Wall Street's third quarter earnings season kicked off this week, with banking giant JPMorgan Chase (NYSE:JPM) leading the reporting print today, soon to be followed by Bank of America (NYSE:BAC), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), Goldman Sachs (NYSE:GS), and Morgan Stanley (NYSE:MS), all reporting their latest financial results in the days to come.

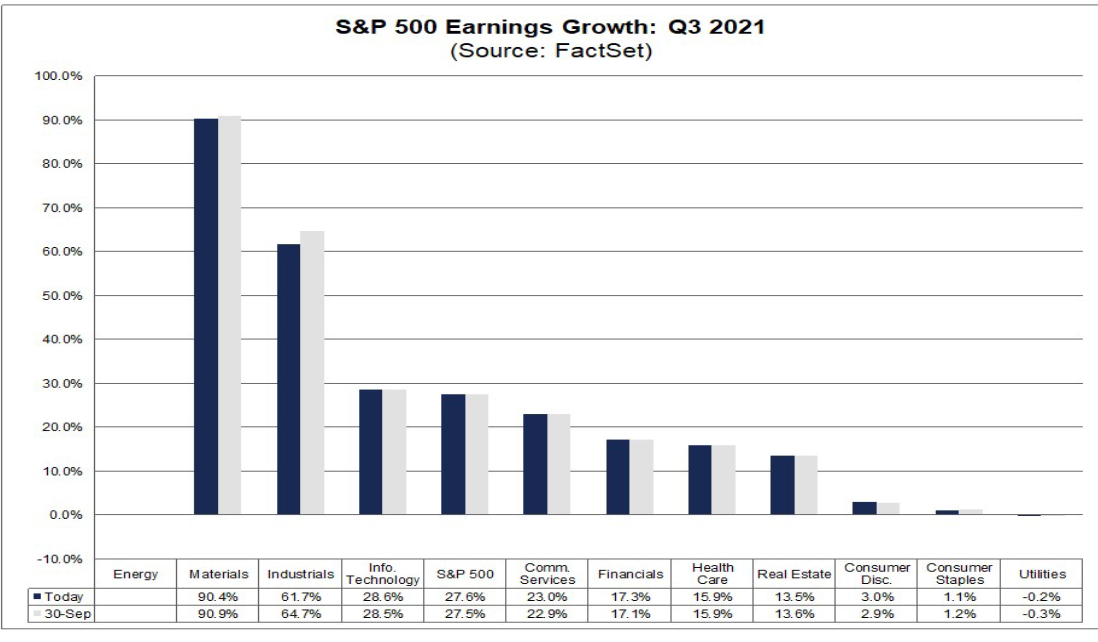

FactSet data shows analysts anticipate Q3 S&P 500 earnings will climb by 27.6% when compared to the same period last year, mainly due to the receding impact of the COVID-19 pandemic on several industries. If confirmed, Q3 2021 would mark the third highest year-over-year (YoY) growth in earnings reported by the index since Q3 2010, when profit growth increased by 34.0%.

At the sector level, ten of the 11 sectors are projected to report YoY earnings growth, led by the Energy, Materials, Industrials, and Information Technology sectors.

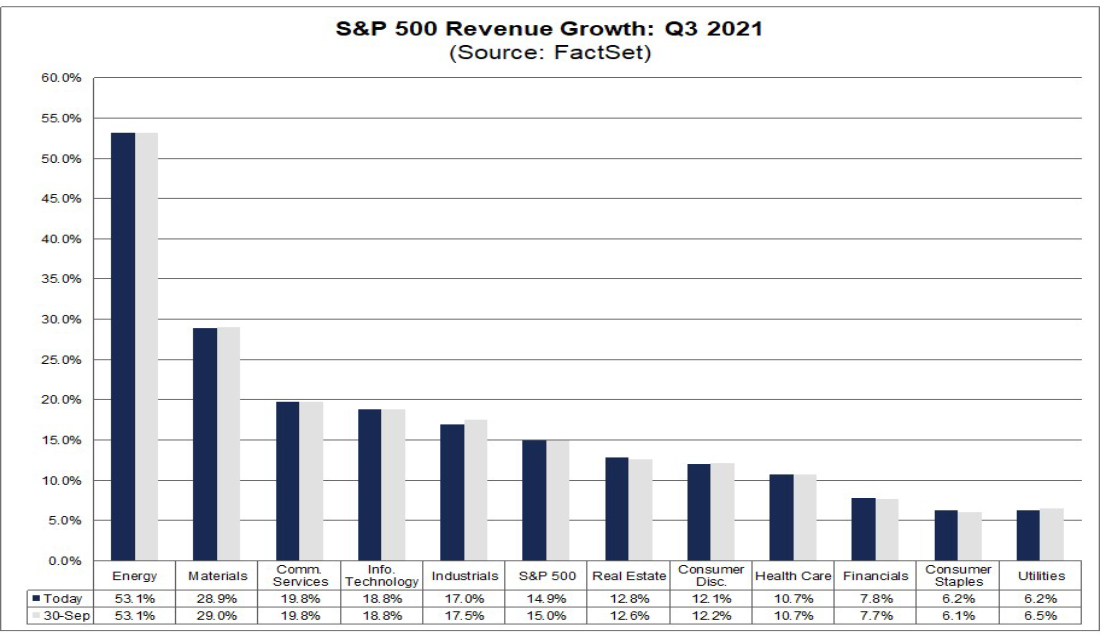

Revenue expectations are also promising, with sales growth expected to rise 14.9% from the same period a year earlier. If confirmed, it will mark the second highest YoY revenue growth reported by the index since FactSet began tracking this metric in 2008. The current record is 25.3%, which occurred in Q2 2021.

