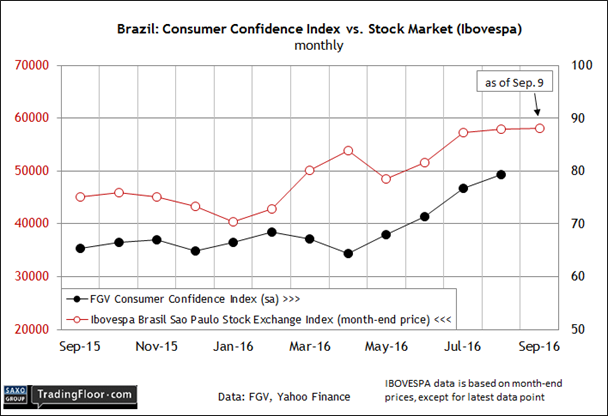

- Will Brazil’s stock market continue to price in expectations for a rebound?

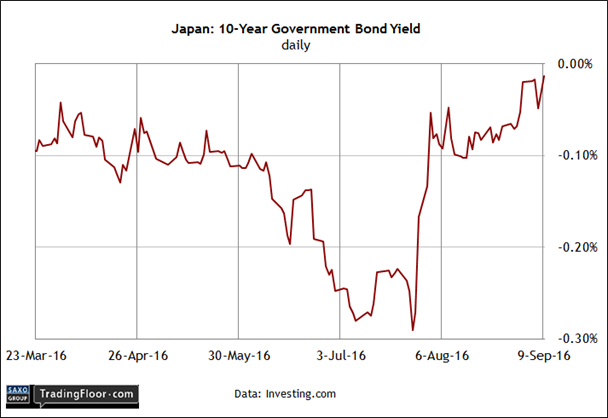

- Japan’s 10-year yield may rise above zero for the first time since February

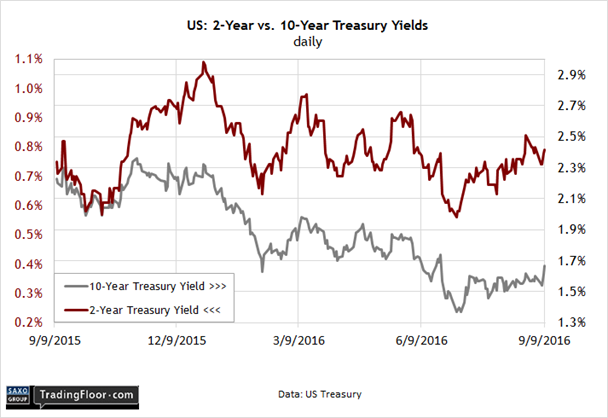

- The 2-year Treasury yield in sight as focus returns to tighter monetary policy

It’s a slow day for scheduled economic reports, but new questions about the outlook for interest rates and economic activity will keep the crowd focused on key market signals this week. Three that deserve close attention: Brazil’s stock market, Japan’s 10-year yield, and the US Treasury’s 2-year yield.

Brazil: Ibovespa Stock Index: Friday’s swoon in global equity prices took some of the wind out of Brazil’s equity market, but stocks continue to anticipate that a recovery is in the works for Brazil’s battered economy.

Although the country is still mired in a nasty recession, sentiment has been trending positive for much of 2016. The latest boost for keeping hope alive is the resolution of the political crisis that's been paralysing the government. But with the recent removal of the president, Dilma Rousseff, her successor has been sworn in and he’s expected to provide some relief by focusing on reviving growth.

It’s a tall order, but for the moment there’s enough goodwill to maintain a positive bias on the outlook. Consumer sentiment, for instance, has increased for four months in a row through August, effectively confirming the stock market’s prediction that the future looks a bit brighter relative to recent history. “Approximately 90% of the increased consumer confidence in the last four months was determined by improved expectations,” said a spokesperson for FGV IBRE, a consultancy that publishes the sentiment data.

