What if I told you I’d found a way for you to bank 7%+ in cash (often paid monthly, no less) from real estate?

And no, we’re not going to send you out on the streets, pounding the pavement with your real estate agent, trooping through one disappointing house after another. And you won’t have to deal with deadbeat tenants, plugged toilets or noise complaints, either.

You’ll have just one job: collect your dividends!

One more thing: we’ll run our “one-click” property play from the safety of our brokerage account, which we can do thanks to a high-yielding investment called a real estate investment trust (REIT).

Safety, Upside and 7%+ Dividends … in One Buy

REITs pools investors’ money, then use that cash to buy (or build) a portfolio of properties that they then rent out to tenants. They then pass the vast majority (usually 90% or more) of the rental income over to us as dividends.

With just a handful of REITs, you get instant exposure to dozens, or even hundreds, of different properties, from cell towers to seniors’ homes. Plus, with REITs, you get a team of professional property managers to handle all the tenant problems for you.

Today I’m going to show you how the top experts pick the best (and safest) of these trusts. I’ll also reveal 2 closed-end funds (CEFs) that have been doing just that for years, handing their investors outsized 432%+ gains in the process.

A Bull Market of 6%+ Dividends

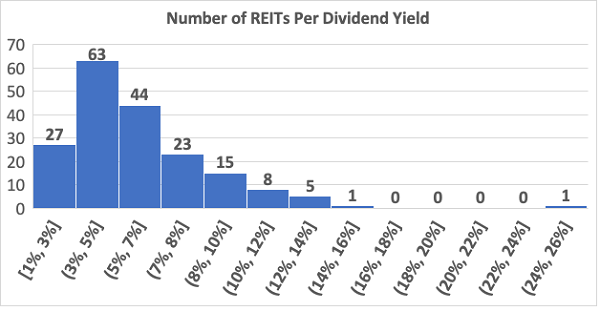

The best thing about REITs—as I hinted above—is obvious: the dividends. Yields of 6% or more are common in this space: of the 189 REITs in America with market capitalizations of $500 million or more, 62 have yields over 6%, with the average yield among all REITs being 5.5%.

Source: Author, Bloomberg, KPMG

Compare that to the skinflints of the S&P 500, whose average yield is a pathetic 1.8% today. And speaking of “regular” stocks, consider this: over the long haul, REITs crush other stocks on a total-return basis (with dividends included).

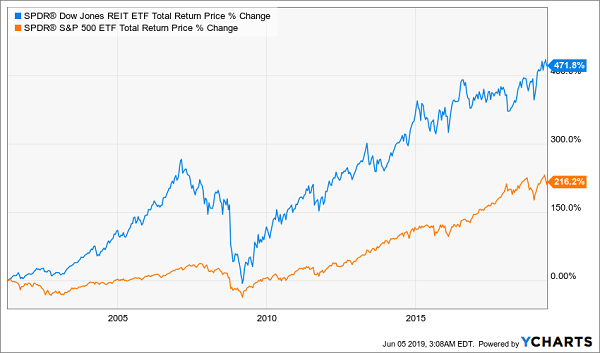

REITs Double Stocks’ Gain—and Then Some

Here you can see the REIT index fund, the SPDR Dow Jones REIT ETF (NYSE:RWR), has demolished the SPDR S&P 500 ETF (NYSE:SPY) since RWR launched in mid-2001. That means REITs beat the index even when you account for the housing-driven crash of 2008/09.

And bear in mind that RWR owners got this return just from picking the “dumb” index fund!

We can do way better when we employ a seasoned real estate professional to manage our REITs for us—and that’s where the 2 REIT funds I have for you today come in.

2 REIT-Focused CEFs With 7% Dividends Paid Monthly

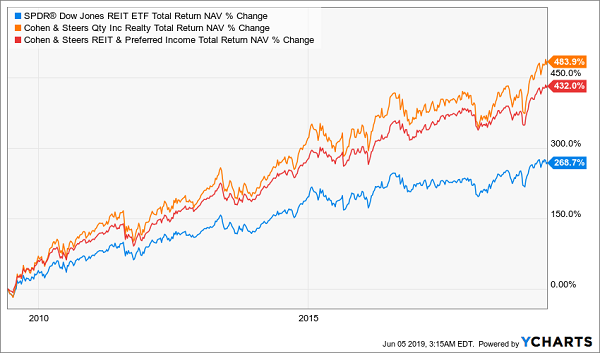

Those 2 funds would be the Cohen & Steers Quality Income Realty Fund (RQI) and Cohen & Steers REIT & Preferred Income Fund (RNP).