All 11 sectors are anticipated to report YoY revenue growth, led by the Energy, and Materials sectors.

Below we break down three select sectors whose financial results are projected to show significant rise from the year-ago period amid the current market conditions.

1. Energy: Soaring Oil Prices Set to Boost Results

- Projected Q3 Revenue Growth: +53.1% YoY

The Energy sector is forecast to report earnings of $20.5 billion for the third quarter, a substantial improvement from a loss of $1.5 billion in the challenging year-ago period, when the COVID-19 health crisis kicked into high gear and the economy shut down.

With higher oil prices benefitting the sector—the average price of WTI crude in Q3 2021 was $70.52 per barrel, 72% above the average price of $40.92 in Q3 2020—it is projected to record the highest YoY increase in revenue of all 11 sectors at 53.1%, according to FactSet.

At the company level, ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX) are expected to be the largest contributors to the YoY spike in earnings for the sector. Combined, the two oil majors account for $10.9 billion of the projected $22.0 billion increase in earnings for the sector.

Two of the other notable names set to enjoy significant improvements in their Q3 financial results are Occidental Petroleum (NYSE:OXY), which is projected to post EPS of $0.58, compared to a loss of $0.84 per share in the year-ago period, and Diamondback Energy (NASDAQ:FANG), which is anticipated to record a 330% YoY increase in EPS.

The Energy Select Sector SPDR® Fund (NYSE:XLE), which tracks a market-cap-weighted index of U.S. energy companies in the S&P 500, is up 48.8% year-to-date, compared to the S&P 500’s 15.8% gain over the same timeframe.

In addition to Exxon and Chevron, some of XLE’s largest holdings include ConocoPhillips (NYSE:COP), EOG Resources (NYSE:EOG), Schlumberger (NYSE:SLB), Marathon Petroleum (NYSE:MPC), Pioneer Natural Resources (NYSE:PXD), Phillips 66 (NYSE:PSX), Kinder Morgan (NYSE:KMI), and Williams Companies (NYSE:WMB).

2. Materials: Metals & Mining Rally Set to Power Profit, Sales Growth

- Projected Q3 EPS Growth: +90.4% YoY

- Projected Q3 Revenue Growth: +28.9% YoY

The Materials sector is predicted to print the largest YoY earnings jump of all 11 sectors, with third quarter EPS anticipated to surge roughly 90% from the turbulent year-ago period, according to FactSet.

With stronger metals prices, e.g., copper, nickel, platinum, palladium, and gold helping the sector, it is also expected to report the second biggest YoY rise in revenue, with sales forecast to grow almost 29%.

Not surprisingly, three of the four industries in the sector are predicted to report robust Q3 EPS and revenue growth, with the Metals & Mining group set to see profit and sales spike 200% and 65% respectively from the year-ago period.

For the Materials sector, we have the Materials Select Sector SPDR® Fund (NYSE:XLB), which tracks a market-cap-weighted index of U.S. basic materials companies in the S&P 500. XLB is up 12.3% in 2021.

XLB’s ten largest stock holdings include Linde (NYSE:LIN), Sherwin-Williams (NYSE:SHW), Air Products & Chemicals (NYSE:APD), Freeport-McMoran (NYSE:FCX), Ecolab (NYSE:ECL), Newmont Mining (NYSE:NEM), DuPont de Nemours (NYSE:DD), Dow (NYSE:DOW), PPG Industries (NYSE:PPG), and International Flavors & Fragrances (NYSE:IFF).

Two companies from the group stand out for their potential to record impressive results. The first is Nucor (NYSE:NUE), which is expected to report earnings per share of $6.81, up nearly 1,000% from EPS of $0.63 in the year-ago period. The second is Mosaic (NYSE:MOS), which is projected to post EPS of $1.57, improving 580% from EPS of $0.23 in the same period a year earlier.

3. Industrials: Airlines, Machinery Expected to Lead YoY Growth

- Projected Q3 EPS Growth: +61.7% YoY

- Projected Q3 Revenue Growth: +17.0% YoY

The Industrials sector—which was amongst the hardest hit by the COVID-related shutdowns this time last year—is expected to report the second biggest YoY gain in earnings of all 11 sectors, with an impressive 61.7% surge in Q3 EPS, according to FactSet.

In fact, all 12 industries in the sector are pegged to report a YoY boom in earnings, led by the Airlines and Machinery groups, which are viewed to see their collective profits jump 86% and 25% respectively from a year ago.

The sector—which is perhaps the most sensitive to economic conditions—is also anticipated to report the fifth largest YoY revenue growth, with Q3 sales set to rise 17.0%.

At the company level, General Electric (NYSE:GE) and United Airlines Holdings Inc (NASDAQ:UAL) are two to watch. GE is forecast to post Q3 EPS of $0.45, an increase of 650% from EPS of $0.06 last year, while United is expected to report revenue of $7.63 billion, up about 200% from sales of $2.49 billion in Q3 2020.

The ETF that tracks the market-cap-weighted index of industrial sector stocks drawn from the S&P 500—the Industrial Select Sector SPDR® Fund (NYSE:XLI)—is up 12.7% since the start of the year.

XLI’s top ten holdings include Honeywell International (NASDAQ:HON), United Parcel Service (NYSE:UPS), Union Pacific (NYSE:UNP), Boeing (NYSE:BA), Raytheon Technologies (NYSE:RTX), Caterpillar (NYSE:CAT), General Electric, 3M Company (NYSE:MMM), Deere (NYSE:DE), and Lockheed Martin (NYSE:LMT).