- Wall Street’s Q2 earnings season gathers momentum as the biggest names in the world get set to report their latest results.

- Using the InvestingPro stock screener, I identified several under-the-radar AI-linked companies that are poised to deliver explosive profit and sales growth.

- As such, here are three stocks worth owning ahead of their quarterly reports in the weeks ahead.

- Looking for more actionable trade ideas? The InvestingPro Summer Sale is live: Subscribe for under $8/month!

The second-quarter earnings season on Wall Street gathers momentum this week, with some of the biggest names in the world set to report their latest financial results.

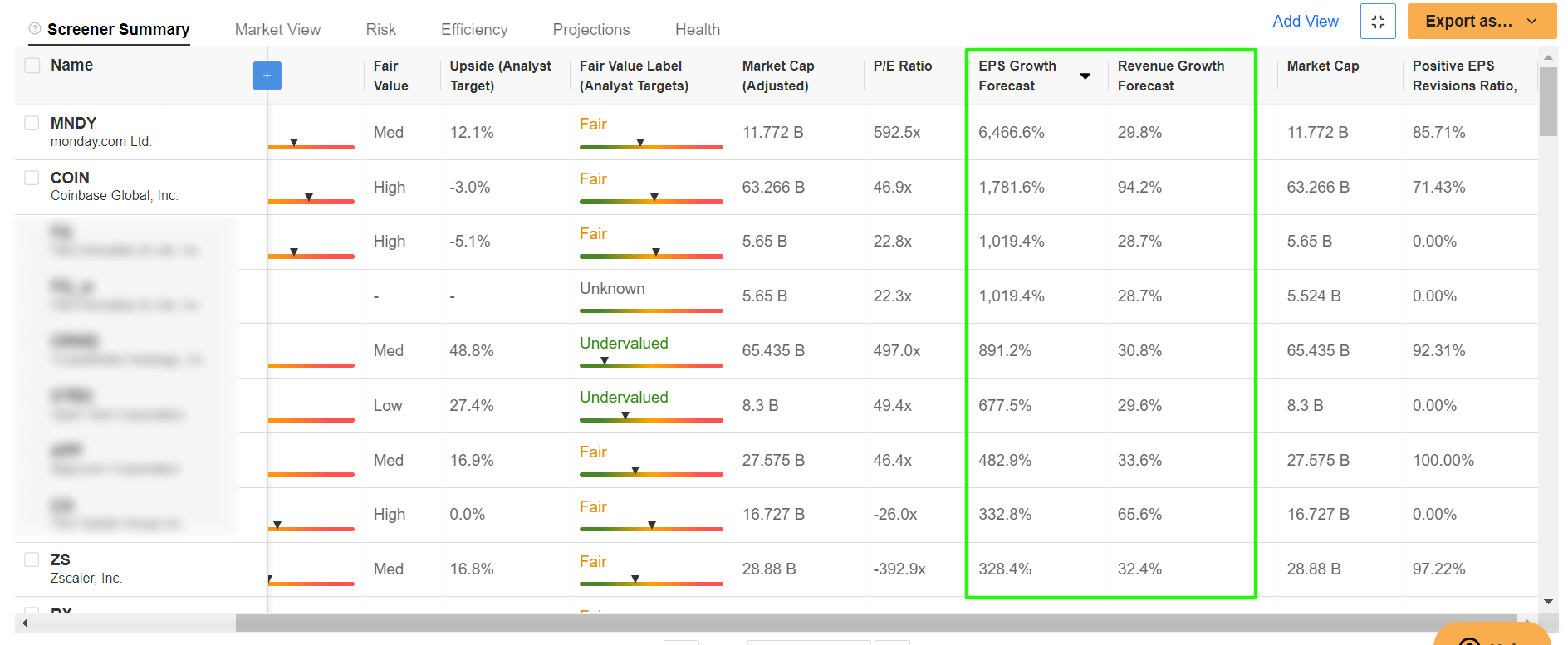

While most of the focus will be on the mega-cap technology stocks yet to report, like Microsoft (NASDAQ:MSFT), Meta Platforms (NASDAQ:META), Apple (NASDAQ:AAPL), and Amazon (NASDAQ:AMZN), I identified several fast-growing names set to enjoy robust earnings and sales growth using the InvestingPro Stock Screener.