Never heard of them? That’s not surprising: both are closed-end funds (CEFs), another corner of the market investors often overlook in their quest for high, safe yields.

The key takeaway is that buying our REITs through a CEF gives us two distinct advantages:

- “One-click” diversification: Both RQI and RNP hold a wide range of REITs, from cell-tower owners like Crown Castle International (NYSE:CCI) to self-storage plays like Extra Space Storage (NYSE:EXR).

- Bigger dividends. As I write, both RQI and RNP yield 7.1%, far higher than the 5.5% the typical REIT pays.

And yes, both funds have demolished RWR: check out their performance over the last decade (and bear in mind that our RQI and RNP owners got more of their return in cash, thanks to these funds’ far bigger dividends).

Crushing the Index by a Mile

You could easily just sock some cash in these two funds as your REIT investment, enjoy their 7% yields and call it a day.

But if you want to discover how to pick the best individual REITs for your portfolio, let me show you how the pros who run funds like RNP and RQI do it.

3 Steps to Picking the Best REITs Now

To pick the best REITs, start by looking at their adjusted funds from operations (AFFO). That’s really just the REIT equivalent of earnings per share (EPS).

While all companies have FFO, REITs adjust this measure to account for incoming rents and maintenance costs on owned properties, making it a more accurate measurement of a real estate manager’s true earnings.

Fortunately, almost all REITs publicly disclose their AFFO every quarter. Then all you have to do is add up the AFFO for the last four quarters, as well as the dividends paid over that time. Divide the yearly payout into AFFO and you’ve got the most important metric in REITs: dividend coverage.

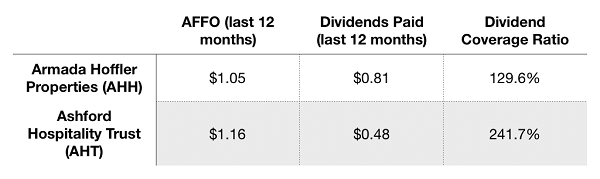

A Picture Starts to Emerge

Source: Author, Bloomberg

Above, we can see that Ashford Hospitality Trust (NYSE:AHT) boasts a dividend-coverage ratio almost twice as healthy as that of Armada Hoffler Properties (NYSE:AHH), despite the fact that AHT’s massive dividend yield, at 10.1%, is much bigger than AHH’s 5% yield.

But that’s only the first step.

Step 2: Put Debt in Perspective

Nearly all REITs use debt to fuel their growth. The key, of course, is for management to use debt prudently when buying new properties, while also freeing up cash by selling real estate that underperforms.

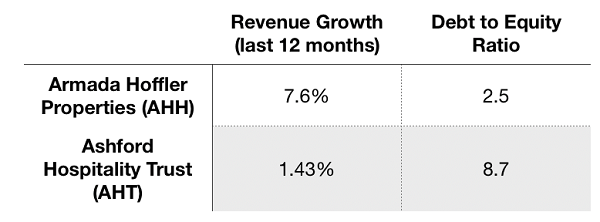

Fund managers measure this by comparing debt-to-equity ratios to revenue growth.

The idea here is simple: if revenue growth is strong, it can counteract a seemingly high debt load. If debts are low and revenue growth is still strong, then we’ve got a strong REIT with more room to expand.

Let’s look at how this plays out with AHT and AHH.

A Massive Difference Appears

Now things look really different! While AHT’s dividend-coverage ratio and yield look great, the company’s not really growing at all. But AHH’s lower dividend coverage is matched with a higher growth rate, while its debt load is over three times smaller than that of AHT.

AHT may have gotten an early start in the race, but AHH is now looking like the clear winner.

Step 3: Valuation

The last step is to see whether the market has already priced in these different factors. If you skip this step, you could simply say AHH’s fundamentals look better than those of AHT and buy that REIT. We need to go further and see if the market has already priced this in.

