When it comes to investing, too many folks ignore the signal and listen to the noise.

Case in point: one of the biggest stories of 2018—a looming trade war between America and China. Lately, the story has mutated into one about a trade war between America and, well, just about everyone—Europe, Asia, Mexico, even Canada!

But this trade war is noise—2018 has been a great year for stocks, and it’s going to get even better. Further on, I’ll give you a couple great ways to cash in.

First, a look at the facts, which are plain for everyone to see … and they clearly prove the naysayers wrong. You only have to look as far as corporate earnings.

American Businesses Are Booming

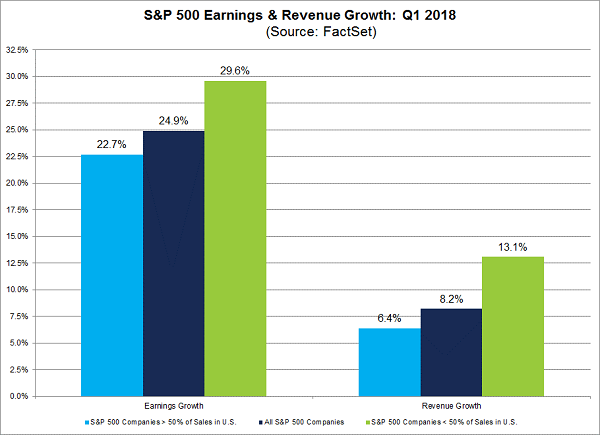

In the first quarter, profits soared a shocking 24.9% and went even higher for companies selling outside the US. At the same time, exporters saw 13.1% sales growth, while all S&P 500 companies’ sales were up 8.2%.

So all great news, right?

Funny thing is, while this news was trickling out, the stock market did this:

Mr. Market Takes a Nap—and Gives Us Our Shot

While the data told us companies’ stocks should be soaring, they were grounded—and the early-year correction held on, even as the data got better. More recently, stocks have been rebounding, as investors finally noticed 3 locked-in trends driving the market higher.

#1: Fatter Profits, Higher Stocks (it’s inevitable)

Second-quarter earnings look strong, with 19% gains expected. And that trend of exporting companies outperforming importing ones is still there (net exporters are expected to see 23.9% earnings increases), again proving the trade-war hysteria wrong.

And I know I don’t have to tell you that where profits go, stock prices follow.

Here’s yet another reason why now is a great time to get in: because of this breakneck earnings growth, the S&P 500’s forward 12-month P/E ratio is 16.6, lower than the long-term average of about 17. But most folks miss the fact that since the S&P 500 is dominated by tech companies that didn’t exist decades ago, and since tech firms tend to have higher P/E ratios, that 16.6 level is even lower than it looks.

#2: Sales—the Key to Rising Profits—Are Heating Up

If a company is growing earnings while revenue slides, it’s probably cutting costs and not investing in itself. But if revenue is rising, obviously the market wants more of its product, and that’s never bad.

And revenue growth is going up. In the first quarter, sales rose 8.2% for the S&P 500, and they’re expected to rise 8.7% in Q2. Simply put: it’s getting easier for businesses to grow, and who wouldn’t want to invest in that kind of market?

#3: No Bubbles in Sight

What’s more, there’s nothing in the economy (with the exception of Bitcoin and cryptocurrencies, which I warned about at the start of 2018) that looks like a bubble.

Corporate-debt levels are modest; default rates have been falling since the end of 2015 (even though this is when the Federal Reserve started raising interest rates); housing-price growth keeps moderating; and other indicators (consumer-debt ratios, inflation, unemployment) look strong.

In short, despite the immature politics and hysterical panic we read about every day, Americans and companies are managing their financial lives in a mature, healthy and sustainable way. And that’s great for the market.

What To Buy Now

Because of these strong (and not yet priced in) tailwinds, now is the time to buy. You’ll likely see gains over the long term with a passive fund of stocks, like the SPDR S&P 500 ETF (NYSE:SPY).

That’s all well and good, but you’ll be far better off with a closed-end fund (CEF) like the Nuveen Tax-Advantaged Total Return Fund (NYSE:JTA) with its 8.2% yield, or the Eaton Vance Tax Managed Diversified Equity Fund (NYSE:ETY), with its 8.1% yield.

(If you’re not familiar with CEFs, don’t worry; they have a lot in common with garden-variety mutual funds. I wrote a quick, easy-to-read primer on CEFs you can check out by clicking here.)

Between them, JTA and ETY have matched the S&P 500’s return over the last year (which isn’t too surprising, since they invest in the same companies), but thanks to their much higher dividend yields (over 4 times as much as SPY’s 1.8%), a huge part of that return was in cash! And that, of course, is far safer than the here-today-gone-tomorrow “paper gains” SPY holders get.

My 4 Best Buys for Massive Cash Dividends and Fast 20% Upside

Why just match the market when you can crush it—and pick up the same incredible dividend yields JTA and ETY offer while you do?

Suffice it to say, that practically locks us in for monstrous upside in the next 12 months—I’m talking 20% as a very conservative baseline.

And that’s just the beginning!

You see, these 4 under-the-radar CEFs also throw off 7.6% dividends, on average … and that’s just the average. The highest-yielder of the bunch drops a rock-steady 8.1% into your pocket—year in and year out—while still handing you that incredible 20% upside I just told you about.

These 4 funds are catnip for your income portfolio, and the fact that they’re also spring-loaded for big price gains is an incredible bonus.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."