Salisbury Bancorp, Inc. (NASDAQ:SAL) seems to be an attractive pick now on the back of its top-line strength and improving operating backdrop.

The company’s inorganic growth initiatives reflect its capital strength. In June 2017, Salisbury Bank and Trust Company, the wholly owned bank subsidiary of Salisbury Bancorp, completed the acquisition of the New Paltz, the New York branch of Empire State Bank.

These factors, along with its other activities, have been successful in gaining analysts’ confidence, as reflected by 2.4% upward revision in the Zacks Consensus Estimate for current-year earnings, over the past 30 days. Thus, the company carries a Zacks Rank #2 (Buy).

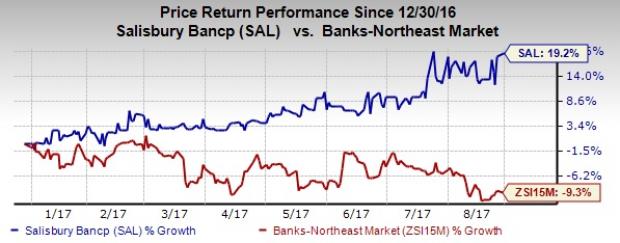

Also, shares of Salisbury Bancorp have gained 19.2% year to date versus the industry’s decline of 9.3%.

Factors that Make Salisbury Bancorp an Attractive Pick Now

Earnings Growth: Salisbury Bancorp’s recorded an earnings growth rate of 4.8% over the last three to five years. This momentum is likely to continue, as reflected by the company’s projected earnings per share growth of 5.8% and 8.6% for 2017 and 2018, respectively.

Also, the company recorded a positive earnings surprise of 15.5% in the last reported quarter.

Revenue Growth: Organic growth remains strong at Salisbury Bancorp. Revenues witnessed a compound annual growth rate of 8.8% over the last five years (2012-2016). Further, the company’s projected sales growth (F1/F0) of 6.5% highlights consistent upward momentum in revenues.

Stock Seems Undervalued: Salisbury Bancorp has a P/B ratio of 1.28 compared with the industry average of 1.41. Based on this ratio, the stock seems undervalued.

Other Stocks to Consider

Eagle Bancorp, Inc.’s (NASDAQ:EGBN) Zacks Consensus Estimate for current-year earnings was revised 3.5% upward for 2017, in the past 60 days. Also, its share price has increased 19.8% in the past 12 months. The stock carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Washington Federal, Inc. (NASDAQ:WAFD) currently carries a Zacks Rank #2. The stock’s current-year earnings estimates were revised slightly upward, over the past 60 days. Further, the company’s shares have jumped 18.3% in a year’s time.

FB Financial Corporation’s (NYSE:FBK) Zacks Consensus Estimate for current-year earnings was revised 3.2% upward, over the last 30 days. Moreover, in the past year, its shares have gained 67.1%. Also, it carries a Zacks Rank #2.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Eagle Bancorp, Inc. (EGBN): Free Stock Analysis Report

Washington Federal, Inc. (WAFD): Free Stock Analysis Report

FB Financial Corporation (FBK): Free Stock Analysis Report

Salisbury Bancorp, Inc. (SAL): Free Stock Analysis Report

Original post