Value’ price target of $556.31.

Additionally, it should be mentioned that Wall Street has a long-term bullish view on Adobe, with 35 out of the 39 analysts surveyed by Investing.com rating it as either a ‘Buy’ or a ‘Hold’.

- Company Health Score:

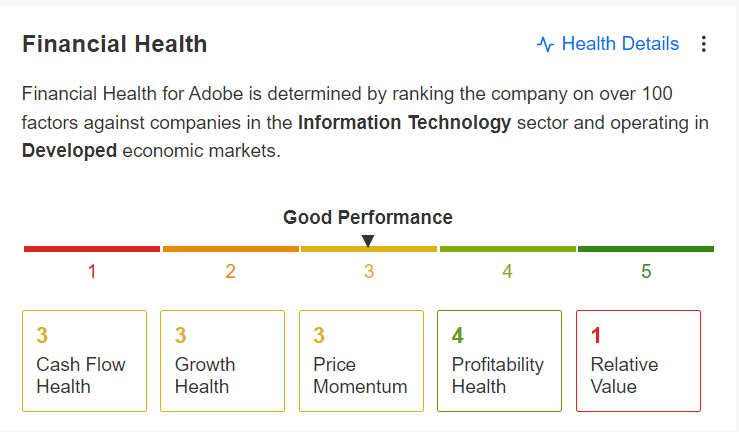

Adobe has an above-average InvestingPro ‘Company Health Score’, indicating its solid financial position, promising growth outlook, and impressive gross profit margins.

Source: InvestingPro

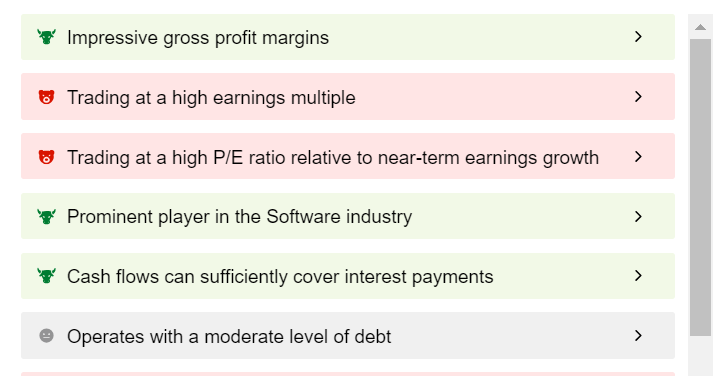

ProTips also highlights that Adobe’s robust financial health is complemented by a consistent track record of revenue growth and strategic acquisitions, bolstering its market position.

Source: InvestingPro

All things considered, Adobe's strong presence in the digital media segment positions it well to capitalize on the growing trend of digital transformation across various industries.