Source: InvestingPro

InvestingPro's stock screener is a powerful tool that can assist investors in identifying high-quality stocks with strong potential upside. By utilizing this tool, investors can filter through a vast universe of stocks based on specific criteria and parameters.

Subscribe now for 50% OFF and position your portfolio one step ahead of everyone else.

Here's a closer look at why these under-the-radar AI stocks are set for remarkable growth.

1. Coinbase

- Earnings Report Date: August 1

- EPS Growth Estimate: +1,781.6% Y/Y

- Revenue Growth Estimate: +94.2% Y/Y

Coinbase (NASDAQ:COIN), which is widely considered the leading cryptocurrency exchange for buying and selling Bitcoin and other tokens, has been leveraging AI to enhance its trading platform, improving fraud detection, and provide more personalized customer experiences. These AI-driven improvements have significantly boosted the company’s operational efficiency and profitability.

Analyst Upgrades:

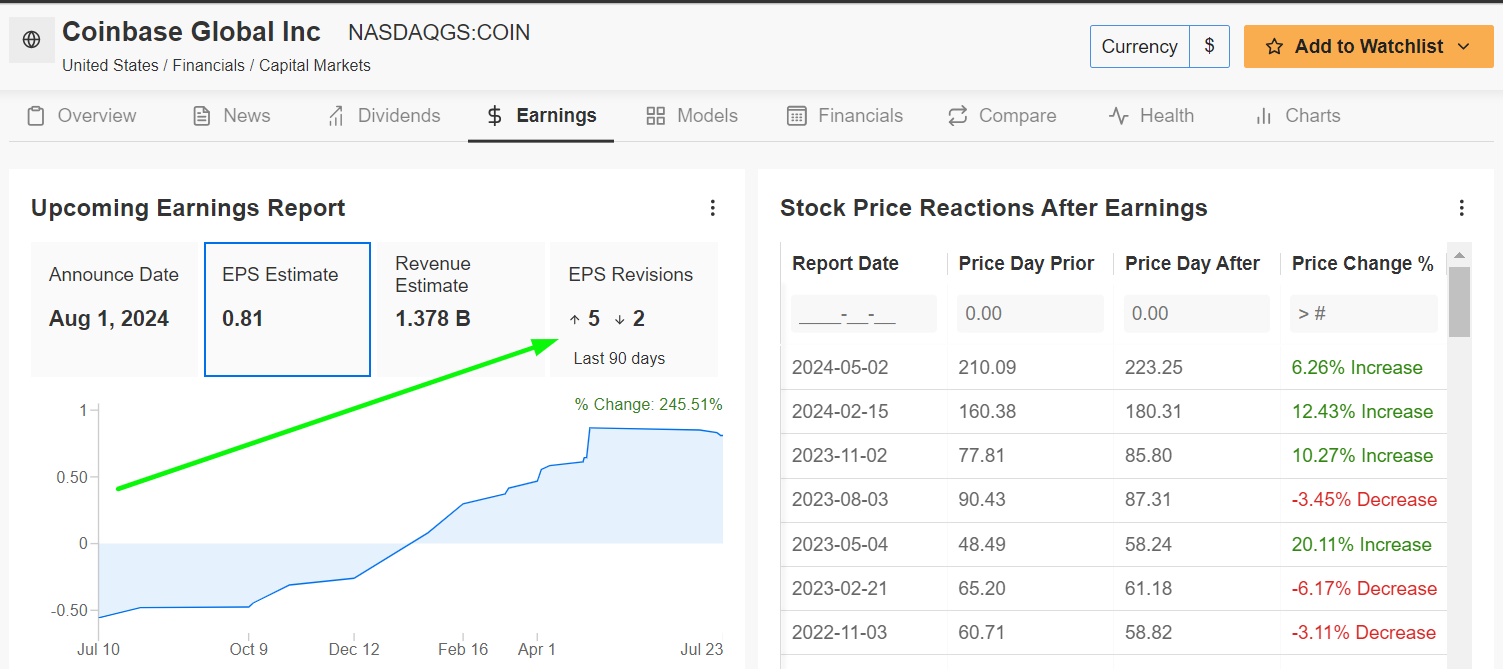

Coinbase is scheduled to deliver its second-quarter earnings and revenue update on Thursday, August 1. InvestingPro data reveals that five of the seven analysts surveyed have upwardly revised their earnings estimates to reflect a gain of 245% from their initial forecasts. This wave of positive revisions indicates strong confidence in Coinbase’s ability to capitalize on the growing demand for cryptocurrency trading.

Source: InvestingPro

