Japan has now registered two consecutive quarters of economic contraction – a persistent absence of growth that defines most recessions. For worse or for better, the world’s third largest economy will simply commit additional electronic money printing resources to acquire more Japanese stock and bond assets. This activity weakens the yen which, in turn, emboldens carry trading institutions to ratchet up the borrowing of the depreciating currency to invest more in the U.S. stock market. As one popular financial blogger joked yesterday evening, “By the laws of QE, U.S. stocks will hit record highs on Monday.”

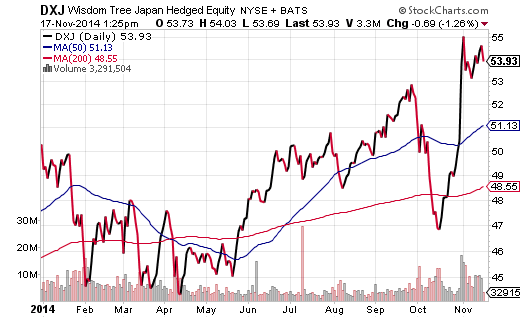

Whereas the Federal Reserve may or may not have been particularly successful at helping the U.S. economy (former Chairman Greenspan recently expressed that the central bank of the U.S. failed in this regard), at least the U.S. economy is actually expanding. In contrast, neither the Bank of Japan nor the European Central Bank (ECB) have been particularly successful at improving the gross domestic output of their respective regions. Ominous? Perhaps. Yet it’s not as if investors in Japan are throwing in the towel; WisdomTree Japan Hedged Equity (DXJ) is still near a 52-week peak.

The October spike that sent WisdomTree Japan Total Dividend (NYSE:DXJ) surging through the roof of the chart came on the announcement that Japan would expand its asset purchasing program. That was a surprise at the time. Looking back, however, it would appear that policy makers had an idea of the recessionary data coming down the pike.

On the other hand, one may want to look around the edges for investment ideas less tethered to the next central bank announcement. For example, it is genuinely assumed that the U.S. is the single bright spot in the world’s weakening economy. Moreover, as other areas of the world are trending toward additional asset purchases, the U.S. is maintaining an ultra-accommodating zero percent rate stance, but no longer acquiring government debt. So the dollar can only get stronger, and commodities can only get weaker, right?

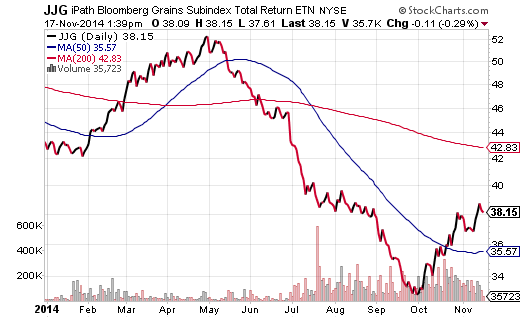

Maybe not. Earlier in the year, the conflict between Russia and Ukraine sent the price of wheat as well as oil higher. Then the conflict cooled. The stronger dollar as well as region-wide deflation slammed oil and grains to multi-year lows. Until now. Russia’s reliance on oil revenue means that it may not have the luxury of agreeing to a resolution in the region. Wheat and other grains have already bounced off those multi-year floors breaking above an intermediate-term 50-day trendline for the first time since May.

How might I play Russia aggression in Ukraine? How might I hedge against conventional wisdom that ongoing deflation in food prices is a certainty? I would consider picking up shares of the iPath DJ-UBS Grains Subindex TR (NYSE:JJG) with its near-term technical uptrend. I would also minimize downside risk with a stop-limit loss order.

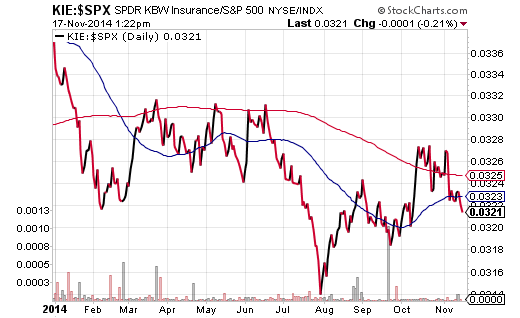

Investing in Japan with the country’s endless loop of failure seems nuts, of course. The same holds true for buying an inflationary asset like grains in the midst of global deflation. Here, then, is a seemingly crazy idea – one based on the notion that fundamental value may once again matter.The SPDR KBW Insurance (NYSE:KIE) has been decidedly weak relative to the S&P 500 throughout the year. Moreover, judging by the KIE:S&P 500 price ratio, there may be little reason to look favorably upon big insurers like Travelers (NYSE:TRV), Chubb (NYSE:CB) or Allstate (NYSE:ALL).

Still, what if you have patience as well as a long-term time horizon? Might the mouthwatering price-to-book of 1.0 and highly reasonable price-to-earnings of 11.5 give you pause? Putting these numbers into perspective, the S&P 500’s trailing 12-month P/E equivalent of 18.7 implies that one would be paying nearly 40% less for the privilege of owning the big insurers as opposed to the broader market. Granted, it may not be a fair comparison, since investors will always pay more for growth-oriented segments like technology and industrials. Still, a 40% relative price discount?

Disclaimer: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.