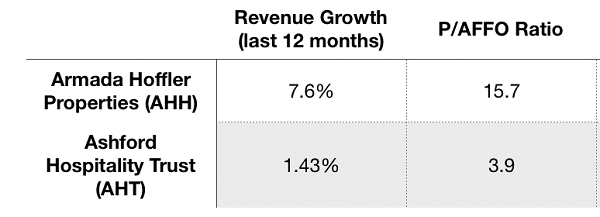

This is easily done in one step: compare revenue growth to the REIT’s price-to-AFFO ratio.

Remember, AFFO is like EPS but for REITs, so price-to-AFFO is like the P/E ratio you’d use when judging stocks. Higher-growth stocks get higher P/E ratios; lower-growth stocks get lower ones.

Let’s see how that works out with these two REITs.

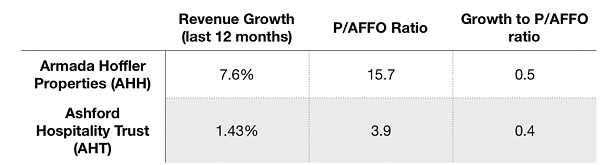

AHH’s bigger revenue growth also means it’s gotten a higher price-to-AFFO ratio, while AHT’s lower growth means it has a lower P/AFFO ratio. If we look at the relationship between revenue growth and the P/AFFO ratio, we can then see if the market has fully priced in the growth difference between AHH and AHT.

If so, both numbers would be about the same, telling us that the market has priced in AHH’s growth relative to AHT’s slower revenue growth through a higher P/AFFO ratio.

And that’s exactly what we see.

With a 0.5 and a 0.4, both AHH and AHT’s prices reflect their current growth about equally well, which means AHH is not the better buy you would assume by just looking at revenue growth on its own. In fact, both are equally attractive from this valuation standard.

Back at the start of 2019, the story was different. AHH’s revenue growth and AFFO metrics were pretty much the same as they are now, but its P/AFFO ratio was much lower, which would have suggested AHH was a better buy. That’s why AHH shareholders have had a 20% total return since the start of 2019, above the index’s 17.2% and better than AHT’s 14.8% over the same period.

NEW: My Top REIT Buy for Fast 28% Gains (and 8% dividends)

If you’re looking to boost your income stream (and who isn’t?), you really should look at my top pick in REITs now.

It’s totally different than AHH and AHT. In fact, it’s not an individual REIT at all.

It’s a REIT-focused CEF, so it’s along the lines of the two funds I mentioned earlier, but it has one critical difference—especially if you’re looking to your portfolio for income.

And that is this: my No. 1 REIT pick now pays an even bigger dividend. I’m talking a reliable 8% here.

Here’s the best news: with most high-yield stocks, you have to give up a significant amount of price gains in order to get a high dividend. It’s the “deal with the devil” every income investor must live with.

But you can forget about that with this fund. Check out the huge 73% return it’s handed shareholders since it launched in 2012!

Top REIT Pick Dials Up a Huge Gain

How does my pick do it?

By investing in one of the fastest-growing megatrends of our time: the need for more—and better—infrastructure.

A $94-Trillion Megatrend

When you consider that, according to Oxford Economics, $94 trillion will need to be spent on global infrastructure by 2040, you can get a glimpse of the size of the opportunity here.

And that’s far from the only reason why this fund tops my list.

Because the team at the top has carefully calibrated its top holdings to focus on the infrastructure that will be in the highest demand as the 21st century continues to unfold.

Top holdings include senior-care-center operator Ventas (NYSE:VTR)—which sits right in the tracks of the aging-boomer trend; warehouse play STAG Industrial (NYSE:STAG)—a clear winner from the explosion of online shopping; and utilities like WEC Energy (NYSE:WEC), a renewable-energy leader.

And now is a terrific time to buy, because this fund trades at a big discount from its “true” value. That discount comes from the gap between this CEF’s market price and the current value of all the holdings in its portfolio—a figure called the discount to NAV.

And as you can see, this stout 8%-payer trades at a ridiculous 12% discount to NAV:

A Bargain on Borrowed Time

That’s despite this fund’s outsized dividend, strong performance and class-leading management team!

But as you can see above, that markdown has already started to narrow, pulling my pick’s market price higher as it does. So if you want to grab the biggest upside, you need to act fast!

Don’t miss your chance to get the name of this retirement game-changer, along with my 3 other top CEF picks to buy now (average combined yield: 8.7%).

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."