- A company's earnings performance is a crucial factor influencing stock prices over the long-term.

- The market is anticipating several companies' earnings per share (EPS) to increase by more than 100% in 2024.

- Let's explore three such stocks poised for a significant earnings surge next year.

History shows that significant drops in Treasury bond yields are favorable for the stock market. Since 1980, there have been 33 instances where the yields on 10-Year Treasury bonds fell by 50 basis points or more in a month.

The average three-month return for the S&P 500 following such occurrences was nearly +8%, and for the Russell 2000, it was +8.2%. This suggests that the stock market is likely to continue its upward trend as we enter 2024.

Meanwhile, over 60% of stocks listed on the S&P 500 hit a new 20-day high last week. Since 1972, this has happened 15 other times, and the index surged one year later on 100% of those occasions, generating an average return of +18%.

In light of these noteworthy facts, FactSet has identified some stocks that are set to ride this potential bull market and experience a 100% surge in earnings next year.

Understanding that these are projections and may not materialize, let's take a look at three top companies set to see their earnings skyrocket.

1. Merck

Merck & Company Inc (NYSE:MRK) is the oldest pharmaceutical and chemical company in the world, having been founded in 1668.

With more than 57,000 employees in more than 60 countries worldwide, Merck is considered one of the largest pharmaceutical companies in the world.

It pays a dividend of $0.77 on January 8, and to receive it, shares must be held before December 14. The dividend yield is +2.95%.

On February 1, it presents its quarterly results. By 2024 it expects revenue growth of 5.3% and earnings per share (EPS) of 513%, i.e., to earn $8.44 per share in 2024.

Its shares are up +1.85% in the last month. The market consensus sees potential at $123.30 in 12 months.

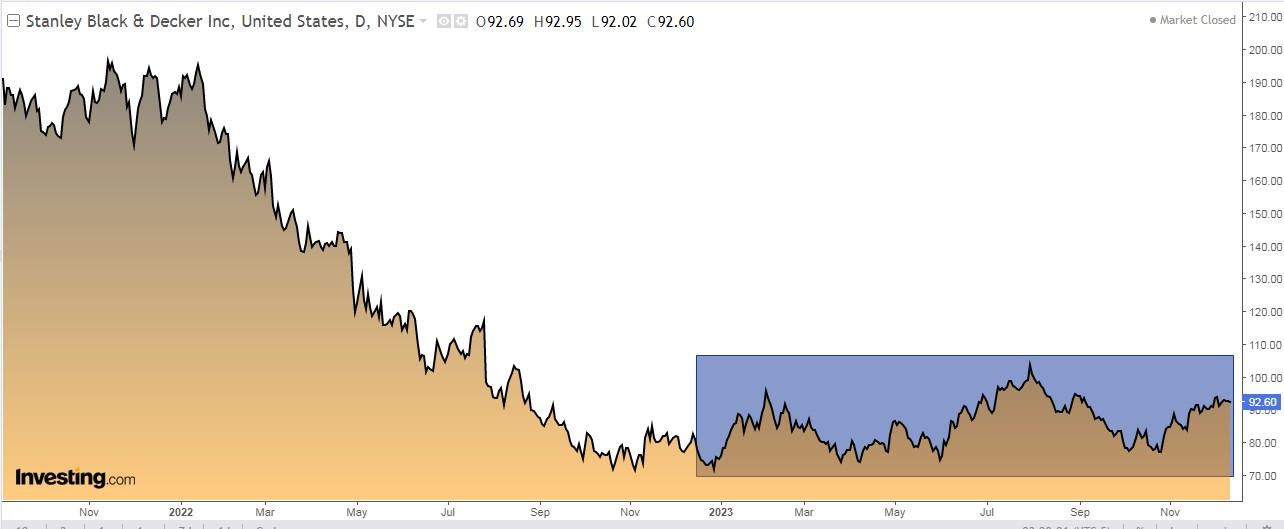

2. Stanley Black & Decker

Stanley Black & Decker (NYSE:SWK) is a manufacturer and distributor of products for do-it-yourself and gardening, as well as for commercial applications.

It was born as a result of the 1920 merger of Stanley's Bolt Manufactory and Stanley Rule and Level Company.

Its dividend yield is +3.50%.

On January 25 it presents its quarterly accounts. By 2024 it expects revenue growth of 2.3% and earnings per share (EPS) of 250%.

Its shares are up +16.10% for the year and +7% in the last three months. It has 17 ratings, of which 3 are buy, 13 are hold and 1 is sell. The market estimates a 12-month potential at $105.16.

3. Pfizer

Pfizer (NYSE:PFE) is an American pharmaceutical company that, after several mergers carried out with Pharmacia Upjohn and Parke Davis, is the world's leading laboratory in the pharmaceutical sector.

The company is headquartered in New York and was founded in 1849. Its dividend yield is +5.74%.

On January 30, it will present its quarterly accounts. For 2024 it is expected to increase revenues by 6.8% and earnings per share (EPS) by 102% to $3.16 per share.

It has not had a good year, but the market estimates its potential at $40-42.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remains with the investor.