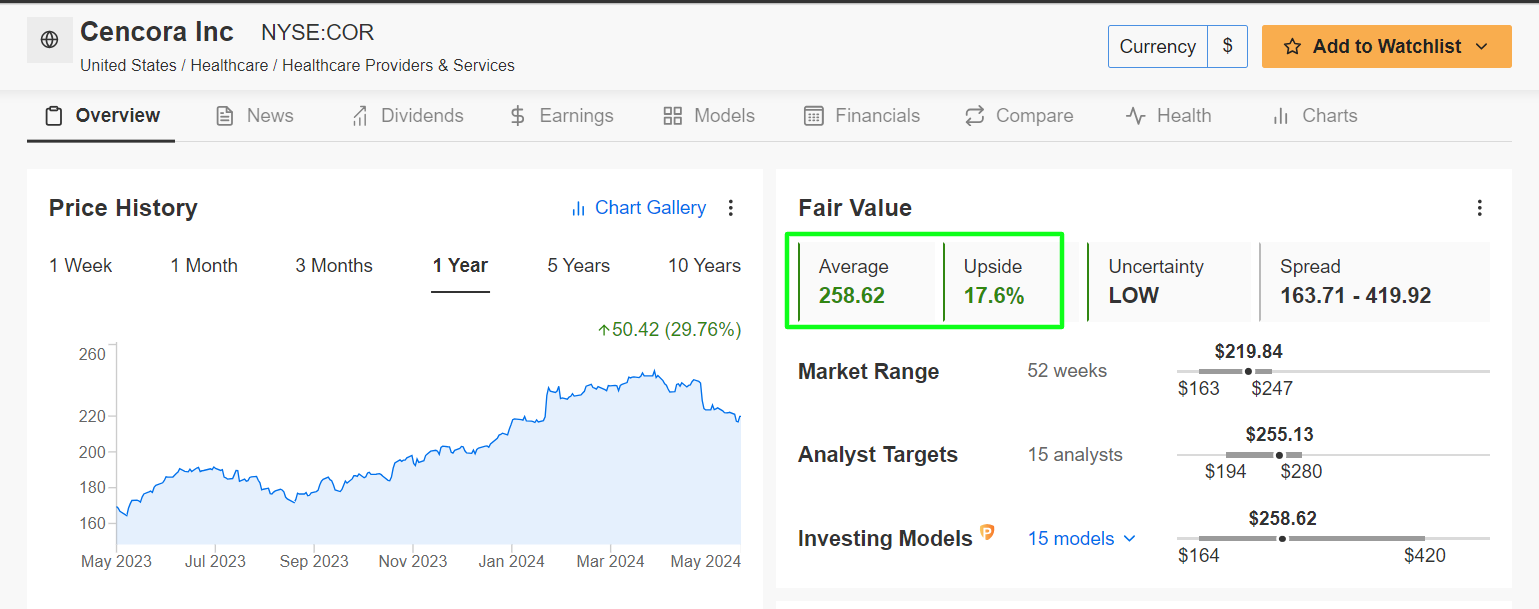

3. Cencora

- Thursday’s Closing Price: $219.84

- Fair Value Estimate: $258.62 (+17.6% Upside)

- Market Cap: $43.8 Billion

Cencora, formerly known as AmerisourceBergen (NYSE:COR), is a leading global pharmaceutical sourcing and distribution services company. It provides distribution and related services to healthcare providers and pharmaceutical manufacturers.

The Conshohocken, Pennsylvania-based company is poised to benefit from the growing demand for pharmaceuticals and healthcare services, driven by an aging population and increased access to healthcare. The ongoing global health initiatives and increased emphasis on healthcare infrastructure also present significant growth opportunities for Cencora.

Additionally, the drug wholesale company's efforts to innovate within the pharmaceutical supply chain, including the integration of advanced analytics and AI, are expected to improve operational efficiency and customer satisfaction.

- ‘Fair Value’ Price Target:

The present valuation of COR suggests it is a bargain, as assessed by InvestingPro's AI-backed models. There's a possibility of a 17.6% increase from last night’s closing price of $219.84, moving it closer to its 'Fair Value' set at $258.62 per share.

Source: InvestingPro

Also worth mentioning is that Cencora remains a favorite on Wall Street, with just one out of the 17 analysts surveyed by Investing.com rating shares as ‘Sell’, while the remaining 16 analysts have it as either ‘Buy’ or ‘Hold’.

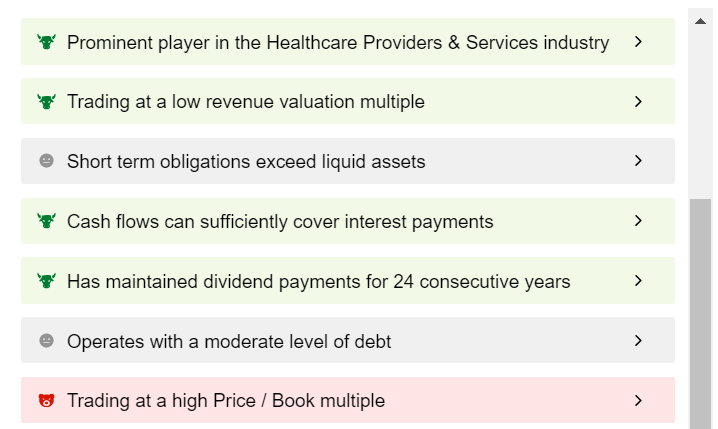

- Company Health Score:

Demonstrating the strength of its business, Cencora’s InvestingPro ‘Company Health Score’ highlights its excellent financial position, healthy profitability outlook, and robust growth potential.

Source: InvestingPro

ProTips emphasizes that Cencora’s management has been effectively using free cash flow to reinvest in the business and return value to shareholders through share repurchases and dividends.

Source: InvestingPro

Cencora currently offers investors an annualized dividend payout of $2.04 per share at a yield of 0.93%. The company, which has been aggressively buying back shares, has maintained dividend payments for 24 consecutive years.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Ray Dalio, Michael Burry, and George Soros are buying.

Don’t forget your 40% discount on the yearly and bi-yearly Pro plans with coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.