Consensus calls for Coinbase to report Q2 earnings per share of $0.81, surging over 1,700% from a loss of -$0.42 in the same quarter a year earlier. Revenue is forecast to jump 94.2% from the year-ago period to $1.37 billion.

Earnings have been catalysts for outsized swings in Coinbase shares, as per data from InvestingPro, with COIN stock rising approximately 6% when the company last reported quarterly numbers in May.

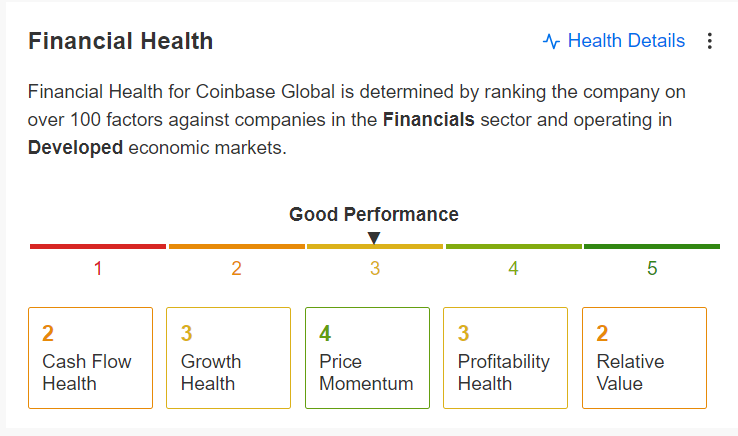

Financial Health and Growth Drivers:

Coinbase holds an above-average Financial Health Score on InvestingPro, supported by rising net income and impressive sales growth.

Source: InvestingPro

The cryptocurrency exchange operator's robust financial performance and strategic use of AI position it well for sustained profitability and growth.

COIN stock ended at $257.63 on Tuesday, not far from its 2024 peak of $283.48 reached on March 25.

Source: Investing.com

Shares are up 48.1% year-to-date, driven by changes in the U.S. political and legal landscape that could positively affect the company's regulatory risks.

2. Monday.com

- Earnings Report Date: August 13

- EPS Growth Estimate: +6,466.6% Y/Y

- Revenue Growth Estimate: +29.8% Y/Y

Monday.Com (NASDAQ:MNDY), which operates a cloud-based platform that allows companies to create their own applications and work management software, has been integrating AI to streamline project management, improve task automation, and enhance user experience.

The Tel Aviv, Israel-based tech firm’s use of AI-driven insights helps organizations manage workflows more efficiently, leading to significant cost savings and productivity gains.

Analyst Optimism:

