Fresh numbers on industrial activity are the main event for today’s macro updates, including the December reports for France and the UK. Meanwhile, US Federal Reserve Chair Janet Yellen is scheduled to speak to Congress today at a time when the Treasury market’s inflation forecast via 10-year maturities has tumbled to seven-year lows.

Rising concern about disinflation/deflation is high on the agenda as Janet Yellen arrives on Capitol Hill.

France: Industrial Production (0745 GMT) Industrial output in Europe’s biggest economy fell sharply in December, delivering a hefty downside surprise. Will France follow Germany’s lead in today’s update on industrial activity for the Eurozone’s number-two economy?

Perhaps not. Analysts are currently looking for a slight rise in output for the monthly change in France’s industrial sector, based on Econoday.com’s consensus forecast. But that’s not enough to keep the year-over-year comparison from easing to a projected 1.8% advance from 2.8% in the previous update.

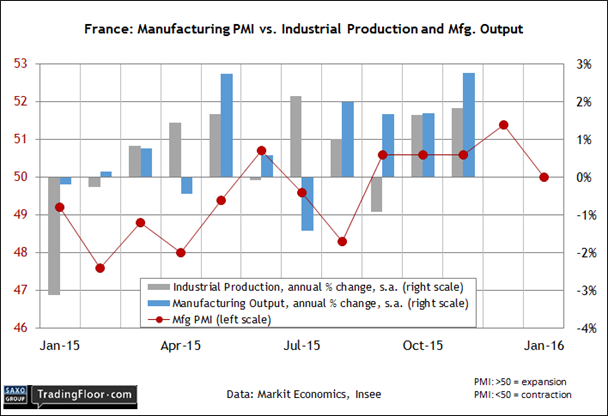

Meanwhile, the latest survey numbers for manufacturing in France hint at weaker comparisons ahead for the hard data. After posting a relatively strong reading in December, the purchasing managers’ index for manufacturing slumped to a neutral reading last month. “French manufacturing growth ground to a halt at the start of 2016, ending a run of modest expansion seen towards the end of 2015,” a Markit economist noted last week.

If today’s numbers for industrial output turn out to be even weaker than expected, the downside surprise will add another layer of concern that Europe’s recovery is faltering. Now-casting.com last Friday downgraded its weekly projection for first-quarter euro area GDP growth to 0.37%. That’s still in line with last year’s third-quarter pace and a fraction above expectations for fourth quarter’s flash GDP report due this Friday.

But in the current climate, with stumbling stock markets and plunging interest rates, another big miss for industrial activity in the Eurozone will heighten fears that the recovery is fading in 2016.

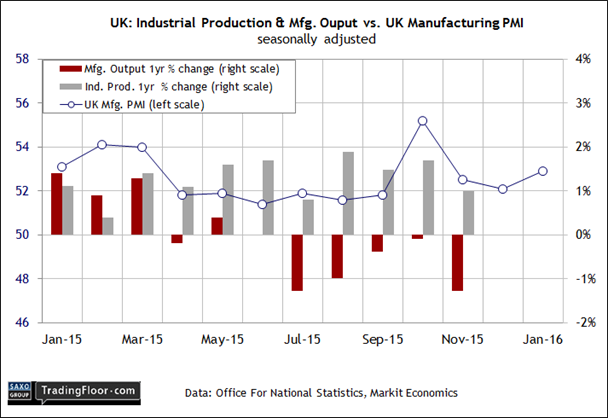

UK: Industrial Production (0930 GMT) In contrast with recent numbers for the Eurozone, industrial output in the UK at the headline level is holding steady at a moderate growth rate for the year-over-year trend. The hard data for the manufacturing component suggests otherwise, but the prospects for firmer numbers ahead looks like a reasonable bet, based on the sentiment data via Markit’s purchasing managers’ index.

Indeed, Markit reported last week that manufacturing output accelerated in January as the UK Manufacturing PMI ticked up to a three-month high of 52.9. That’s well below the recent high set back in October, but it’s comfortably above the neutral 50 mark.

It doesn’t hurt to see that the broad macro trend in Britain has been held steady at a respectable 0.6% growth rate for the three months through December, based on data from the National Institute of Economic and Social Research (NIESR), a consultancy in London. (Keep in mind that NIESR’s monthly GDP estimate is scheduled for an update today at 1500 GMT.)

The UK, in short, still shows a healthy footprint from a macro perspective. The question is whether the upbeat assessment will survive today’s release?

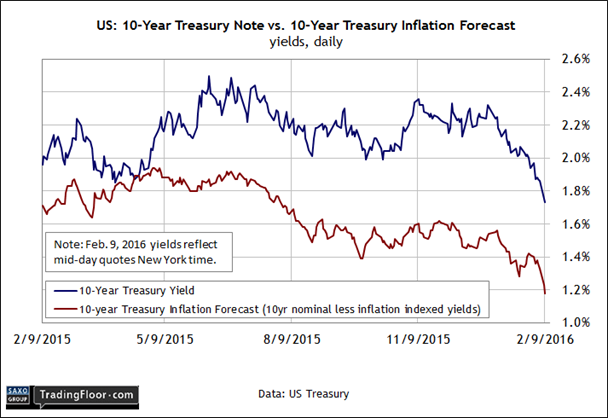

US: Treasury-Market Inflation Forecast The recent surge in market volatility, combined with wobbly economic data, are sure to be front and centre today when Fed Chair Janet Yellen speaks with the House Financial Services Committee, starting at 1500 GMT. Meanwhile, keep your eye on the 10-Year Treasury market’s inflation forecast, which has tumbled recently, plumbing the lowest levels since the Great Recession was roiling the macro landscape in early 2009.

Rising concern about disinflation/deflation, in other words, is high on the agenda as Yellen arrives on Capitol Hill today. The yield spread for the nominal 10-Year note less its inflation-indexed counterpart dipped below 1.20 in midday trading on Tuesday — a seven-year low. The slide is one of several factors that raise new questions about the wisdom of the Fed’s 25-basis-point rate hike in December — the first round of monetary tightening since 2006.

Mohamed El-Erian, chief economic adviser at financial services firm Allianz (DE:ALVG), wrote on Tuesday that Yellen should address deflation risk today — is it now a key risk for the US economy? “The possibility of higher wage growth suggests an upward trend for inflation,” he noted yesterday. “But there also are forces pushing in the other direction, including the further fall in oil prices over the last few months, which has added to the deflationary trends in Europe in particular.”

The Treasury market is inclined to see D risk on the rise. What does that mean for Fed policy going forward? For the immediate future the crowd’s betting that there’s close to zero possibility for a rate hike at next month’s policy meeting, based on CME data.

Is that a temporary affair or an early signal that the Fed will be forced to reverse its mildly hawkish plans until further notice? All eyes and ears will directed at Yellen today in search of an answer.

Disclosure: Originally published at Saxo Bank TradingFloor.com