- Will Brazil’s Manufacturing PMI for July hint at a recovery for this battered economy?

- US construction spending expected to bounce after two monthly declines

- The US ISM Manufacturing Index is on track to hold at a 17-month high for July

The new trading week kicks off with a busy day of updates for manufacturing survey data, including the first look at Brazil’s PMI numbers for July. We’ll also see the July release of the US ISM Manufacturing Index and the June report on US construction spending.

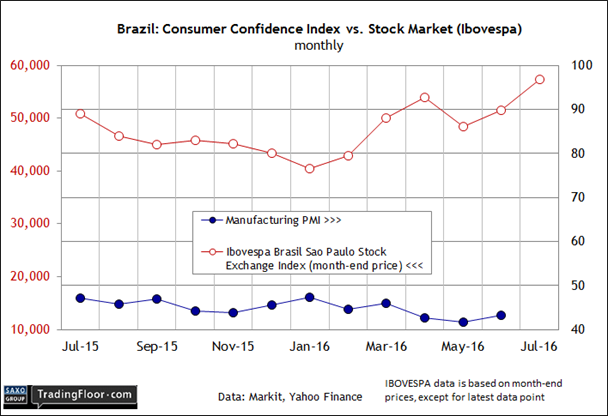

Brazil: Manufacturing PMI (1300 GMT): Latin America’s largest economy remains under enormous pressure, but recent data hints at the possibility that the start of a recovery may be near. Today’s July numbers for the Manufacturing PMI will offer fresh context for deciding if a bit of optimism is still warranted.

Last week’s modest bounce in consumer sentiment looks encouraging. For the third month in a row, the Consumer Confidence Index inched higher. “The increase in consumer confidence in the last three months was almost entirely determined by improved expectations,” advised FGV, the consultancy that publishes the data.

Confidence is firming up among Brazilian companies too, rising to a two-year high last month, according to Markit Economics. “June’s outlook survey data highlight a substantial strengthening of optimism among Brazilian companies, which is expected to end a long spell of economic woes,” a Markit economist said in mid July.

Brazil’s macro trend is still heavily challenged and a recovery is expected to be long and slow. Nonetheless, analysts see light at the end of this tunnel. “We’re near a turning point,” the chief economist at Sulamerica Investimentos in São Paulo recently told The Wall Street Journal. “While we are hitting the bottom, it will not be a V-shaped recovery.”

Nonetheless, another upbeat report in today’s sentiment numbers in manufacturing for July will support the idea that the worst has passed.

Brazil’s stock market is leaning towards that view. The Bovespa Stock Index in recent days has been trading near one-year highs and closed on a high note at the end of July. Optimism is still fragile and so a string of disappointing numbers could send equities prices tumbling.

Indeed, the country’s manufacturing sector is still contracting, as indicated by recent PMI data that have been running at well below the neutral 50 mark for nearly two years. That’s not about to change, although a lesser pace of decline in today’s July update will keep the crowd talking about green shoots for Brazil’s macro outlook.

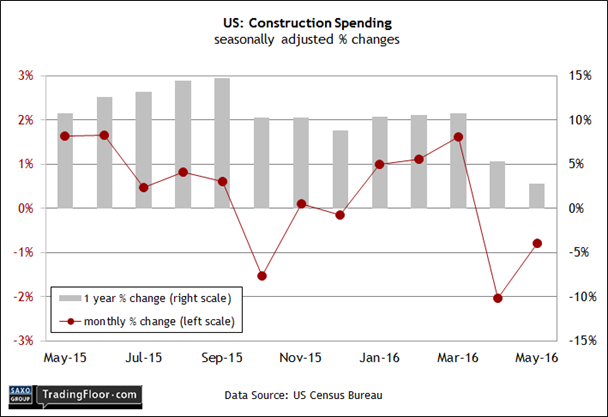

US: Construction Spending (1400 GMT): The nominal value of construction delivered a downside surprise in May. Even worse, the 0.8% slide marks the second consecutive monthly decline – weakness that weighed on the year-over-year trend. The 2.8% annual increase in May is the softest gain in more than four years.

Another disappointing round of numbers in today’s update for June would be worrisome. Indeed, Friday’s “advance” estimate of Q2 GDP growth was considerably lighter than economists expected. US output increased by only 1.2%, fractionally above Q1’s weak and downwardly revised 0.8% advance (seasonally adjusted annual terms).

“We’re just muddling through,” said the chief US economist at Deutsche Bank in New York. “Consumer spending looks good, but the problem is that the rest of the economy is soft.”

Just how soft the rest of the economy will or won’t be is still a guessing game until more data arrives. Meanwhile, today’s construction spending will be widely read for rounding out the macro profile at Q2's close.

Some analysts warn that the weak Q2 GDP raises recession risk. That’s still a minority view, but another round of disappointing news for the hard data on construction spending may convince more economists that trouble is brewing for this year’s second half.

Analysts, however, are expecting some relief in today’s June profile. Econoday.com’s consensus forecast calls for a 0.6% bounce in spending. One monthly advance could be noise, of course, but if the projection holds it will at least ease worries that a new recession is fate.

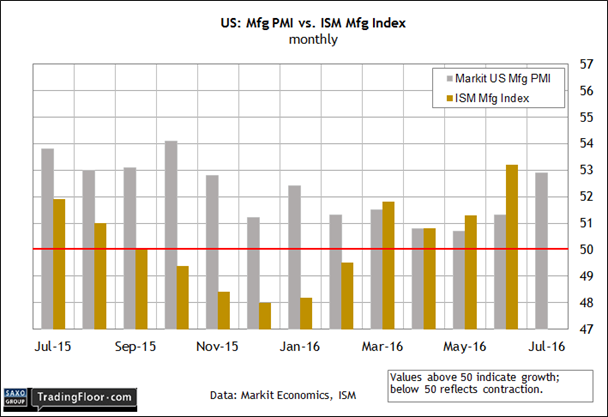

US: ISM Manufacturing Index (1400 GMT): In contrast with the downshift in construction spending lately, sentiment in the manufacturing sector is showing signs of life. The crowd will be keenly focused on learning if the recent bounce can hold on to the recent gains.

The flash July data for the Manufacturing PMI offers some encouragement. The index posted a solid rise last month, touching the highest level since November 2015.

Markit’s latest polling also reflects firmer levels of production in the past two months and survey respondents have cited strong sales growth. In addition, there are signs of an “upturn in hiring, which resulted in the strong growth for a year,” Markit advised.

The ISM Manufacturing Index has rebounded too, albeit as of June. But today’s July release is expected to hold on to the 53.2 reading – the highest in more than a year – according to Econoday.com’s consensus forecast.

In that case, the news will bring a stronger level of support for arguing that the sector is recovering.

For additional perspective, keep an eye on today’s revised PMI data for July, which is scheduled for release at 1345 GMT, just ahead of the ISM report.

Disclosure: Originally published at Saxo Bank TradingFloor.com