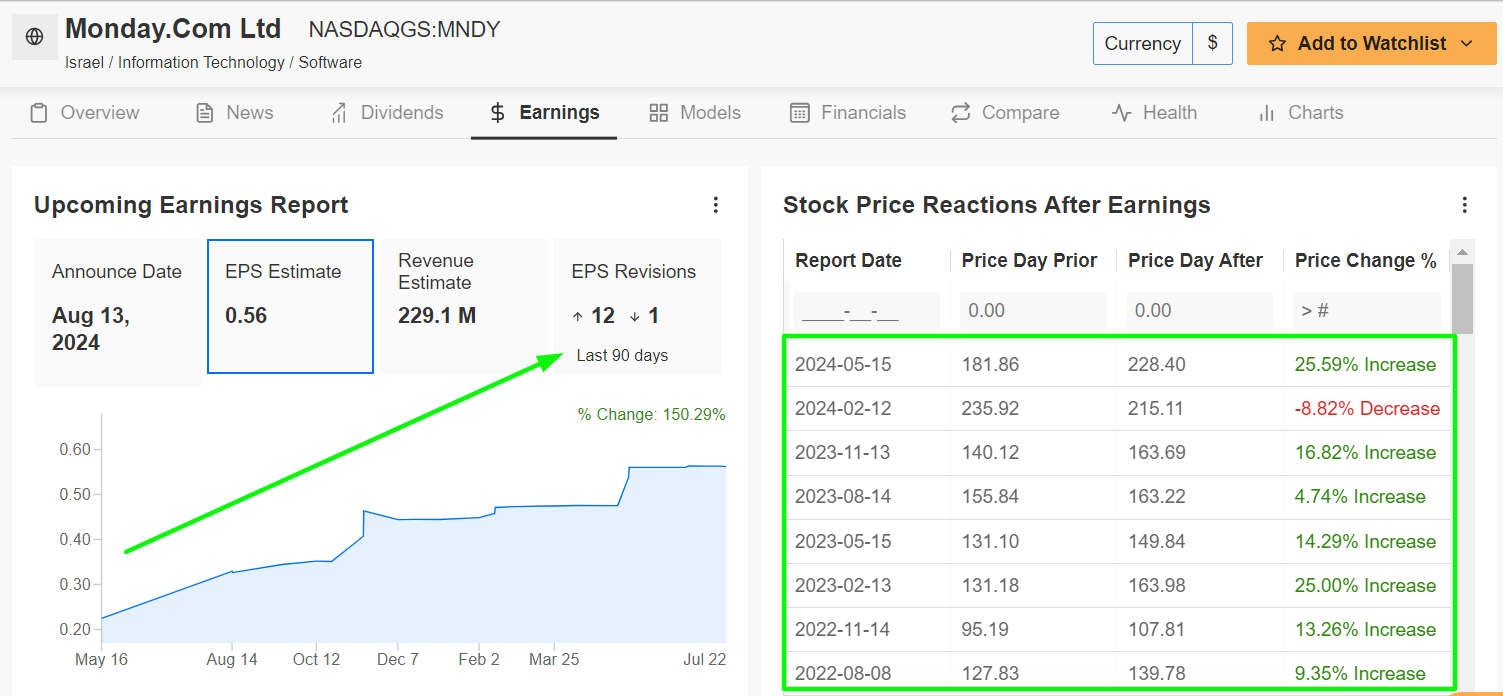

Monday.com is expected to deliver explosive profit growth when it releases its second-quarter update on Tuesday, August 13. In a sign of increasing optimism, analysts have made substantial upward revisions to their EPS forecasts according to exclusive data from InvestingPro. Notably, 12 out of the last 13 EPS revisions have been to the upside, reflecting growing confidence in the enterprise communication software company’s financial performance.

Source: InvestingPro

Wall Street sees Monday.com earning a profit of $0.56 per share, improving by a whopping 6,466% from the year-ago period. Meanwhile, revenue is expected to increase nearly 30% year-over-year to $229.1 million, fueled by strong demand for its products across all ends of the market.

Notably, Monday.com has beaten Wall Street’s expectations for both the top and bottom line in every quarter since going public in June 2021, as organizations increasingly embrace cloud-native architectures and digital transformation initiatives.

Some of its most notable customers include Walmart (NYSE:WMT), Coca-Cola (NYSE:KO), Occidental Petroleum (NYSE:OXY), Stryker (NYSE:SYK), and Uber (NYSE:UBER).

