Tim Cook is stealing the day with his new fangled products and slick presentations. Everyone is paying attention. But if you can turn your head away for a minute, just a glance, not that long, there are some stocks other than Apple (NASDAQ:AAPL) that are primed to move higher. And frankly if you do not already own Apple what are you waiting for?

One that caught my eye this weekend was Best Buy Co Inc (NYSE:BBY). This stock was left for dead as a big box retailer. But the chart says you should be buying it very soon.

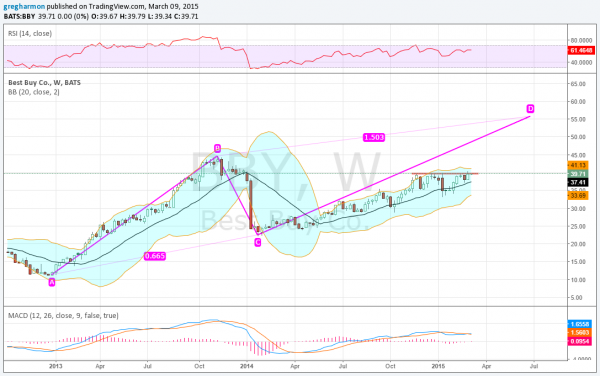

The chart above shows the stock in a AB=CD pattern. This pattern looks for the AB leg to be repeated in the CD leg in price and time. It tends to work a lot better in the price dimension though. It suggests that the full move higher off of the January low will be at about 56. That means that the the current consolidation under 40 as resistance would need to continue higher. And the SMA’s are trending that way, with a bullish momentum indicator, RSI. The MACD, another momentum view, is running flat in the consolidation but just crossed the right way.

You will notice that in the two uptrends the 20 week (can substitute 100 day) SMA has been a determinant of trend. If the price is above the 20 week SMA then it is rising and below it falling. This gives a natural area to use as a stop loss.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.