But in a sign that a recovery still faces challenges, PMI survey data for Brazil’s manufacturing and services sectors ticked lower in August after several months of firming up, albeit by posting lesser degrees of contraction. “August saw no end to the problems affecting the Brazilian manufacturing industry as the economic crisis continued to restrict demand,” a Markit economist advised earlier this month. A similar story weighs on the services sector.

Brazil’s stock market, however, is still trending higher, if only slightly. Despite Friday’s tumble, the Ibovespa remains well above its 50 and 200-day moving averages.

The uptrend suggests that the optimism still has a firm grip on the crowd. Expectations have probably run ahead of reality and a period of backfilling may be coming.

But as long as the Ibovespa holds above its 50 and 200-day averages, there’s still a reasonable case for thinking that the economy will continue to move in the right direction, albeit slowly and in fits and starts.

A stress test, however, may be in store for the week ahead in the wake of Friday’s tumble in stocks generally. “The market believed that authorities everywhere would do almost anything to support [economic] activity, and that doesn’t seem so true now,” said an analyst at the brokerage Elite Corretora in Rio de Janeiro. “Assets are now adjusting to a tougher reality.”

Japan: 10-Year Yield: DoubleLine Capital Chief Investment Officer Jeffrey Gundlach thinks it’s finally time to prepare for higher interest rates.

“Interest rates have bottomed,” he told Bloomberg last Thursday. “They may not rise in the near term as I’ve talked about for years. But I think it’s the beginning of something and you’re supposed to be defensive.”

The market took the hint on Friday, with yields jumping around the world. The rise includes the Japanese 10-year yield, which is inching closer to zero at last week’s close. If this global bellwether crosses into positive territory in the days ahead, the shift will mark the first time since February that Japan’s benchmark bond was priced to deliver an actual interest payment.

The higher yield follows news last week that the Bank of Japan is running out of government bonds to buy to finance its quantitative easing program. The scarcity highlights the limits that central banks overall are facing in the business of providing more stimulus via monetary policy. Meanwhile, the news was a factor for renewed bond selling late last week, which boosted yields.

Another catalyst for rethinking the outlook for fixed-income assets overall was last Thursday’s decision by the European Central Bank to forgo an extension of its existing asset-buying program.

The question is whether the selling is just a round of temporary disappointment or the perception that central banking has reached its limits for juicing growth and firming up inflation? If the Japanese 10-year yield moves decisively into positive territory in the days ahead, Gundlach’s analysis that tighter policy is coming, intentional or otherwise, will continue to resonate.

US: 2-Year Yield: Friday’s hefty tumble in US stocks was all about fears of a rate hike, according to most press accounts. Yet for all the light and heat about what the Federal Reserve may or may not do at next week’s monetary policy meeting, the most sensitive slice of the yield curve’s rise at last week’s close was surprisingly muted.

The 2-year yield inched higher, closing at 0.79% on Friday, just four basis points above where this closely followed rate began the trading week. In other words, this rate remains more or less a middling yield vs. the range we’ve seen this summer, based on daily numbers from Treasury.gov. What, then, were equity investors so worried about? The Boston Fed’s Eric Rosengren probably factored into the mix:

“My personal view, based on economic data that we have received to date, is that a reasonable case can be made for continuing to pursue a gradual normalisation of monetary policy,” he said in speech on Friday. “I expect some continuing drag from foreign activity,” he added. “But underlying domestic strength is likely to be sufficient to engender continued improvement.”

With the Fed’s monetary policy meeting scheduled for next week, Rosengren’s comments were widely interpreted as a clue for thinking that a rate hike is still possible when the Federal Open market Committee statement hits the streets on September 21. Possible, but still open for debate.

Fed fund futures are still projecting a rate hike next week as unlikely. CME data, as of September 9, tells us that there’s a 24% probability for raising the current 0.25%-to-0.50% Fed funds range.

But keep your eye on the 2-year yield for a delayed reaction to the revived focus on tighter monetary policy. “There is room for a robust discussion,” said Fed Governor Daniel Tarullo on Friday.

The question is whether the Treasury market will lean one way or the other in the “discussion” this week?

Disclosure: Originally published at Saxo Bank TradingFloor.com