Financial Health and Tailwinds:

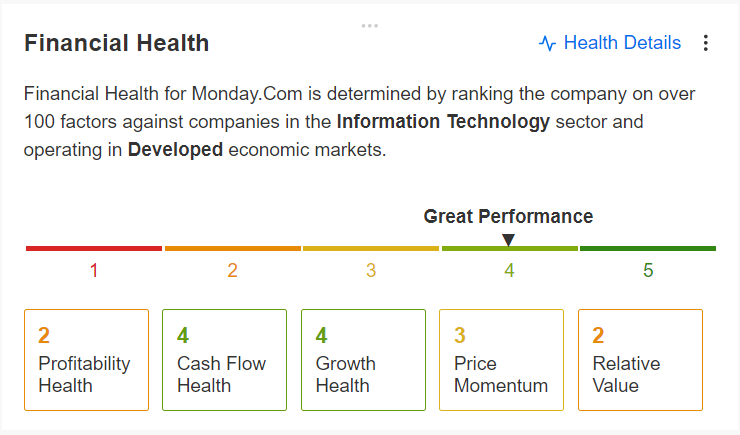

Monday.com boasts an impressive Financial Health Score on InvestingPro, driven by a pristine balance sheet and strong gross profit margins.

Source: InvestingPro

The company’s robust net income and sales growth further underline its solid financial standing and future growth potential.

MNDY stock closed at $236.49 yesterday, giving the workplace management software maker a market cap of $11.8 billion.

Source: Investing.com

Shares have increased around 26% year-to-date, compared to the Nasdaq 100’s 17.4% gain.

3. Zscaler

- Earnings Report Date: September 5

- EPS Growth Estimate: +328.4% Y/Y

- Revenue Growth Estimate: +32.4% Y/Y

Zscaler (NASDAQ:ZS), a leader in cloud security, utilizes AI to enhance its cybersecurity offerings. The San Jose, California-based firm provides automated threat forensics and dynamic malware protection against advanced cyber threats.

The company's AI-driven threat detection and response capabilities provide superior protection for enterprises, making it a key player in the rapidly growing cybersecurity market.

Analyst Enthusiasm:

