Three Trillion dollars gained in the U.S. markets since the Presidential election in November 2016 are now at risk...and more.

With the recent failings of two attempts by the President to implement temporary travel restrictions from several foreign countries via his executive orders, and the failure of Republicans to reach a consensus on passing a bill that would have repealed and replaced Obamacare, one has to wonder whether Republicans can, in fact, ever reach agreement on any of President Trump's economic, fiscal, national security, tax and regulation reform, and immigration reform agenda.

Combine these recent failures together with ongoing intelligence investigations of election activities and of the President and his campaign officials, themselves, as well as the Senate's inability to have confirmed a full Trump cabinet and a new Supreme Court Justice, to date, and we're left with a big question mark in that regard.

Unless Republicans pledge their complete loyalty to the President and become united in their efforts to seriously move that agenda forward as a professional governing party, nothing will be accomplished in the next two to four years. They are risking three trillion dollars that have been pledged by market participants in their faith that they would, in fact, do that very thing...and, likely, much more is at stake.

If they simply attempt to stumble forward, like a bull in a china shop, with fractured ideas and methods without, first, addressing and fixing that problem, they are assuring continued failure of this President and their party. In fact, I'd suggest that their future as a viable governing party is at risk at this very moment and they'll be doomed to limp along forever as an infantile opposition party.

So, the time for individual political posturing and gamesmanship is over. It's time to put your constituents' livelihoods and that of your country's ahead of your own agenda, roll up your sleeves and hammer out solutions with your fellow party members and that of your leader. That's what successful societies do.

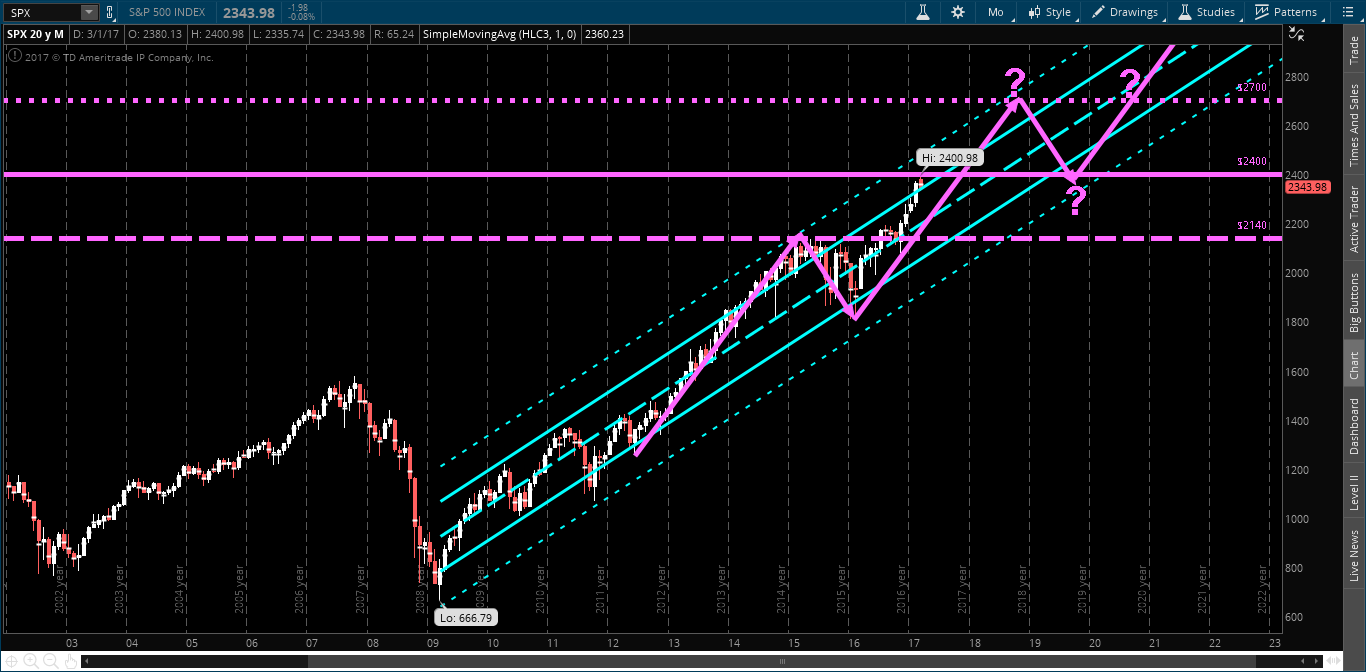

No doubt about it...markets will make their own interpretations as to how serious politicians are at coalescing and advancing this ambitious agenda. Right now, they're at a crossroads, as evidenced by the pause that the S&P 500 Index has taken this month, as shown on the following Monthly Chart of SPX.

Price is sitting just above a 161.8% external Fibonacci retracement level, after hitting a new high at 2400. A drop to the next Fibonacci level would see price hit somewhere around 2200. That would also tie into the next support level (provided by the median of a long-term uptrending channel), as shown on the next Monthly Chart of SPX.

Such a drop could be sooner rather than later, as well as swift, and, perhaps, be the jolt that makes Republicans finally sit up and take notice of how their actions (or inactions) are affecting more than just themselves. We'll see if they're willing to take that risk, or whether they can act more quickly than markets.

Finally, my post of earlier in March and update of March 19th mentioned a level of 200 as being an important "new bull market territory" level on the SPX:VIX ratio.

The following Monthly ratio chart of SPX:VIX shows that price has fallen below that level. As long as price holds below that level, we'll see an increase in volatility in the equity markets. We could see price on this ratio drop as low as 150, or lower, if the SPX does drop to 2200.

Any further setbacks for the Republican administration in the near term would, likely, compound existing political problems and contribute to such a drop.