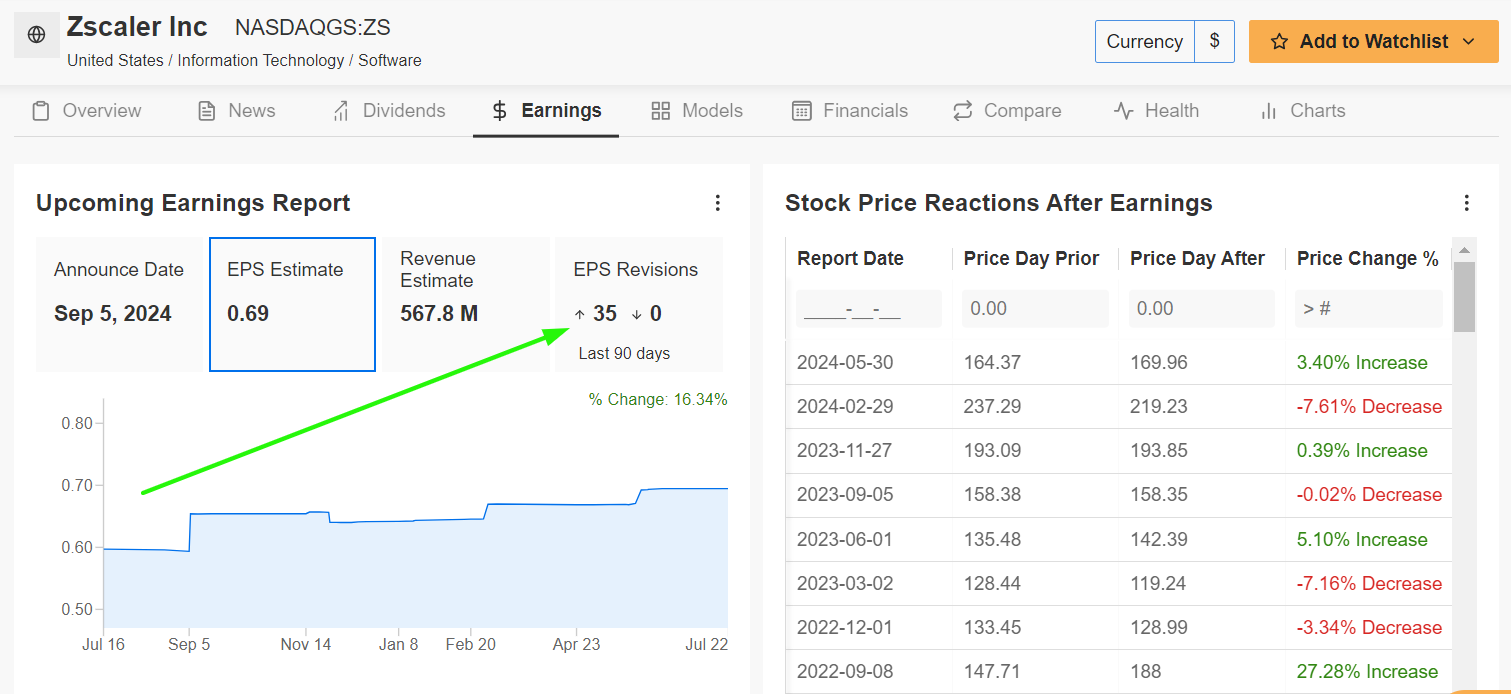

Zscaler is forecast to report strong triple-digit earnings growth for its fiscal Q4 when it delivers its quarterly update on Thursday, September 5. Not surprisingly, Wall Street is increasingly bullish on the cloud security company’s prospects, with all of the last 35 analyst revisions being upward, according to InvestingPro data. This unanimous optimism underscores Zscaler’s strong growth prospects and expected financial outperformance.

Source: InvestingPro

Consensus expectations call for Zscaler to post a profit of $0.69 a share, surging 328.4% from the year-ago quarter. Revenue is anticipated to jump 32.4% annually to $567.8 million, benefiting from solid demand for its cybersecurity platform.

Demonstrating the strength and resilience of its business, Zscaler has beaten Wall Street’s top line expectations for 24 consecutive quarters dating back to Q2 2018.

Financial Health and Tailwinds:

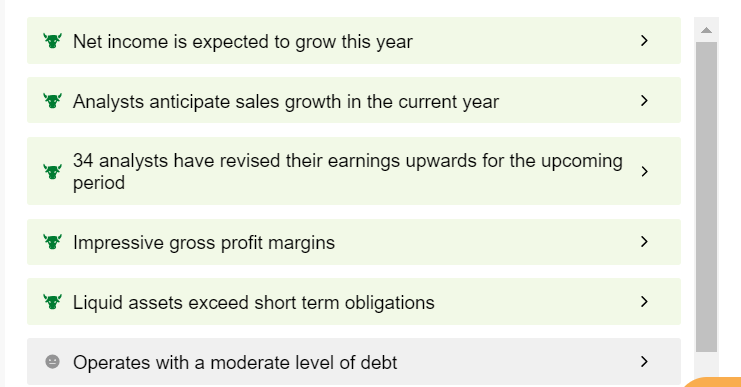

Zscaler’s financial health is robust, featuring rapid sales growth and a healthy balance sheet.

Source: InvestingPro

The company's ability to leverage AI for superior cybersecurity solutions, combined with its solid financial metrics, makes it a standout in the tech sector.

ZS ended Tuesday’s session at $191.07, bouncing off its 2024 trough of $155.25 touched on May 30. At current levels, Zscaler has a market cap of $28.9 billion.

Source: Investing.com

Shares have underperformed the broader market by a wide margin so far this year, falling 13.7% year-to-date amid worries over increasing competition in the cybersecurity space.

Conclusion

As the AI landscape evolves, Coinbase, Monday.com, and Zscaler are set to deliver exceptional earnings growth, driven by their innovative use of AI technologies. These companies not only show significant EPS growth potential but also boast strong financial health and positive analyst sentiment. For investors looking to capitalize on the AI boom, these under-the-radar stocks present compelling opportunities.

By leveraging InvestingPro’s advanced tools and exclusive data, you can uncover such high-potential stocks and make informed investment decisions. Don't miss out on the next big winners in the market—start exploring today with InvestingPro.

Our InvestingPro Summer Sale Is Now Live!

Readers of this article can subscribe to InvestingPro for less than $8 a month as part of our summer sale.

To apply the discount, don't forget to use the coupon code PROTIPS2024.

Subscribe here and unlock access to:

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.